The BRIC countries were hyped to be the top investment destination before the Global Financial Crisis. As the craze for emerging markets soared Wall Street came up with a nice-sounding term BRIC to denote the next emerging countries of Brazil, Russia, India and China. The simple catch phrase caught on and investors couldn’t get enough of the stocks from these countries during the bubble phase.

From the beginning the term and the logic behind it made no sense. Still no one cared as long as everyone was able to make profits. For instance, there was nothing in common between these countries other than all being developing countries. Brazil was democratic but has so many structural political and economic issues and always remains to be the country of the future. Russia obviously was never democratic and is a superpower in military might but the economy is average. India is another democracy but is plagued by issues even worse than Brazil. China is also neither a democracy nor a military dictatorship but is communist. Somehow these four countries were grouped together to form the BRIC. In reality investors in the BRICs have seen their returned almost turned into worthless bricks in the past decade. In fact, the BRICs have experienced a lost decade.

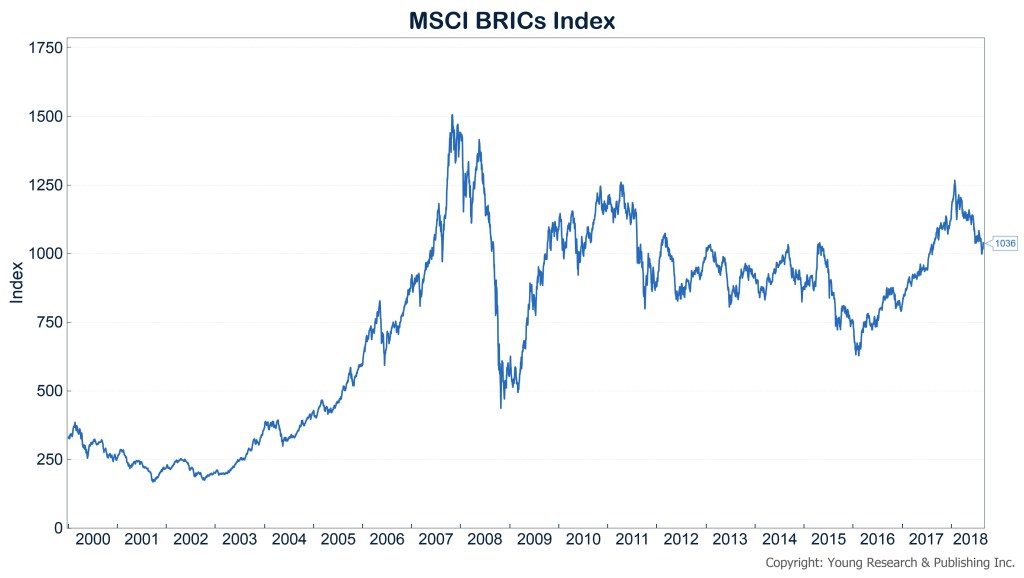

The MSCI BRIC Index reached its peak in 2007 and is still well below 30% of that peak as shown in the chart below:

Click to enlarge

Source: August 2018 Client Letter: BRICs and FAANGs by Matthew Young, Young Investments Ltd.

The key takeaway for investors is to not get carried away by hype such as the BRICs. Or for that matter the newer versions such as MINT, CIVETS, NUTS, EAGLES, etc.

Related ETFs:

- iShares MSCI Brazil Index (EWZ)

- iShares FTSE/Xinhua China 25 Index (FXI)

- Market Vectors Russia ETF (RSX)

- iShares S&P India Nifty 50 Index (INDY)

Disclosure: No Positions