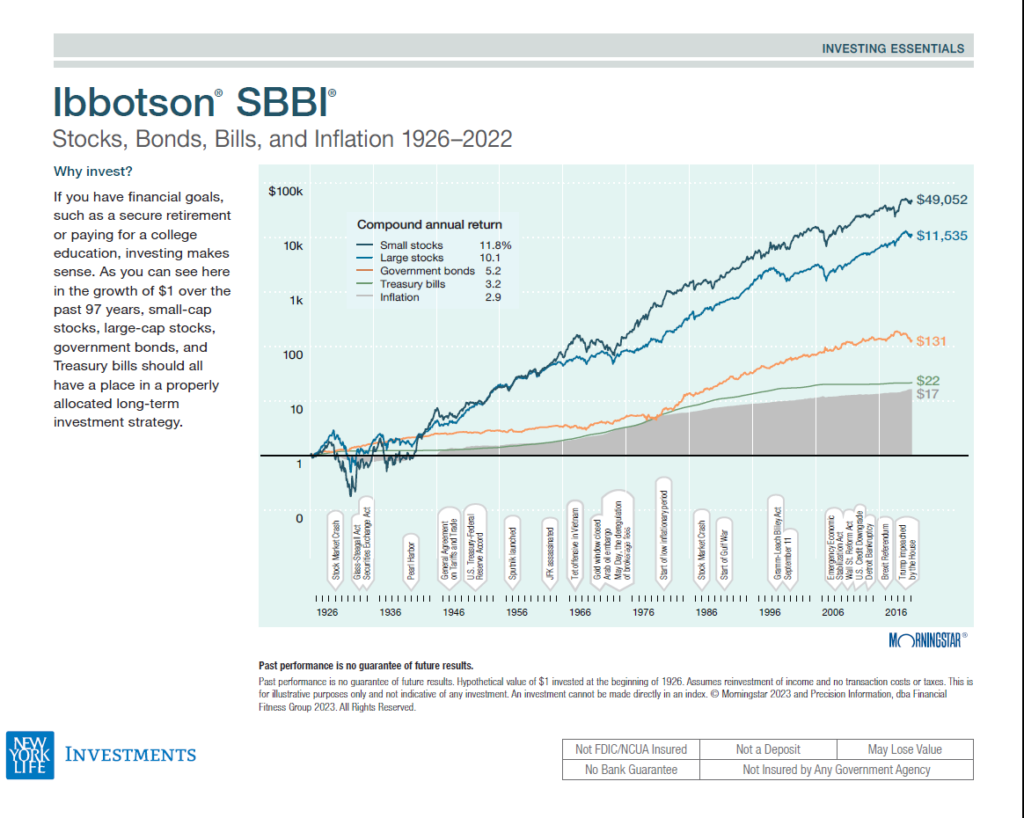

Investing in equities and bonds is one of the best ways to grow wealth. This is especially true when it comes to long-term. Over many years or decades due to the effect of compounding stocks have historically generated the highest returns over bonds and other assets. The following chart shows the growth of $1 from 1926 to 2022. Small caps had a higher return than large caps in this long period. The chart also shows the return on bonds and T-Bills together with inflation.

Click to enlarge

Source: New York Life Investments

Related ETFs:

Disclosure: No positions