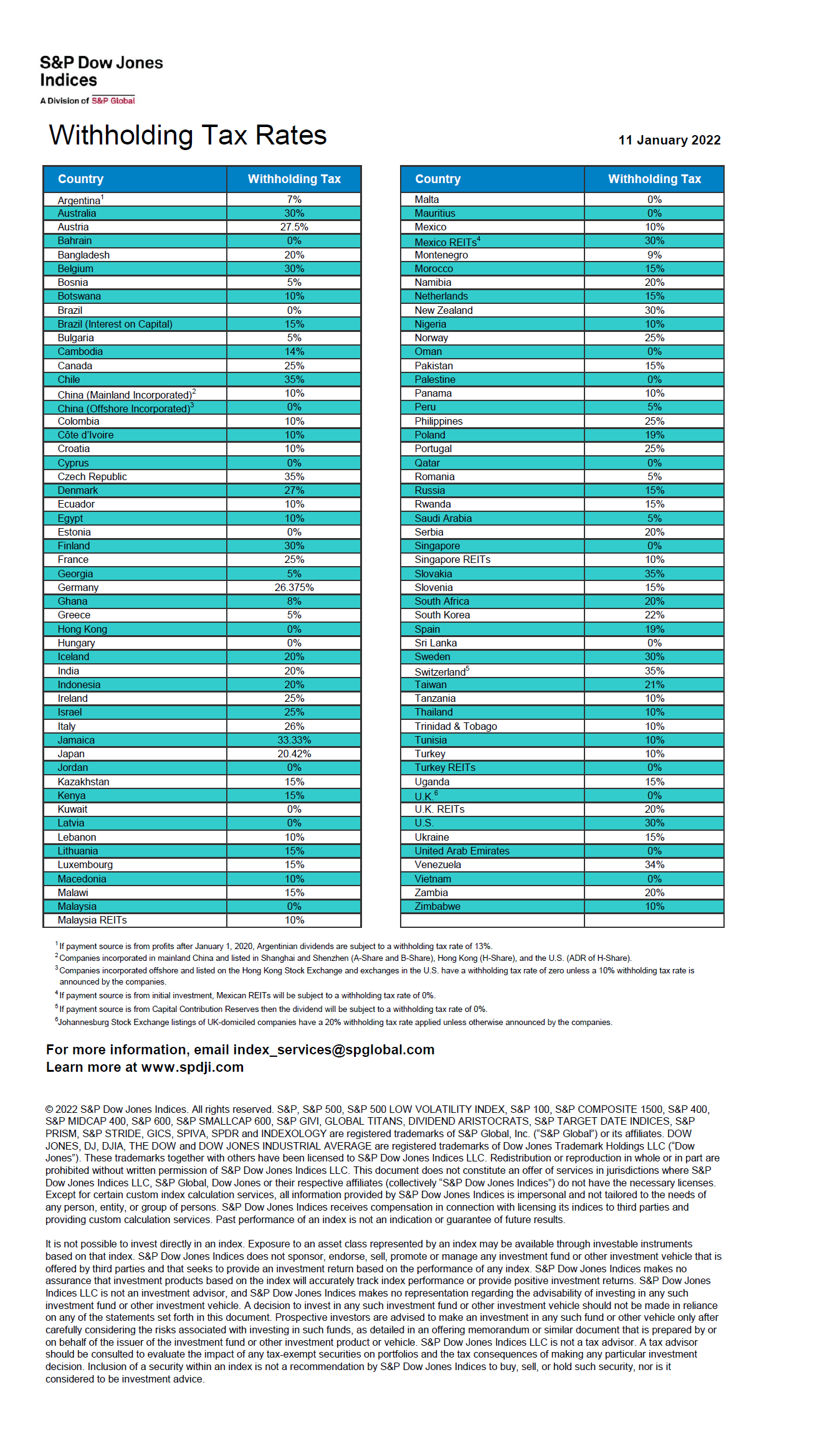

S&P Global has updated the Dividend Withholding Tax Rates by Country sheet for 2022.This one-pager is very useful for ADR investors that pay dividends. Countries such as Singapore, UK, Malaysia, etc. do not withhold any taxes on dividends paid out to non-residents on stock only. Though the rate for Canada is noted as 25% in this table, this can be reduced to 15% in non-retirement accounts by submitting NR-301 form to Canada Revenue Agency (CRA). For stocks (excluding REITs) held in qualified retirement accounts, Canada does not withhold any dividends for US residents. So investors are better off owning income stocks such as Canadian Banks, Utilities, etc. in retirement accounts.

Click to enlarge

Source: S&P Dow Jones

Bermuda is a very important omission. Home of many high dividend companies, especially shipping industry.

Yes. Sorry about that. It was not included by S&P Global in the original table.

But I will update it later today.

Agree Bermuda is important to list here. Thanks for the note.