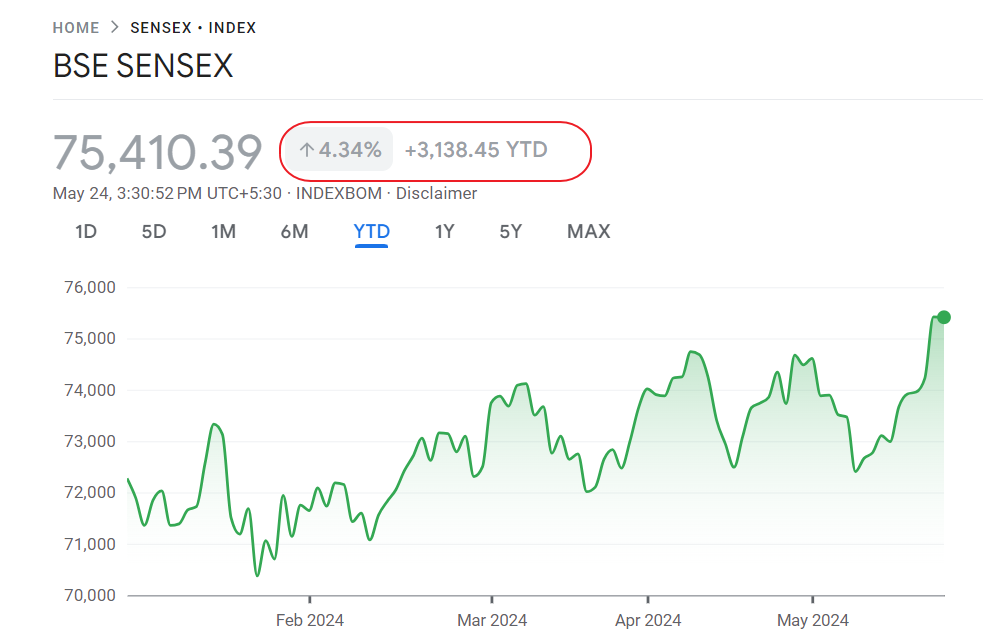

The Indian equity market is one of the best performing markets so far this year. The benchmark S&P BSE Sensex is up by over 17% year-to-date. Despite the strong gains, Morgan Stanley’s Jonathan Garner, the chief Asia and emerging markets equity strategist predicts the index may reach 34,000 by June, 2018 according to an article in Lievemint. From the article:

Where do Indian markets go from here? Up another 9%, says Jonathan Garner, the chief Asia and emerging markets equity strategist at Morgan Stanley.

The investment bank has set a Sensex target of 34,000 for June 2018. Garner cited an upbeat corporate earnings outlook and strong economic growth as reasons for the prediction.

