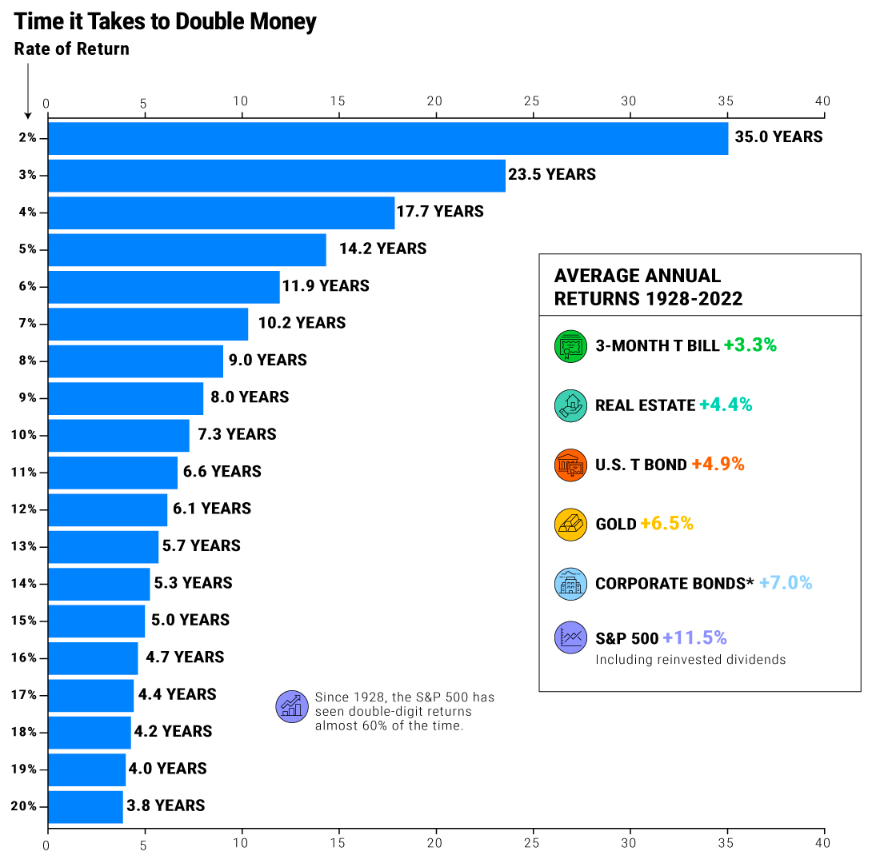

I came across the below interesting chart showing how long it takes to double your money based on rate of return. At 5% it takes just over 14 years to double your money. The S&P 500 has returned an average annual return of 11.5% since 1928 to thru last year. However since it is an average and over such a long period it is highly unlikely most retail investors would generate that rate of return. However even if we assume the rate is 5% it is not bad to double one’s money in 14 years.

Click to enlarge

Source: Market Index

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Gold Trust ETF (GLD)

- Vanguard Total Bond Market ETF (BND)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

Disclosure: No positions