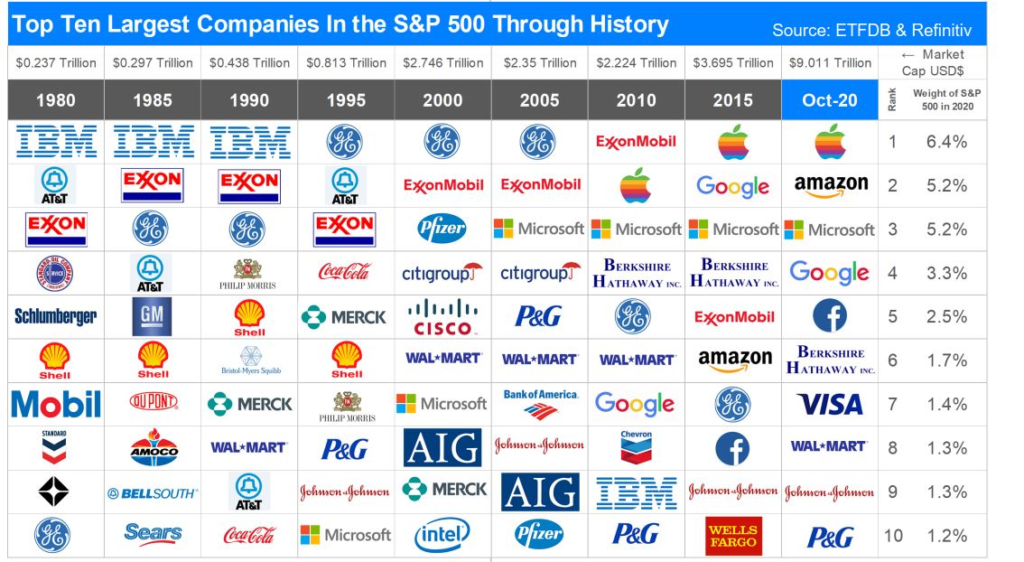

One of the main strategy for success with investing in equity markets is diversification. Companies tend to rise to the top based on the theme that is hot during a specific period. Once at the top no company stays there forever. Leadership in the S&P 500 changes on a regular basis. One time it may be the tech sector that is hot while another time it may be the good old oil or some other sector. So the important point to remember is today’s leaders could become tomorrow’s losers and vice versa. The following chart shows this concept with the leadership changes in the S&P 500 from 1980 to 2020:

Click to enlarge

Source: Lessons From Market History: Price Does Matter, Pacifica Partners

Tech giant IBM (IBM) used to be a market darling during the 80s and early 90s. That is no longer the case. IBM nowadays is just another also-run company that is still living off its former glory. Similarly who could forget about that great American wonder called the GE(GE). After a spectacular collapse the company is basically today nothing that made GE the GE. Its appliance business was taken over some Chinese firm and GE also exists but barely. Oil major ExxonMobil(XOM) appearing in this list for many years shows the importance of oil for the US economy.

The key takeaway from this post is that today’s hot stocks like Tesla(TSLA), Nvidia(NVDA), Facebook(FB), etc. could easily turn out to be duds in the years to come.

Disclosure: No positions