Emerging markets have performed poorly so far this year. While this year’s meltdown in emerging markets can be attributed to China’s economic slowdown, some emerging markets such as Brazil have been in a downward trend for a few years now due to domestic issues.

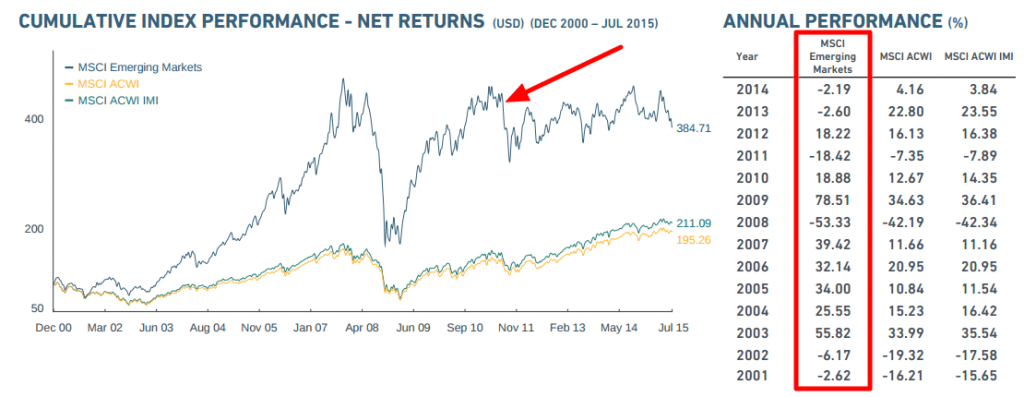

The widely-followed MSCI Emerging Markets Index is down by over 4% as of the end of July. The following chart shows the long-term performance of the index and the annual returns:

Click to enlarge

Source: MSCI

The iShares MSCI Emerging Markets (EEM) which tracks the index is down 14% year-to-date. Since markets worldwide fell dramatically this month (which is not included in the chart), the chart above shows only single digit losses.

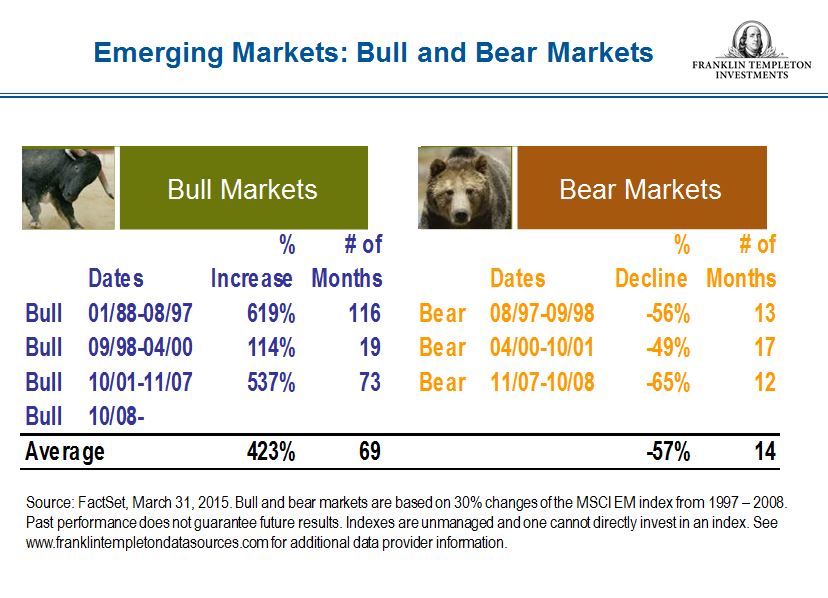

However despite the big selloffs in emerging equities, long-term investors can find opportunities in those markets. According to an article by Emerging Markets guru Mark Mobius, bull markets in emerging markets have lasted longer than bear markets in the past. While this does not necessarily predict the behavior of the markets in the future, it is still worth taking note in order to select stocks that can profit from the potential growth of emerging markets.

Click to enlarge

Source: On Market Corrections, and Keeping a Calm Head, Franklin Templeton Investments

In developing countries, certain sectors are better to invest in than other others. For example, companies in the banks, utilities, consumer staples sectors offer better options than those in tech, internet. mining, etc. sectors.

Ten stocks from emerging markets are listed below for adding in phases to a well-diversified portfolio at current levels:

1.Company: Ecopetrol SA (EC)

Current Dividend Yield: 10.31%

Sector: Oil & Gas Producers

Country: Colombia

2.Company: Bancolombia S.A. (CIB)

Current Dividend Yield: 4.00%

Sector:Banking

Country: Colombia

3.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield: 4.68%

Sector: Banking

Country: South Africa

4.Company: Banco de Chile (BCH)

Current Dividend Yield: 5.16%

Sector:Banking

Country: Chile

5.Company: Itau Unibanco Holding SA (ITUB)

Current Dividend Yield: 5.45%

Sector: Banking

Country: Brazil

6.Company: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.64%

Sector: Banking

Country: India

7.Company: Coca-Cola Femsa SAB de CV (KOF)

Current Dividend Yield: 1.43%

Sector:Beverages

Country:Mexico

8.Company:Fomento Economico Mexicano SAB de CV (FMX)

Current Dividend Yield: 0.82%

Sector:Beverages

Country:Mexico

9.Company: Malayan Banking Berhad (MLYBY)

Current Dividend Yield: 7.88%

Sector: Banking

Country:Malaysia

10.Company: Ultrapar Participacoes SA (UGP)

Current Dividend Yield: 2.50%

Sector: Oil, Gas & Consumable Fuels

Country: Brazil

Note: Dividend yields noted above are as of Aug 28, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long EC, BCH, ITUB