Emerging market banks occupy the top positions in a ranking of the world’s most valuable financial institutions based on their stock price to book values as of Dec 31,2009 according to a recent article in The Financial Times.

Click to Enlarge

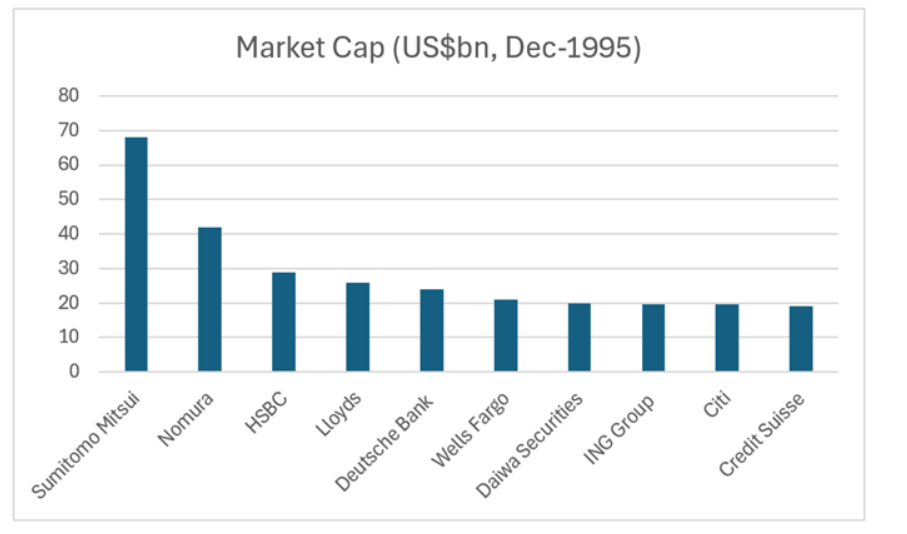

Chinese banks took the first four spots easily beating western banks which were highly valued back in 2000.

From the article:

“China Merchants Bank, China Citic, ICBC and China Construction Bank lead the table, followed by Itaú Unibanco of Brazil, all with a price-to-book multiple of more than three.

Over the past six years, the average price-to-book value of the biggest 50 banks has halved from two to one.

This means that investors believe the average bank is worth no more than the value of its balance sheet. Most western banks are trading at well below their book value.

But investors are attaching a growing premium to emerging markets banks, led by China Merchants, the most highly rated of the biggest 50 banks by market capitalisation, on a multiple of 4.3, according to Bloomberg data.

At the start of the last decade, the US dominated the rankings. The top five were Bank of New York Mellon , Lloyds of the UK, Morgan Stanley, Citigroup and Wells Fargo.

Only last year US Bancorp topped the table and Wells Fargo was in the top 10. ”

Canadian banks Bank of Novo Scotia (BNS) and Royal Bank of Canada(RY) have climbed in this price-to-book ranking. Australian bank Commonwealth Bank of Australia(OTC: CMWAY) is ranked number eight in this list. Similar to Chinese banks, Brazilian banks Banco Do Brasil(OTC: BDORY), Itau Unibanco(ITUB) and Banco Bradesco(BBD) also rebounded sharply after the credit crisis since their exposure to sub-prime loans were negligible.