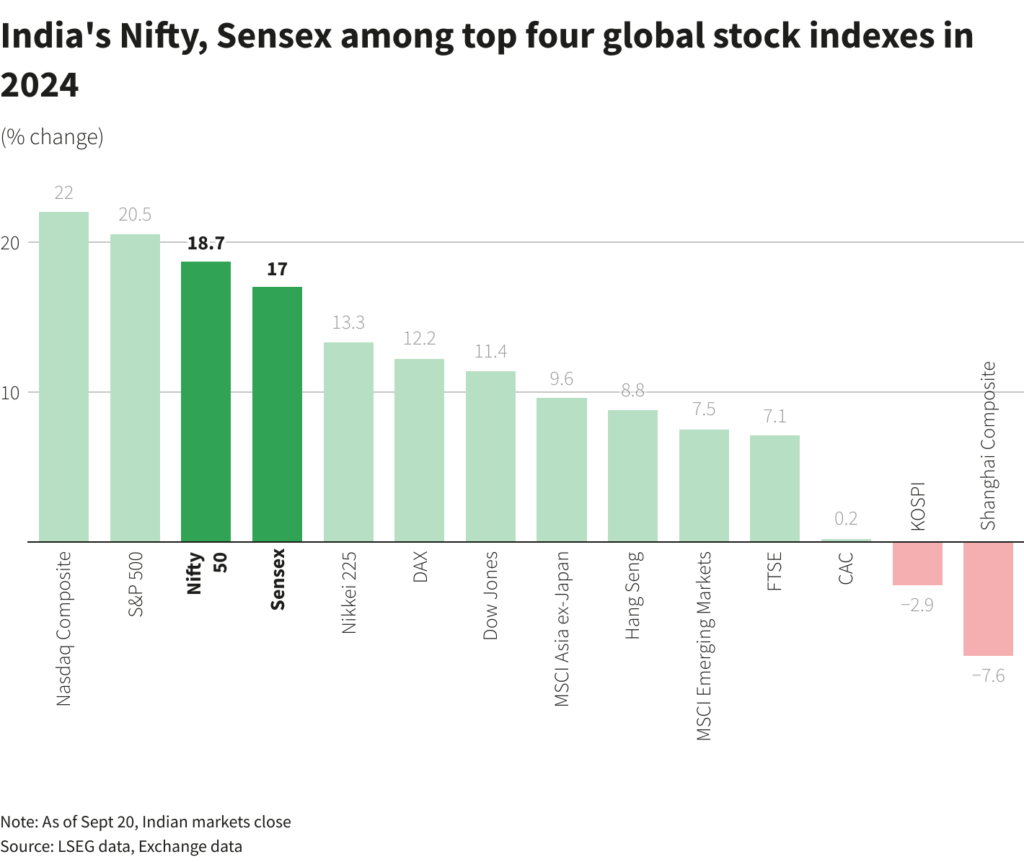

On Tuesday, the benchmark 30-stock Sensex closed at 31,190.6 points, 0.38% lower than the previous close. The gauge has climbed 17.1% since January, trailing only the broader Nifty and Hong Kong’s Hang Seng index.

“We are bullish on the Indian market, In fact, we are overweight India relative to our coverage,” Garner said in a phone interview with Mint. “If you look at the situation for equities globally, it is characterized by very strong earnings growth.”

Garner said he expected the Sensex to deliver 18% earnings growth for fiscal year 2018 on the back of likely synchronized upswings in the infrastructure and consumption sector in India.

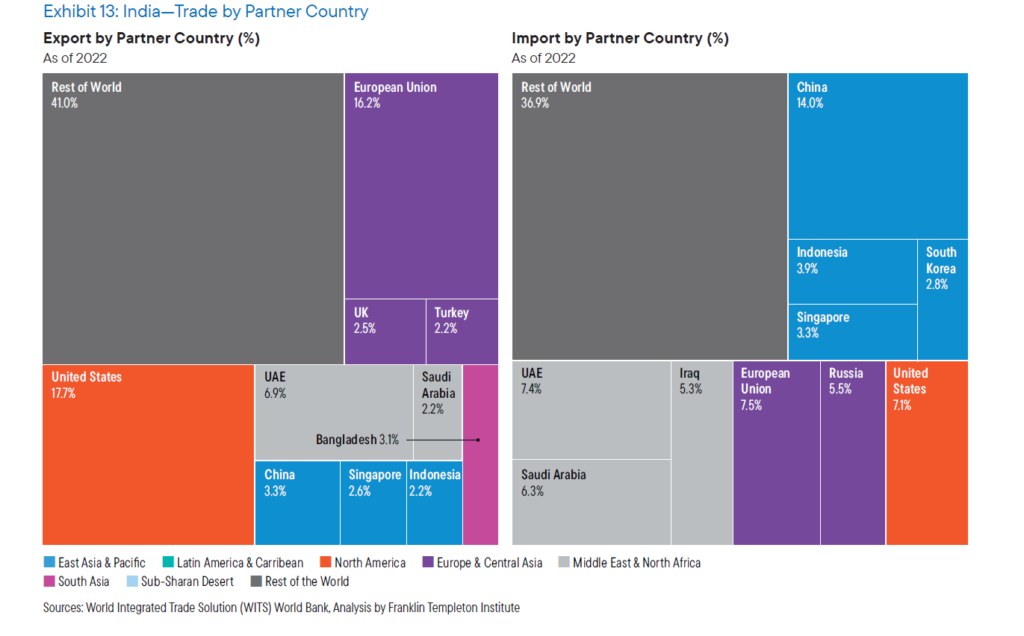

“(There is) increasing support from exports, while global trade growth is recovering. We also think corporate capex spending will be rising globally,” he added.

Source: Sensex seen scaling 34,000 in a year’s time, Livemint

Though the Indian economy is in a sweet spot among major emerging markets, global investors may have to a little cautious on Indian equities especially after the double digit growth so far this year.

Related ETFs:

Disclosure: No positions