The Global Financial Crisis(GFC) of 2007-09 was one of the worst financial crises in modern history. During this man-made crisis that started in the US, untold misery was inflicted on investors, homeowners, retirees and everyone else globally. However from an investment point of view, the crisis was one of the great time to pick up stocks on the cheap. Today GFC feels like ancient history. The table below shows a brief history of the crisis:

| When | What happened |

|---|---|

| Apr-07 | The first signs of trouble in the US housing market as subprime specialist lender New Century Financial files for bankruptcy. |

| Aug-07 | French bank BNP Paribas suspends three funds that invested in the US mortgage market. It blames a complete evaporation of liquidity. |

| Sep-07 | In the UK, investors queue to take their money out of Northern Rock the first run on a bank in the UK since 1866. |

| Mar-08 | JP Morgan agrees to buy Bear Stearns, which is on the brink of collapse due to its exposure to the failing subprime investments. |

| Jul-08 | Authorities prop up America's two largest lenders Fannie Mae and Freddie Mac, two government-sponsored enterprises that bought mortgages from banks. |

| Sep-08 | US bank Lehman Brothers collapses. Banks and corporations globally begin to fail. In the UK, HBOS is taken over by Lloyds. |

| Oct-08 | US signs an act to effectively bailout its financial system. UK government steps in to save its banking system. |

| Nov-08 | The International Monetary Fund begins approving loans to stabilise countries including Ukraine and Iceland. |

| Dec 2008 Jan 2009 | Global economies begin to go into recession. Central banks cut rates in a co-ordinated effort to stem the crisis. |

| Mar-09 | Global stockmarkets hit post crisis lows. Interest rates are reduced to record lows in US and UK. Both countries begin huge quantitative easing measures. |

| Jun-09 | OECD says the world economy is near the bottom of its worst recession in post-war history. |

From an article David Brett at Schroder’s :

The rise of the stockmarket

During the worst phases of the crisis, Japanese and European stockmarket indices lost more than half of their value, as measured by the MSCI Japan and the MSCI Europe (excluding UK) indices. World, US and Asia (excluding Japan) indices all fell by more than 40%, while the UK lost over 35% of its value.

However, the knock-on effect of central bank attempts to stimulate economies has sent stockmarkets roaring back. US stocks have risen more than 260% since the crisis low in March 2009. UK, European and Asian stocks are all up more than 150% in the same period.

Low interest rates and the effect of money being pumped into the economy has benefited businesses and therefore the stockmarkets on which they are listed.

Low interest rates have enabled companies to restructure their balance sheets at lower costs because loans are cheap. And low rates have made shares, with relatively high dividend yield, more attractive. The UK stockmarket yields around 3.8% compared to 0.9% on a 10-year UK government bond.

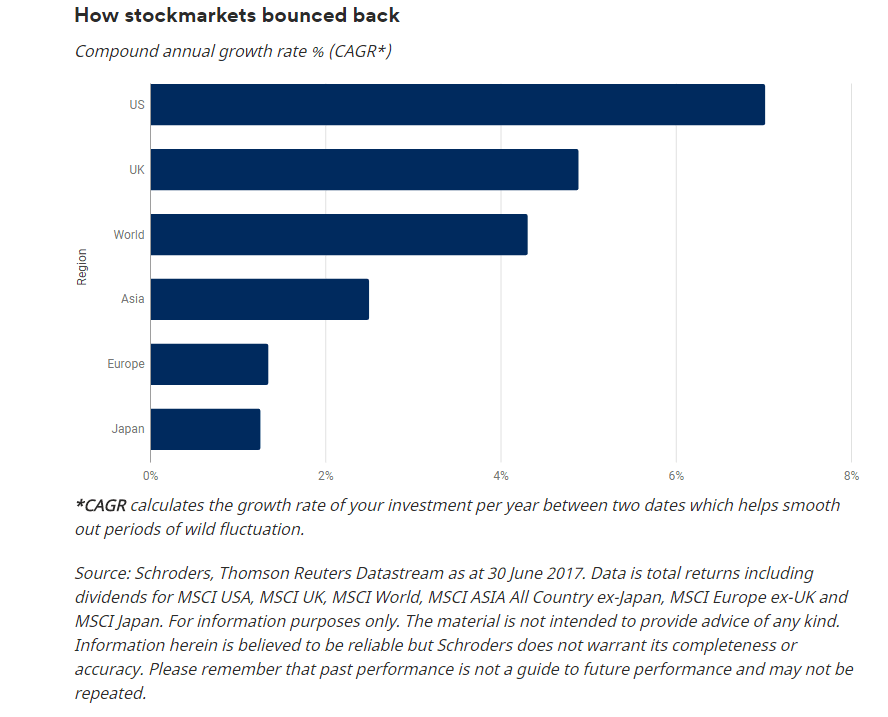

Stockmarkets have provided decent returns since the crisis.

