European banks have lagged in performance relative to their American peers since the Global Financial Crisis for many reasons. For example unlike U.S. banks, most banks in Europe were reluctant to raise capital by issuing shares. This only made the situation worse as they were unable to recover quickly.

Five years after the crisis, the U.S. banking sector has recovered well and is growing again thanks to TARP and other actions taken by them. As a result U.S. banks stocks have taken off and many have reinstated the dividends or even increased dividends in the past few years. The SPDR® S&P® Bank ETF (KBE) which can be considered as a proxy for the sector has shot up by 27.60% as of the end of third quarter this year. On the other hand, the iShares MSCI Europe Financials ETF (EUFN) has risen by only 16.70%. Though bank stocks account for only about half of the fund and the rest are from the REIT, Insurance sector it can still be considered as proxy for the European banking industry. Another ETF that can be a proxy for European banks is the iShares STOXX Europe 600 Banks ETF trading on the Frankfurt Stock Exchange. This ETF is up by 20.99% year-to-date in Euro terms.

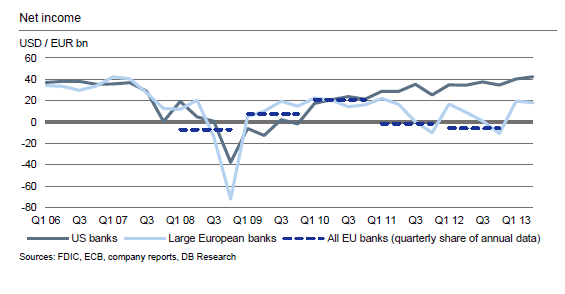

In a report published by Deutsche Bank Research Jan Schildbach notes three factors for the divergence between European and American banks. From the report:

Three main underlying causes: Macroeconomics, banks’ own decisions, insti-tutional differences. The US economy has been growing relatively steadily since 2010 already; output in Europe, by contrast, suffered a double-dip recession from which it is just about emerging. Furthermore, EU banks’ greater need to raise capital ratios to more prudent levels and their stronger deleveraging and shrinking has put them at a competitive disadvantage against their American competitors, not least in fast-growing emerging markets. Doubts by some market participants over the very survival of the European Monetary Union, weak domestic governments, an emerging patchwork of rules in the European financial market, and much more aggressive market interventions by the US Fed have also affected the Europeans and helped US banks to regain strength.

Outlook: Improvements ahead for both, but the “ocean” will turn into a “sea” only. With the US recovery now well established and Europe probably having turned the corner, banks may see this tailwind translate into better operating results, though much remains to do especially for European financial institutions. Given substantial catch-up potential, they may be able to narrow but probably will not close the gap to their US peers in the coming years. A gradual exit from the extremely loose monetary policy on both sides of the Atlantic does not seem to represent a major risk for the two banking systems.

Click to enlarge

Source: Bank performance in the US and Europe – An ocean apart, Sept 26, 2013 Deutsche Bank Research

I agree with Mr.Jan’s outlook for European banks. Though they will not close the gap with their U.S. peers in the coming years they may be able to narrow the gap between them and U.S. banks. Hence the “catch-up” potential presents some attractive investment opportunities in the European banking sector at current levels.

Five European banks trading on the U.S. markets are listed below for consideration:

1.Company: Barclays PLC (BCS)

Current Dividend Yield: 2.21%

Country: UK

2.Company: Credit Suisse Group AG (CS)

Current Dividend Yield: 0.34%

Country: Switzerland

3.Company: Banco Santander SA (SAN)

Current Dividend Yield: 7.24%

Country: Spain

4.Company:Deutsche Bank AG (DB)

Current Dividend Yield: 1.91%

Country: Germany

5.Company:ING Groep NV (ING)

Current Dividend Yield: No dividends paid

Country: The Netherlands

Note: Dividend yields noted are as of Oct 10, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long ING, SAN