The S&P 500 Index is the best representation of large cap U.S. companies. The index was first published in 1957 and the components in the index capture 75% coverage of all U.S. stocks. The S&P 500 is the widely followed barometer of the U.S. equity markets.

The S&P/TSX Composite Index is the benchmark index of the Canadian equity market.This index provides coverage for 95% of the Canadian market.A total of 239 companies are in the index.

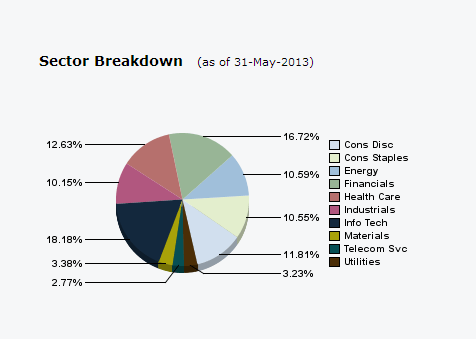

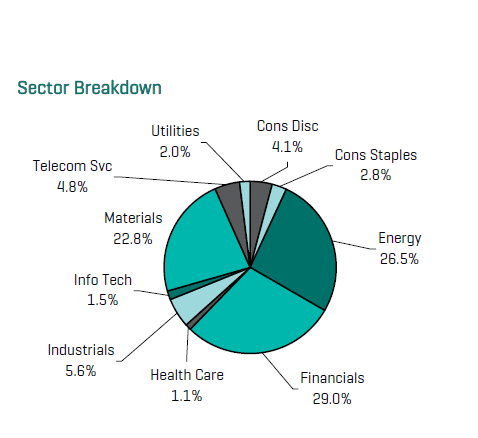

The following charts show the composition of the indices:

1) S&P 500 Index (as of May 31, 2013):

Click to enlarge

2) S&P/TSX Composite Index (as of October 31, 2011):

The Top 10 Constituents of S&P 500 Index:

| S.No. | Constiuent | Ticker | Sector |

|---|---|---|---|

| 1 | Apple Inc. | AAPL | Information Technology |

| 2 | Exxon Mobil Corp | XOM | Energy |

| 3 | Microsoft Corp | MSFT | Information Technology |

| 4 | General Electric Co | GE | Industrials |

| 5 | Chevron Corp | CVX | Energy |

| 6 | Johnson & Johnson | JNJ | Health Care |

| 7 | Google Inc | GOOG | Information Technology |

| 8 | International Business Machines Corp | IBM | Information Technology |

| 9 | Procter & Gamble | PG | Consumer Staples |

| 10 | JP Morgan Chase & Co | JPM | Financials |

The Top 10 Constituents of S&P/TSX Composite Index:

| S.No. | Constiuent | Ticker | Sector |

|---|---|---|---|

| 1 | Royal Bank of Canada | RY | Financials |

| 2 | Toronto-Dominion Bank | TD | Financials |

| 3 | Bank of Nova Scotia Halifax | BNS | Financials |

| 4 | Suncor Energy Inc | SU | Energy |

| 5 | Canadian National Railways | CNI | Industrials |

| 6 | Barrick Gold Corp | ABX | Materials |

| 7 | Bank of Montreal | BMO | Financials |

| 8 | Potash Corp of Saskatchewan | POT | Materials |

| 9 | Canadian Natural Resources | CNQ | Energy |

| 10 | BCE Inc | BCE | Telecommunication Services |

Source: Standard & Poor’s

As a resource-based economy, Canada’s benchmark index is concentrated with financials, energy and materials. These three sectors account for about 79% of the index with energy and materials alone having a weightage of about 50%. In the S&P 500, financials account for about 17% while materials and energy make up less than 15% of the index.

Among the top 10 constituents, the TSX Composite is dominated by companies in the above three sectors with the exception of one firm (Canadian National) from the industrial sector. In the S&P 500, just two companies from the energy sector are in the top 10. The presence of four IT firms shows the importance of the industry for the U.S. economy.

Related ETFs:

Disclosure: Long BMO, BNS, CNI, TD and RY