It is, of course, almost impossible to time the market. Those who sold their investments at the top in the autumn of 2007 and bought back at the low of spring 2009 would have done so more out of luck than judgement.

But as the chart below illustrates even if you had left your money in stocks at the pre crisis highs in 2007 you would still have made a healthy return, albeit having endured some nervous moments.

Between Q3 2007 and Q2 2017 US stocks returned more than 7% per year including dividends. UK and world stocks returned 4.9% and 4.3%, respectively.

Japan and Europe, which have seen some of the worst economic woes in the last decade, were the two main underperformers, although shares still returned more than bonds. The stockmarket indices for each indicate returns of 1.26% and 1.35% respectively.

Source: The global financial crisis 10 years on: six charts that tell the story, Schroder’s

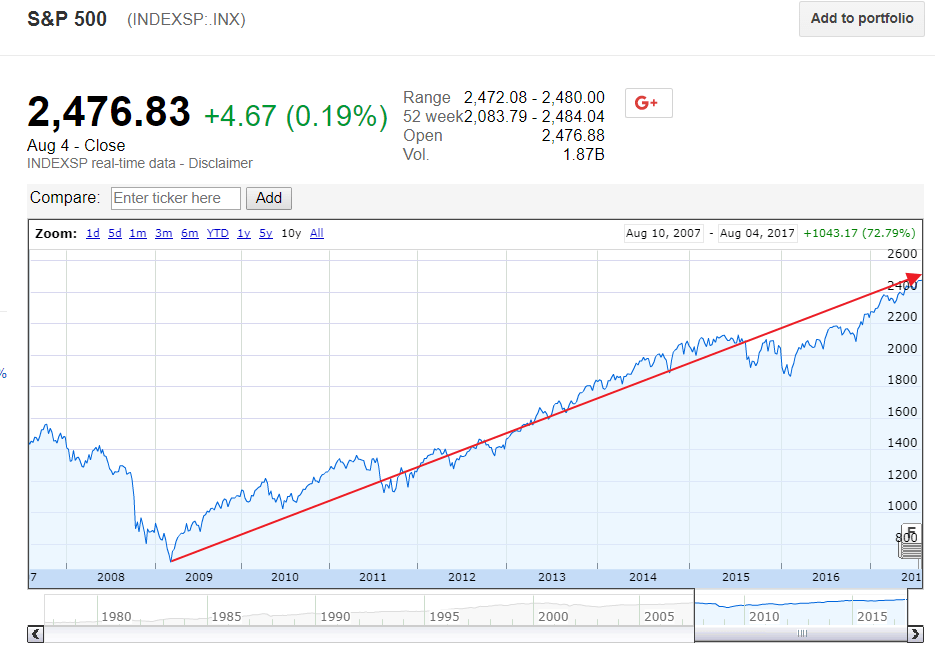

Ever since the GFC, US stocks have soared to record highs. The S&P is over 2,476 now and the Dow also at an all high high of over 22,000. In a recent article the WSJ discussed five theories on why US stocks keep hitting records. The full article is worth a read.

The chart below shows the astonishing growth of the S&P 500 since the depths of the GFC:

Note: Data shown is as of Aug 4, 2017

Source: Google Finance

Five lessons for investors from the global financial crisis of 2007-09:

- The best time to buy is when there is blood on the street. The GFC was indeed an excellent time to buy stocks especially blue-chips on the cheap.

- Always have some cash ready to deploy. You never know when opportunities might pop up.

- Do not suspend dividend reinvestment when stocks are continuously falling like during GFC unless the company is in serious trouble.

- Be calm and brave when everything seem to collapse and some “experts” predict the end of the western civilization or the world is near.

- Do not panic and liquidate stocks at the height of a crisis. Millions of investors lost out billions in profits doing this.

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions