During high inflationary periods such as the one we are currently in now, many investors are in search of assets that would help them earn returns that are equal to if not better than the inflation rate. While bonds provide fixed income on a regular basis and the principal invested is safe for the most part, bonds are not the best asset class to beat inflation. Stocks on the other hand are ideal to own when inflation is high since dividends paid out by them can increase and also stocks can generate capital appreciation. Together the returns from these two sources can match or even beat inflation. Though the fixed income from bonds is consistent and regular, they are more exposed to inflation than stocks.

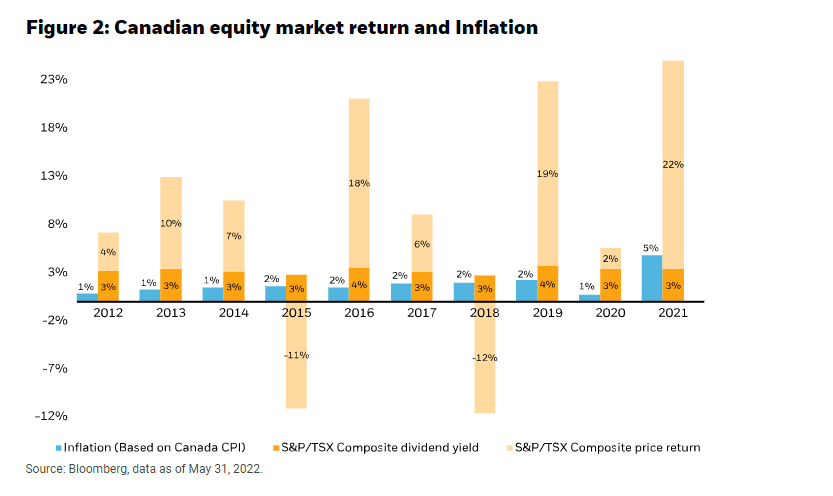

The following chart shows that stocks are better to match or beat inflation using the example of Canadian equities:

Click to enlarge

Source: A case for dividend investing, RBC Global Asset Management

Related ETFs:

iShares MSCI Canada Index Fund (EWC)

Disclosure: No positions