I have written many times before that time in the market is more important than timing the market, if that is even possible. It is worth repeating this concept especially during volatile market times as more investors tend to think about bailing out of the market. The problem with this idea is while it is easy to get out at any time to cut down further losses it is not easy to say the least of figuring out when to get back in. Since nobody knows when the market would turn for the better it is foolish to hope that one can predict this. For example, for the past few weeks many experts have been trying to identify “the bottom” of this market in a futile exercise.

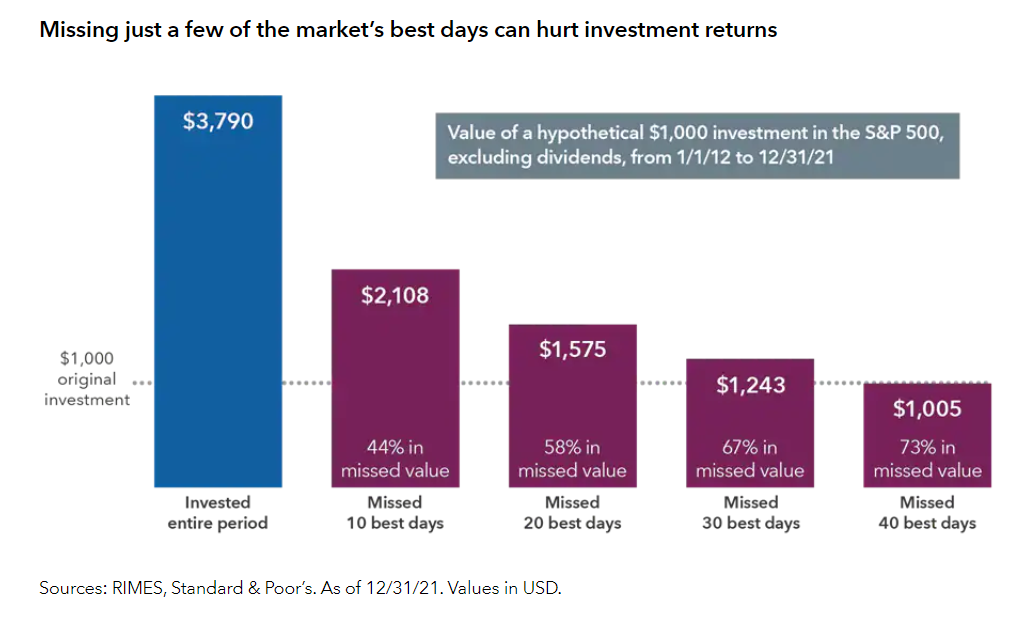

Staying invested during good and bad times is important because even just missing the best few days will lead to a much lower return as shown in the chart below:

Click to enlarge

Source: How to handle market declines, The Capital Group

An excerpt from the above piece:

Even missing out on just a few trading days can take a toll. A hypothetical investment of $1,000 in the S&P 500 made in 2012 would have grown to more than $3,790 by the end of 2021. But if an investor missed just the 10 best trading days during that period, he or she would have ended up with 44% less. (emphasis mine)

Another important fact to remember is that the best days seem to be closer to the worst days and vice versa. This makes it even more difficult to time the market. When the market plunges say 5% one day an investor that sells out will inevitably miss the say 3% surge that may follow in the next few days.

A recent article at Vanguard UK makes this point very clear. From the article:

Another reason for clients to stay invested and not time the market is that, historically, the best and worst trading days have come close together, making it difficult to avoid one without the other. Last week was a perfect example of that, with US share prices surging on the day of the Fed’s rate-hike announcement, followed by a plunge the next day.

Remember also that some of the best trading days have occurred during periods of long market downturns, as shown in the chart below. Missing those key trading days lowers long-term returns.

Again, please note, that the returns data shown below only cover the 500 biggest listed companies in the United States and is in US dollar terms. However, the US market accounts for well over half the world’s shares by value and it’s a similar picture in other currencies.

Past performance is no guarantee of future returns. Sources: Vanguard calculations, based on data from Refinitiv using the Standard & Poor’s 500 Price Index. Data between 1 January 1980 to 31 December 2021.

The bottom line for investors is that sticking to your long-term investment strategy may be the best route to investment success.

Historically, investors with patience and a long-term perspective would have benefitted more from staying the course than trying to time the market when things get choppy.

Source: Keep perspective when markets are volatile, Vanguard UK

So the key takeaway for investors is that it is wise to simply stay put during adverse market conditions and focus on the long-term by ignoring the day to day noise and other distractions.

Related ETFs:

Disclosure: No Positions