Two of the largest German electric utility stocks E.ON AG(EONGY) and RWE AG(RWEOY) were on a downtrend trend for a few years now and seemed to be stuck in neutral this year.The end of the Federal elections recently has also not yet brought changes to highly controversial German energy policies.

The main reason for the poor performance of traditional electric utilities is the subsidies offered to renewable energy companies. From an article in The Wall Street Journal:

In the late 1990s and early 2000s, Germany, France, Italy and some other EU countries began subsidizing solar and wind power in an effort to minimize the region’s reliance on imported fossil fuels and to reduce power prices.

“We’ve failed on all accounts: Europe is threatened by a blackout like in New York few years ago, prices are shooting up higher, and our carbon emissions keep increasing,” said GDF Suez CEO Gérard Mestrallet ahead of the news conference.

The European Commission, the bloc’s executive body, is scheduled to discuss the issue next week.

Under the subsidy mechanisms, wind and solar power producers benefit from priority access to the grid and enjoy guaranteed prices. In France, for instance, even as wholesale prices hover around €40 ($54) a megawatt hour, windmill electricity goes at a minimum of €83 a megawatt hour, regardless of demand. The difference is charged to customers.

The system certainly lured investors into wind and solar power projects. Germany now has 60 gigawatts of wind and solar capacity—about 25% of the country’s total power-generation capacity. But the guarantees mean households now pay double than before—29 euro cents a kilowatt-hour, up from about 14 cents a kilowatt-hour in 2000.

Source: EU Chiefs Knock Solar Aid, The Wall Street Journal, Oct 12-13, 2013

In 2000, Germany implemented the German Renewable Energies Law (EEG). Under this law, the country aims to generate 80% of total energy from renewable energy sources by 2050. So in order to achieve this goal, high subsidies were given to renewable energy providers with higher prices paid by consumers.This made traditional electric utilities in uncompetitive. Earlier this year a reform proposal put forth by Environment Minister Peter Altmaier to cap subsidies for renewable energy producers failed to pass in the Bundesrat according to an article in the Deutsche Welle. From that article:

Under an ambitious new energy policy, Germany seeks to boost renewables to make up 80 percent of total power generated by 2050. Along the way, nuclear power is to be completely phased out by 2022, and fossil-fuel based energy production sharply reduced.

However, since the EEG law was implemented in 2000, German electricity retail prices have risen from then 14 eurocents per kilowatt-hour to almost 29 cents today, according to data released by the Association of Energy and Water Industries (BDEW).

Much of the increase is the result of a surcharge on electricity bills paid by private households and businesses to finance state subsidies for renewable energies. Wind, solar and biomass energy producers are guaranteed fixed so-called feed-in tariffs above market price for 20 years. These subsidies have led to an investment boom propelling the amount of renewable energy from 15 percent of German power generation in 2008 to 23 percent in 2012.

Accordingly, the surcharge on electricity rose steeply, too, increasing by 47 percent just within the last year. In a recent estimate, the government has calculated that the surcharge will likely rise from currently 5.3 eurocents per kilowatt-hour to 6.2 eurocents in 2014.

Source: German energy transition caught in subsidies’ trap, Deutsche Welle

Clearly German policies for the past decade or so has tilted way too far on the side of renewable energy companies. As consumers become increasingly angry for footing the bill for this ambitious but badly-implemented policies,the pendulum may finally swing to the other side. Investors may want to monitor the developments with respect to the energy sector in Europe particularly any regulatory changes in Germany. Capping subsidies to renewable energy companies should provide a big boost to the share prices of E.ON and RWE AG.

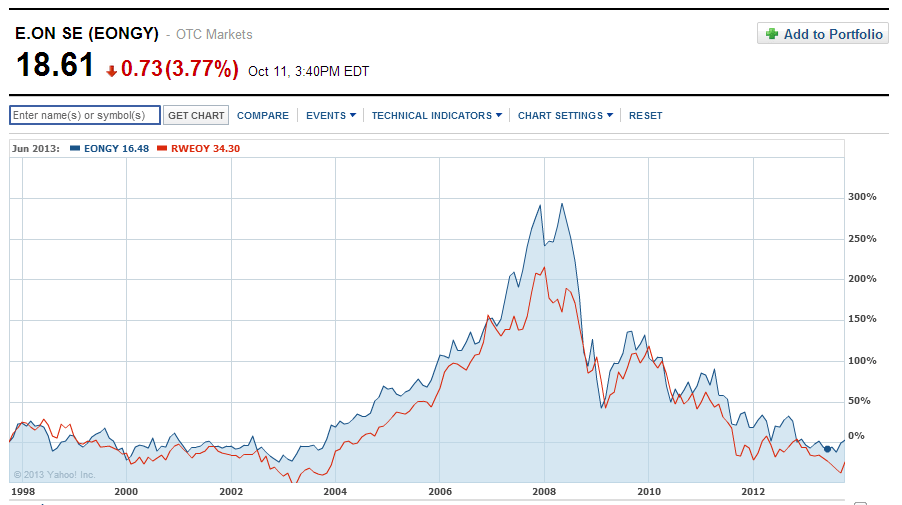

Currently EONGY and RWEOY have dividend yields of 5.68% and 7.16 respectively. The chart below shows the long-term performance of these stocks:

Click to enlarge

Source: Yahoo Finance

Disclosure: Dividend yields noted are as of Oct 11, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long EONGY and RWEOY

Related:

German call to ‘undo’ energy privatisation amid Berlin vote (BBC)

Germany’s Energy Poverty: How Electricity Became a Luxury Good (Der Spiegel)

Travails of renewable power in Germany (The Hindu)