The current dividend yield on the S&P is 2.30% as of Dec 20, 2013. Compared to this low yield, some markets in the Asia Pacific region have higher yields while others have similar low yields. The dividend yields of select Asian countries according to data from Financial Times are listed below:

Australia – 4.1%

China – 4.5%

Hong Kong – 2.9%

Indonesia – 2.7%

India – 1.7%

Philippines – 1.9%

South Korea – 1.1%

Taiwan – 2.7%

Thailand – 3.3%

Investors generally invest in Asian stocks mainly for price appreciation and not for dividend returns. This is particularly true for investments made in emerging Asian countries. However this need not be the case. Instead of simply focusing on price appreciation, investors must consider total returns which includes both price appreciation and dividend returns.

Asian dividend stocks should be part of well-diversified portfolio. Some of the reasons for holding dividend stocks from the Asia Pacific markets include:

- Dividends boost the total return even when the yields are low such as the Korea market with its 1.1% yield.

- They help reduce volatility in a portfolio. Unlike developed markets, Asian emerging markets are highly volatile. It is not uncommon for stable large-cap stocks such as those in consumer staples, banking, utility sector to swing 5% to 10% from one day to another.

- Dividends can account for a large portion of total returns in the long-term.

- Many emerging Asian companies are embracing the dividend culture and are increasingly paying out a larger portion of profits to shareholders.

- In some countries, the government is the majority shareholder in publicly-traded companies which were formerly state-owned monopolies. These companies regularly pay out big dividends in order to please the government.

According to a research report by Nikko Asset Management annualized volatility for Asia-Pacific equity markets since 1988 was 21.8% which is much higher than the US rate of 14.8%.

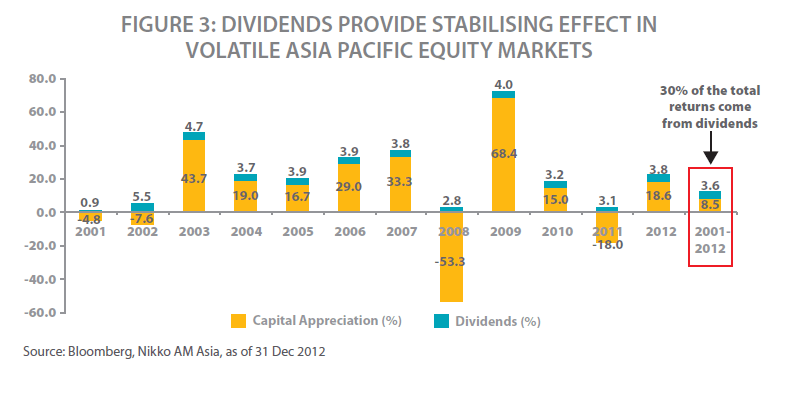

The following chart shows the importance of dividends in Asian equity returns over the long-term:

Click to enlarge

On a yearly basis dividend returns are small compared to price appreciation. However for the period from 2001 to 2012 dividends accounted for an astonishing 30% of the total returns.

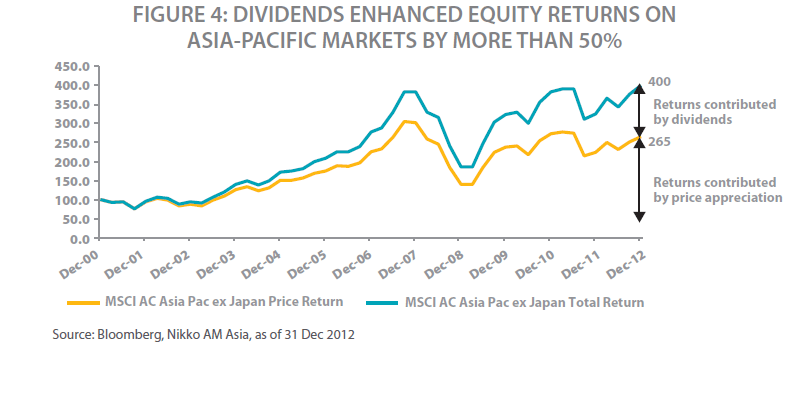

The chart below shows how reinvestment of dividends boosted total returns by more than 50% during the same time period:

Source: High Dividend Investing – East Side Story, Nikko Asset Management, Singapore

Ten Asia-Pacific dividend stocks are listed below for further research:

1.Company: Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Current Dividend Yield: 3.15%

Sector: Semiconductors

Country: Taiwan

2.Company: PetroChina Co Ltd (PTR)

Current Dividend Yield: 3.68%

Sector: Oil & Gas Operations

Country: China

3.Company: Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 4.14%

Sector:Communications Services

Country:Philippines

4.Company: China Petroleum & Chemical Corp (SNP)

Current Dividend Yield: 4.40%

Sector: Oil & Gas Operations

Country: China

5.Company: Chunghwa Telecom Co Ltd (CHT)

Current Dividend Yield: 5.81%

Sector: Telecom

Country: Taiwan

6.Company: PT Telekomunikasi Indonesia (TLK)

Current Dividend Yield: 3.37%

Sector: Telecom

Country: Indonesia

7.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 5.92%

Sector: Banking

Country: Australia

8.Company: Australia and New Zealand Banking Group Ltd (ANZBY)

Current Dividend Yield: 5.13%

Sector: Banking

Country: Australia

9.Company: Telstra Corporation Ltd (TLSYY)

Current Dividend Yield: 5.92%

Sector:Telecom

Country: Australia

10.Company: DBS Group Holdings Ltd (DBSDY)

Current Dividend Yield: 5.04%

Sector: Banking

Country: Singapore

Note: Dividend yields noted above are as of Dec 24, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions