The country of Chile in South America has one of the strong democratic governments. Chile has been following sound free market economic policies since the 1980s. With a population of about 12 million Chile’s economy is export-oriented with concentration in fishing, forestry and copper.

According to Wikipedia, Chile’s financial system is among the top in South and Latin America and this has helped Chile achieve the strongest sovereign bond ratings in South America. As the country is heavily dependent on foreign trade Chilean banks provide all the services needed for trade and domestically they provide many of the same financial products available in developed countries such as home equity loans, mortgages, credit cards, etc.

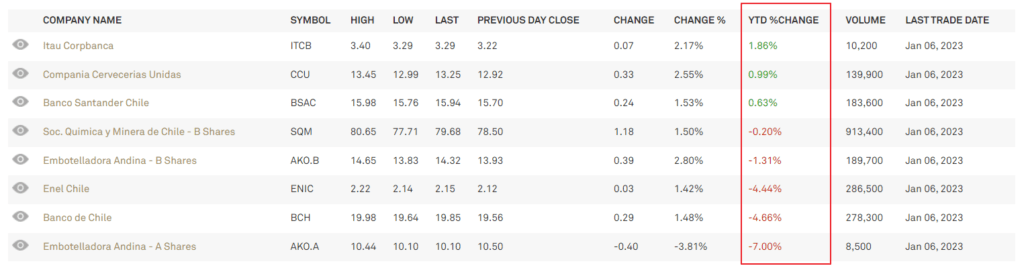

Three banks of Chile are listed in the US markets as ADRs. The following is a brief overview of them.

1. Banco Santander-Chile (SAN) provides commercial and retail banking thru a network of 467 branches . The current yield is 6.13% and the annual EPS growth is about 8%. The 5-year annualized return is 13.7%.

2.Corpbanca(BCA) is money-center bank with 84 branches. BCA pays a dividend of 12.80% but the annual earnings growth over the last 5 years is -3.01%.

3.Banco de Chile (BCH) is the second largest bank in Chile with a total of 298 branches. BCH is down 27.75% over the past 52 weeks and currently an excellent dividend of 13.26%.