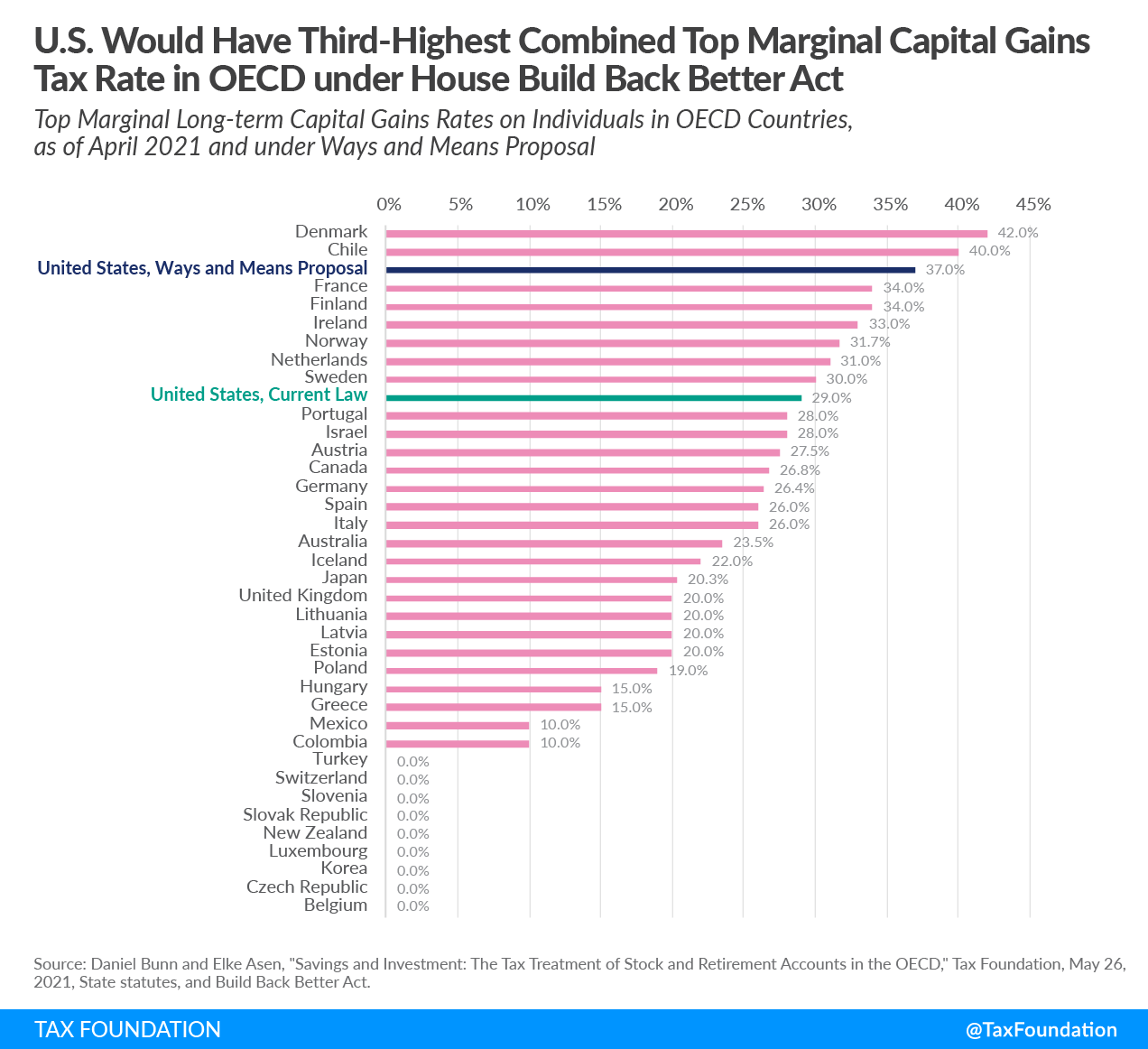

Under the House Build Back Better Act proposal, the US would have the third-highest combined top marginal tax rate on long-term capital gain taxes among OECD countries according to an article at the Tax Foundation. Currently Denmark has the highest rate at 42 percent followed by Chile. As an emerging country, Chile used to have attractive low capital gain taxes a few years ago. That has changed and now high dividend withholding taxes are levied on dividends paid out foreigners by Chilean firms.

Under the proposal, the US combined tax rate on long-term capital gains would be an astonishing 37 percent. This rate includes long-term capital gain taxes, net investment income tax and a new 3 percent tax on high earners.

Click to enlarge

Source: Proposed Top Combined Marginal Capital Gains Tax Rate Would Be Third-Highest in OECD by Erica York, Tax Foundation