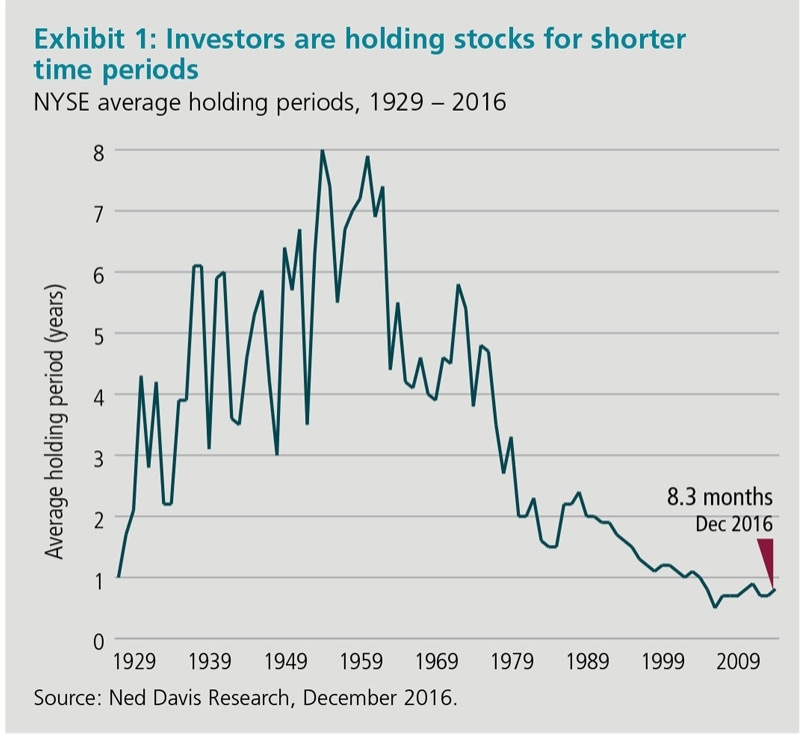

The average stock holding period for stocks trading on the NYSE has declined to an astonishing 8.3 months as of December, 2016 according to an white paper published at MFS Investment Management Canada Limited. The curent holding period of less than a year is indeed shocking since stocks should be held for the long-term in order to achieve a particular goal or earn a high return on one’s investment. Constantly trading stocks is never a good strategy especially for retail investors. Some hedge fund manager, mutual fund managers and other institutional investors trade all day long because it is their full-time job. Even most of those professionals lose money most of the time.

From the paper:

Stocks are being held for shorter periods than at any time since the 1920s, as the New York Stock Exchange (NYSE) average holding period data shown in Exhibit 1 reveals. On average, a stock is being held for

1.92 years, less than eight quarters8.3 months, less than a year (my updates).This reflects investment transactions driven by both individuals and institutional investors. Until the 1970s, the investment landscape was largely dominated by wealthy individuals and families; this has since changed markedly, with professional investors now accounting for the largest share of investment activity, though it should be noted that these professionals manage significant mutual fund asset pools that are driven by retail investors.Click to enlarge

One might expect that professional investment managers would have a more long-term perspective; however, the data suggests that investment managers take an equally short-term view in their investment approach.

Their excellent paper also discusses some of the reasons for the dismal short-termism in the equity markets. For example, money managers have huge incentives to trade often since their compensation is based on annual performance.

Source: LENGTHENING THE INVESTMENT TIME HORIZON by Michael W. Roberge, CFA, Joseph C. Flaherty, Jr., Robert M. Almeida, Jr. and Andrew C. Boyd, MFS Canada

Also see:

- Duration of Stock Holding Periods Continue to Fall Globally, TFS, Sept 2010