The Global Financial Crisis (GFC) started in the U.S. in 2008 and by any measure has ended. As a result of the crisis the Federal Reserve slashed the Fed funds rate to almost 0% effectively handing out money to banks and other institutions for “free”. The Federal Reserve has kept the rate between 0 to 0.25% since December 2008. Even though we are now in Q3,2013, the Feds continue to maintain the ultra-low rates crushing savers in the process and encouraging speculation and asset price growth. The disastrous effect of this policy for the past five years has been felt by seniors and others that depend on income from their savings in fixed income instruments such as bank CDs.

Currently the interest rate for a 1-year and 5-year CDs are 0.65% and 1.33% respectively according to Bankrate.com data. Hence a senior citizen with a cash savings of one million dollars in a 5-year bank CD would earn a shocking $13,300 in interest per year before taxes. Obviously the majority of the population does not have that kind of money in the bank and hence the intense competition for low-paying service sector jobs remains high.

Here is an excerpt from “At 77 He Prepares Burgers Earning in Week His Former Hourly Wage” in Bloomberg:

It seems like another life. At the height of his corporate career, Tom Palome was pulling in a salary in the low six-figures and flying first class on business trips to Europe.

Today, the 77-year-old former vice president of marketing for Oral-B juggles two part-time jobs: one as a $10-an-hour food demonstrator at Sam’s Club, the other flipping burgers and serving drinks at a golf club grill for slightly more than minimum wage.

While Palome worked hard his entire career, paid off his mortgage and put his kids through college, like most Americans he didn’t save enough for retirement. Even many affluent baby boomers who are approaching the end of their careers haven’t come close to saving the 10 to 20 times their annual working income that investment experts say they’ll need to maintain their standard of living in old age.

For middle class households, with incomes ranging from the mid five to low six figures, it’s especially grim. When the 2008 financial crisis hit, what little Palome had saved — $90,000 — took a beating and he suddenly found himself in need of cash to maintain his lifestyle. With years if not decades of life ahead of him, Palome took the jobs he could find.

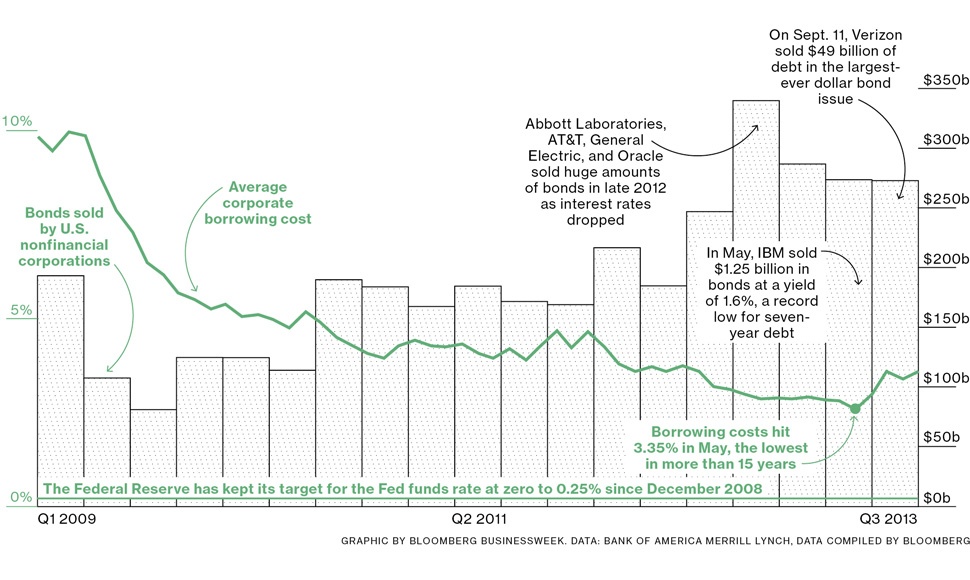

However not everyone is suffering from the low rates. According to an article in the recent edition of Bloomberg BusinessWeek American companies are highly benefiting from the Feds policy. The article states that corporate America saved $900 billion in interest in the past four years due to the low rates.

Click to enlarge

Source: Bloomberg BusinessWeek

For anyone curious to know why the Federal Reserve keeps rates so low for so long here is the answer straight from the feds themselves:

By law, the Federal Reserve conducts monetary policy to achieve maximum employment, stable prices, and moderate long-term interest rates. The economy is recovering, but progress toward maximum employment has been slow and the unemployment rate remains elevated. At the same time, inflation has remained subdued, apart from temporary variations associated with fluctuations in prices of energy and other commodities. To support continued progress toward maximum employment and price stability, the Federal Open Market Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In its September 2013 statement, the Committee indicated that it currently anticipates that a target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than half a percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.

Source: Why are interest rates being kept at a low level?, The Federal Reserve

The unemployment rate stood at 7.3% in August according to the Bureau of Labor Statistics. Since it is well above 6.50%, we can expect the interest rates to remain for the foreseeable future.

Update:

Why U.S. uncertainty could mean ultra-low rates for years — or even ‘decades to come’ (Financial Post)