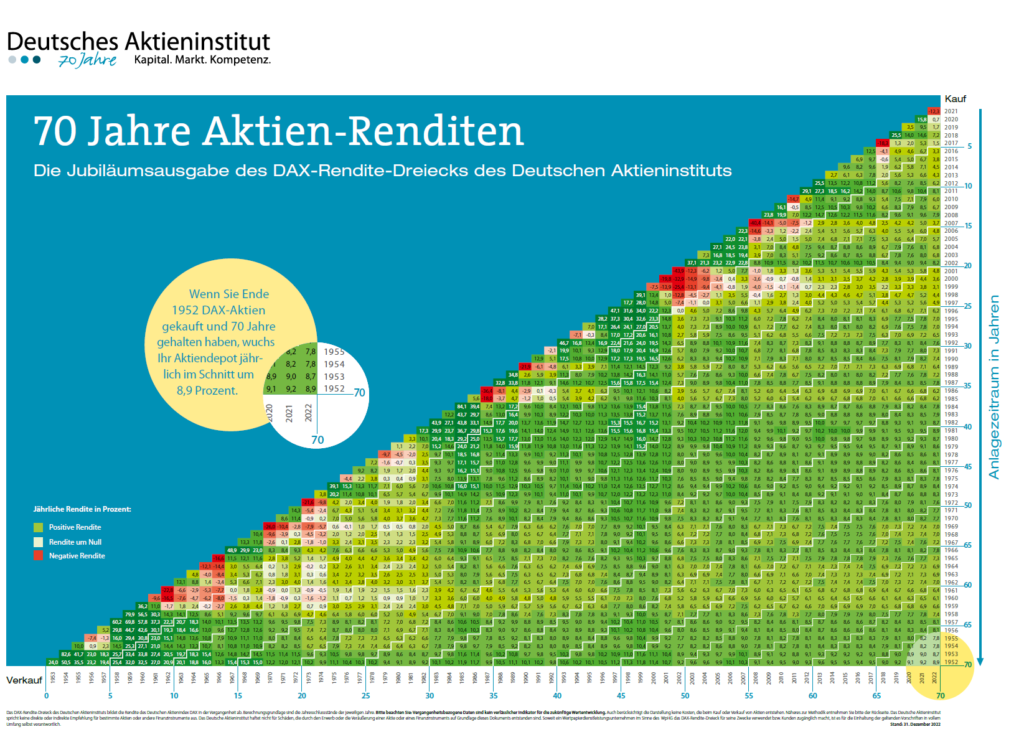

The German stocks market is one of the best performing markets in Europe over the long-term. For example, in the 25 years leading to 2013 the DAX index grew by more than eight times.From 1955 thru 2012, the index had returns in 39 years and negative returns in only 19 years.

In 2013, German stocks generated a 31.7% return based on the MSCI Germany Index.The 1o-year annualized return for Germany is a solid 12.0%. Despite such strong performance and home to many leading world-class companies, most Germans ignore the stock market. In fact, direct equity ownership is under 10% compared to Anglo-Saxon countries which have much higher figures. So I was curious as to why Germans do not invest in stocks.

The following are some of the reasons why equity ownership is very low in Germany:

1. The banking system in Germany is dominated by local savings banks and co-operative banks who tend to offer conservative investment advice to their customers. This is vastly different from other developed markets where many banks are national and they try to encourage their customers into higher risk products such as stocks.

2.In 2003, the Neuer Markt which is similar to the technology-heavy NASDAQ market collapsed. This scared retail investors from investing in the stock market.

3.In the late 90s, Germany privatized state-owned companies such as Deutsche Telekom and Deutsche Post and sold shares to the general public.n fact in 2000, The Economist magazine reported that “Germany was share-crazy. Gone is the image of a nation dourly stuffing its spare cash into a safe-as-houses, low-interest Sparbuch savings account. Money poured into initial public offerings… Germans were opening share-dealing accounts – online, naturally – at a furious rate.”

These IPOs soared during then dot-com bubble and then crashed spectacularly when the bubbled popped. I Germans who ventured into the stock market with these IPOs were burned badly. They decided to never again play the stock market game at least via investing directly as opposed to via pensions, insurance policies and other ways.

Unlike Germany, Americans returned to stocks even after the NASDAQ imploded when the technology bubble crashed and investors lost billions of dollars. This may be attributed to the difference in cultures between Germany and the U.S.. Unlike conservative Germans, Americans are high risk-takers as everyone is chasing the “American Dream”. Moreover with returns from bank deposits and other ways practically meaningless Americans are artificially forced to invest in stocks by the state.

4.The great crash 0f 1929 is still vividly remembered by older Germans and younger generations learn about it from their parents and in schools.

5. Germans tend to invest big in life insurance policies and other similar products because there is a set guarantee of returns. With stocks there is no guaranteed return and even dividends can be suspended or cut for any or no reason by a firm’s management.

Back in 2007, Franz-Josef Leven of the Deutsches Aktieninstitut (German Equities Institute, DAI) said “The risk of stock investing and not having a guarantee of how much of a return an investment will yield is a central reason why Germans tend to avoid stocks.”

6. The “equity culture” is almost non-existent in Germany due to the difference in corporate financing culture between Germany and other developed countries. For instance, German firms have traditionally depended on banks or debt for their financing needs.But most American companies generally rely on selling equity to raise funds. Hence American firms sell shares to the public to generate funds whereas most Germans firms don’t. In the U.S. even today a dot-com with no profits or even revenues can raise millions in capital by selling equity.

- Sources:

Why Don’t Germans Invest in Stocks?, September 30, 2010, Bloomberg BusinessWeek

Shares vs Public Ownership, Business-Managed Democracy

Equity ownership culture in Germany, Toytown Germany

Related ETFs:

- iShares MSCI Germany Index Fund (EWG)

Disclosure: No Positions

Related:

- East Germans still invest very less in the stock market, Research Paper at University of California, Berkeley