Dividend-paying stocks are a favorite for many investors. These stocks have become attractive for many years now as U.S. investors look for decent yields on their investment especially in this ultra-low interest environment when other investments such as bank Certificate of Deposits (CDs) practically earn 0% or very low interest. Dividend stocks are suitable for all investors to hold for the long-term for a multitude of reasons.For example, a retired senior citizen can hold these stocks to earn a quarterly or monthly income which will supplement social security, pension and other sources of income. Young investors may chose dividend stocks in order to build a sizable retirement nest egg since they can wait out market ups and downs. These stocks are perfect such investors since dividend growth and reinvestment of dividends can amplify their returns over many years till they retire. Regardless of the investor type, one important reason why investors choose dividend stocks is to keep up with inflation. Put another way, the return on investment should be high enough to at least equal or beat inflation. High inflation rates can easily eat way most if not all of the returns from an equity investment. So if the inflation rate is at 2% investors try to earn at least 2% or more to make their investment worthwhile.

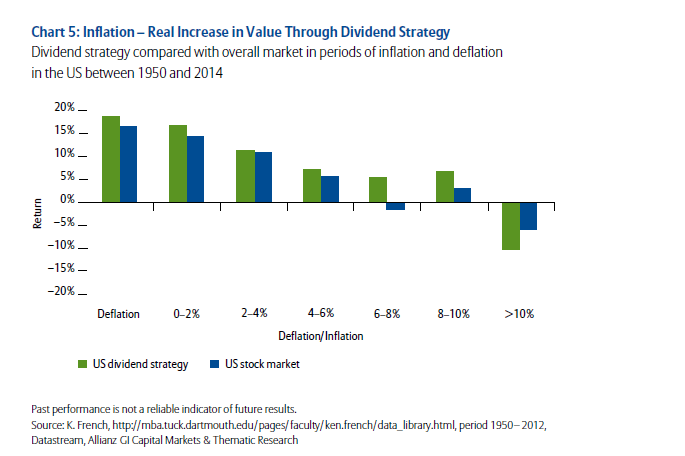

Some investors may wonder whether dividend stocks are good to hold during periods of inflation and deflation. The past performance of these stocks during such periods reveal that indeed dividend stocks outperform during periods of both inflation and deflation according to a research report by Alliance Global Investors.

From the report:

A look at the US since 1950 shows that, here too, dividend strategies have outperformed the wider market in times of both rising inflation (up to 10 %) and deflation (see Chart 5). This is really quite interesting since inflating the economy as part of a financial repression regime can be one effective means of reducing the huge debt in the industrialised world, in addition to consolidating national budgets and growth.

Click to enlarge

Source: Dividend strategies in times of financial repression, Alliance Global Investors

Hence dividend stocks can beat the overall market in terms of returns during inflation and deflation. Since deflation is highly unlikely in the U.S. for the foreseeable future and prices of goods and services are more likely to increase year after year the case for dividend stocks cannot be overstated. While in the past basic essentials such as food and utilities used to remain stable, in recent years the prices of pretty much everything has gone up and Americans have been forced to endure atrocious price increases in healthcare, college tuition, etc. It can argued that the economic policies of this country have been disastrous for the majority of average workers since real wages have barely moved higher in the past few decades but the prices of goods and services have soared higher on a consistent basis. So adding dividend stocks to a well-diversified portfolio can help mitigate some of the adverse effects of inflation.

One way to identify dividend stocks for long-term investment is to refer to the S&P 500 Dividend Aristocrats index. It is comprised of S&P 500 companies that have increased dividends every year for the last 25 consecutive years.

Ten stocks from the S&P 500 Dividend Aristocrats index are listed below for consideration:

1.Company: AT&T Inc (T)

Current Dividend Yield: 5.25%

Sector: Telecom

2.Company: Kimberly-Clark Corp (KMB)

Current Dividend Yield: 3.06%

Sector: Household Products

3.Company:The Clorox Co (CLX)

Current Dividend Yield: 3.42%

Sector:Household Products

4.Company:Colgate-Palmolive Co (CL)

Current Dividend Yield: 2.25%

Sector: Household Products

5. Company: PPG Industries Inc (PPG)

Current Dividend Yield: 1.28%

Sector: Chemicals

6.Company:Procter & Gamble Co (PG)

Current Dividend Yield: 3.08%

Sector: Household Products

7.Company: Abbott Laboratories(ABT)

Current Dividend Yield: 2.30%

Sector: Pharmaceuticals

8.Company: Johnson & Johnson (JNJ)

Current Dividend Yield: 2.71%

Sector: Pharmaceuticals

9.Company: T. Rowe Price Group Inc (TROW)

Current Dividend Yield: 2.16%

Sector: Investment Management

10.Company: The Coca-Cola Co (KO)

Current Dividend Yield: 3.13%

Sector:Beverages

Note: Dividend yields noted above are as of Apr 4, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions