Generally small caps yield higher returns over large caps over long periods. In the last decade small cap stocks easily beat large cap stocks in terms of returns. From an article I wrote in May:

- The S&P 600 Index, a small-stock index, gained nearly 100% in the decade that began Jan 1, 2000Â , producing an annualized return of 7.1%. In the same period, S&P 500 has lost almost 2% per year for a total loss of about 18%.

- Small caps benefit more quickly when the economy recovers.

The current recession started in December 2007 and ended in June 2009 according to by the National Bureau of Economic Research (NBER).

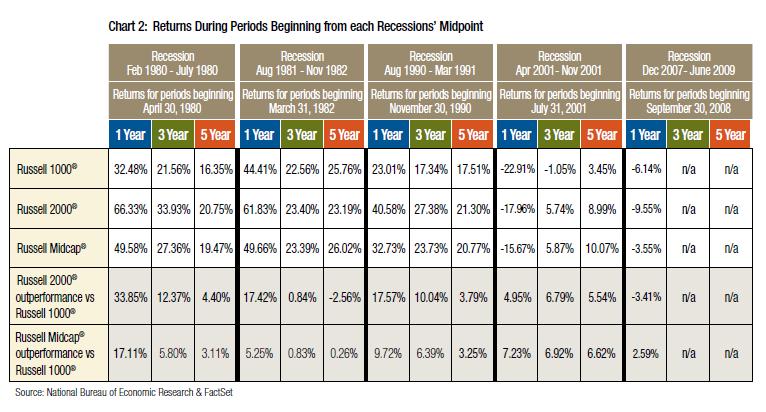

The chart below shows the one,three and five-returns of small, mid and large-caps beginning from the mid-point of each recession:

Click to enlarge

Source: Smaller-Cap Equity Performance Coming Out of a Recession by Michael Weiss and Yuliya Tarasava, Managers Investment Group

Small-caps as noted by The Russell 2000 Index have outperformed large-cap stocks following all of the recessions except the 5-year period associated with the 1981-82 recession and the 1-year period associated with the 2008-09 recession. However, mid-cap stocks outperformed large-cap stocks following all of the recessions.

The authors note that ” it is important to note that the smaller-cap stock underperformance exception that occurred after the 1981/1982 recession came after a long period of small-cap stock dominance over large-cap stocks. According to Morningstar/Ibbotson Associates’ 2008 SBBI Yearbook, from 1971 through 1980,small-cap stocks returned 17.53%, substantially outperforming large-cap stocks, which returned 8.44%.

Similarly,relative asset class performance during the downturn period for the 2008/2009 recession might explain the one-year performance exception.”

Why do smaller-cap stocks perform better than large-cap stocks coming out of recessions?

Michael and Yuliya mention the following key arguments to support the theory for the relative outperformance of smaller-caps:

“First, in order to adjust to an environment moving from contraction to expansion, a company needs to be nimble. To that end, small- and midsized companies are generally better able to quickly add to their work forces and ramp up production in anticipation of an improvement in the economy.

Second, small caps generally experience steeper declines early in a recession due to a flight to safety that naturally occurs, resulting in oversold conditions and undervalued small- and mid-cap stocks.

Third, smaller companies tend to get a performance boost when merger and acquisition activity increases, which is common toward the end of a recession when valuations become more attractive and larger companies look for ways to grow their businesses.”

It must be noted that small-cap stocks are extremely risky and can be highly volatile. Hence an investor can allocate a small portion of their portfolio to small caps and use a mutual fund or an ETF instead of picking individual stocks.

Related ETFs:

U.S. Small Cap ETFs

iShares S&P SmallCap 600 Index Fund (IJR)

iShares Russell 2000 Index Fund (IWM)

SPDR DJ Wilshire Small Cap ETF (DSC)

Vanguard Small-Cap ETF (VB)

International Small-Cap ETFs

iShares MSCI EAFE Small-Cap Index Fund (SCZ)

International Small-Cap Fund (GWX)

Vanguard FTSE All-World ex-U.S. Small Cap ETF (VSS)

SPDR S&P Emerging Markets Small Cap (EWX)

Disclosure: Long GWX

I completely agree with the arguments and I think its evident from the present situation as well.