Investors are attracted to defensive sector stocks for their stability and consistent growth.One of the defensive sectors is the food producers. Some of these stocks have held up well during the past few months.

Investors are attracted to defensive sector stocks for their stability and consistent growth.One of the defensive sectors is the food producers. Some of these stocks have held up well during the past few months.

In this post lets review the Top Ten Global Food Producer stocks. This ranking is based on the total revenue generated in 2007 by each food producer and was compiled by a company called DataMonitor. Seven out of the top ten are US companies.

The Top 10 Global Food Companies

[TABLE=113]

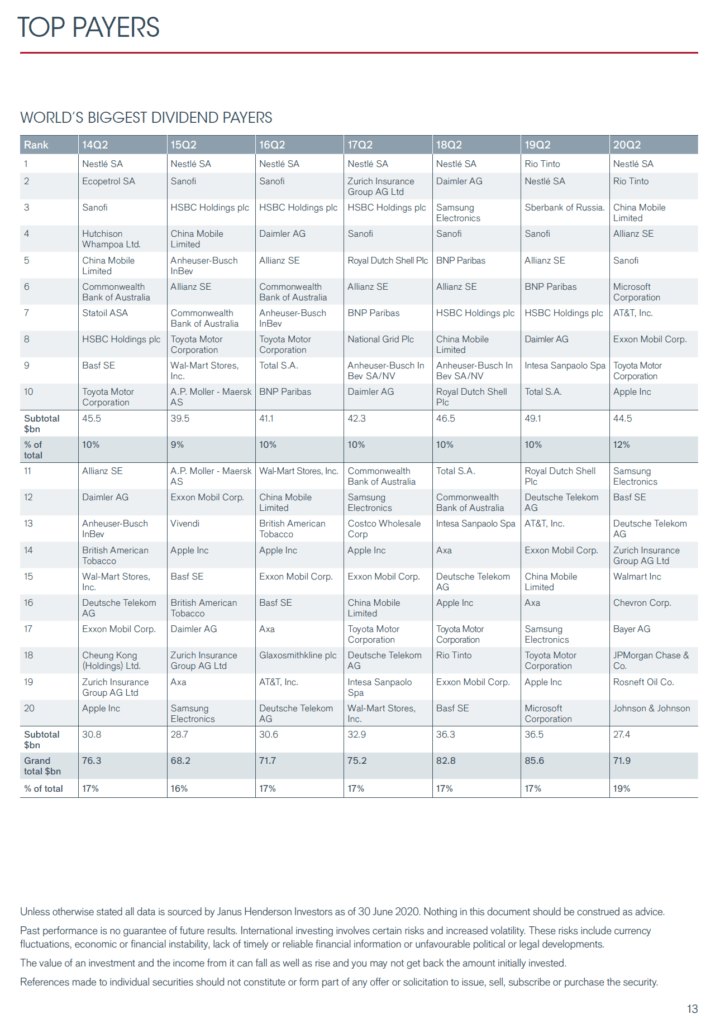

1.Nestle SA (NSRGY) is the largest food producer in the world. Nestle’s brands covers all food and beverage types.Some of the famous Nestle brands include KitKat,Nescafe,Hot Pockets,Dog Chow & Purina(Pet Foods),etc.The stock is one of the most traded on the OTC market and pays a dividend of 3.09%.

2.Cargill Inc is a privately-held company.

3. The USA-based Kraft Foods Inc. (KFT) operates sells its products in more than 150 countries.Kraft was spun-off from Altria Group. Kraft has an yield of 4.28% and the annual dividend growth over the last 5 years is 13.18%. The profit margin is only 6.15% and the beta is 0.6. Some of Krafts brands are Oreo, Ritz, House,Planters, Easy Mac,etc.

4.Unilver NV (UN) is an Anglo-Dutch multi-national company with operations in 100 countries and owns over 400 brands in foods,beverages, cleaning agents and personal care.Some of the famous brands are Lipton,Knorr,Ben & Jerry’s and Breyers Ice-creams, Dove, Rexona, Slim-Fast,etc. Unilever pays a dividend of 6.74% Profit margin is 10.57%, better than Kraft Foods Inc.Annual dividend growth over the last 5 years is 21.42%. Unilever’s UK division trades with the ticker UL in New York Stock Exchange.

5.Tyson Foods Inc (TSN) produces and distributes meat and poultry products. TSN has a low dividend yield of 1.66% and over the last 5 years revenue growth has been flat.The company is below average in managing their resources and hence Return on Assets,Revenue per Employee, Return on Equity are all below it’s peers.

6.PepsiCo Inc (PEP) is a global beverage and snack company based in the USA.PepsiCo’s brands owns hundreds of brands including Quaker Oats, Pepsi,Gatorade,Lay’s Potato Chips,Diritos,Tropicana,AquaFina, etc. The current yield is 3.28% and the profit margin is 13.26%. Earnings have grown at15.38% annually over the last 5 years and it has raised dividends by 19% annually in the same period.

7.Minneapolis,MN-based General Mills, Inc (GIS) is a manufacturer and marketer of many consumers foods including Cheerios,Wheaties, Pillsbury,Haagan Daas Ice Cream,Betty Crocker,Progresso,etc. GIS has a dividend yield of 2.68%.The profit margin is 8.28% and earnings have grown annually at 8.86%.

8.Based in Paris,France Groupe Danone (GDNNY) is a producer of fresh dairy products, biscuits,cereals,etc. Some of its brands include Evian water,Activia and Dannon,Danone yogurts,etc.The OTC market listed GDNNY’s dividend yield is 3.21% and the profit margin is 9.91%. Danone’s yogurt lines are a favorite among female consumers due to health benefits.

9. Kellogg (K) is a leader in the manufacture and marketing of cereals and convenience foods. K pays a dividend of 2.82% and the average annual earnings growth rate is 9.5%.Some of its competitors are Heinz,General Mills,Campbell Soup Inc. Kellogg’s products are sold in more than 180 countries and some of its brands are Pop-Tarts,Froasted Flakes,Special K,Graham Crackers,Keebler Cookies,etc.

10.The USA-based ConAgra Foods(CAG) company is a leading packaged food company with many brands such as Healthy Choice, Chef Boyardee, Egg Beaters, Hunt’s, Orville Redenbacher’s, PAM,Reddi-WIP, etc.The current yield is 4.52% and the revenue growth over the past 5 years is 12.85%. The dividend yield paid is in-line with its peers in the food-processing industry.

Disclosure: Long GIS

Thanks for informative post. It is good to see return within the industry. Which one would you prefer?

UN seems to be very sold out. Almost 40% down for “defensive play”.

Vlada

Thanks for the post Vlada.

Yes.I prefer UN since it is down a lot and has strong brands in emerging countries.Long-term value pick.Nestle is also very good.

-David