I have written many times before on the futility of market timing. The saying that time in the market is so important than timing the market couldn’t be understated. Market timing is impossible to achieve because an investor has to be right twice. Once when they sell stocks and again when they re-enter the markets. This is easier said than done since predicting the future is difficult. While selling stocks in a falling market is easy markets can turn in the other direction almost overnight.

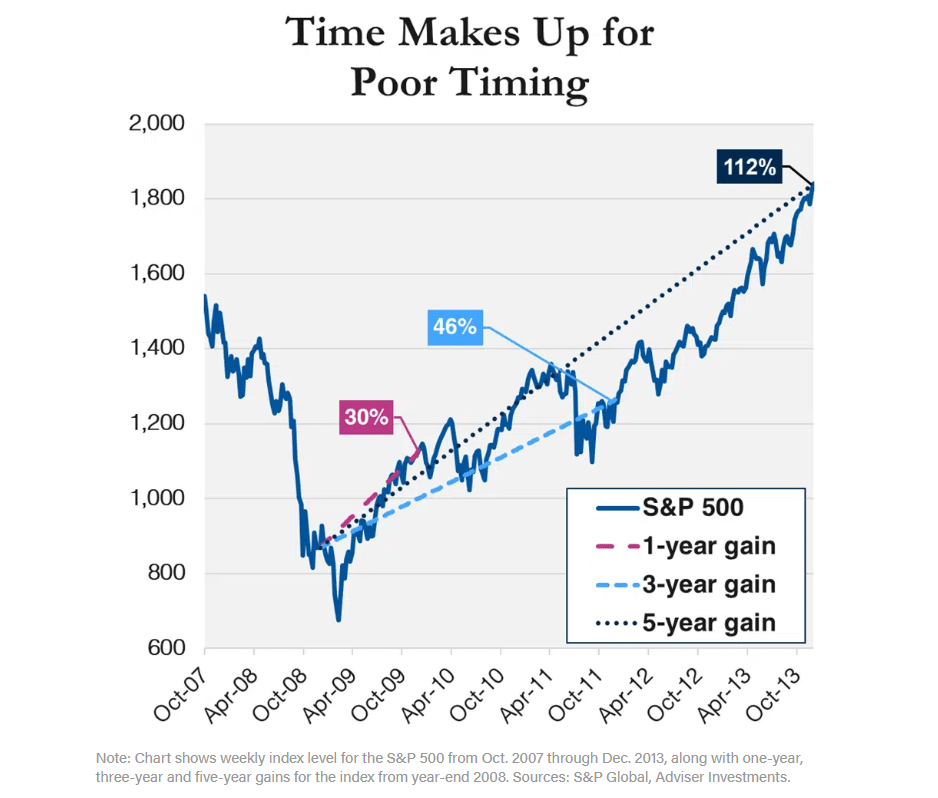

With that said, the below chart shows how holding stocks for the long-term beats short-term declines and produces excellent returns:

Click to enlarge

Source: Chart of the Week: A Bullish Case for Resisting Market Timing by Jeffrey DeMaso, Adviser Investments

An excerpt from the above piece:

Consider an investor who bought a U.S. stock index fund at the end of 2008. The S&P 500 index fell 18.6% over the first two months of 2009 and the investor likely felt discouraged by their purchase. However, by the end of 2009, the S&P 500 and our hypothetical investor’s fund were 30% higher than they were at the start of the year, despite the “early” entry into the market. And that’s before counting dividendsA cash payment to investors who own stock in the company.

Look out a little further and the results are even better. Three years after their purchase, the investor was up 46%. Five years on and they had more than doubled their money with a 112% gain.

In an ideal world, you could buy right at the bottom and ride the wave to the top. But you probably don’t have perfect timing (I’ve never met anyone who does). The remedy to imperfect timing is extending your time horizon—over time you’re likely to come out ahead of where you started

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions