The S&P 500 closed at 4,458 on Friday. The index is up over 20% as of last Friday’s close and has reached 54 records so far this year. The P/E ratio stands at over 34, well above the historic levels at around 20. At current levels, US stocks are expensive indeed. However that does not seem to stop investors’ attraction towards equities. In fact, as recent as last quarter even foreign fund managers were pouring money into the red-hot US equity market.

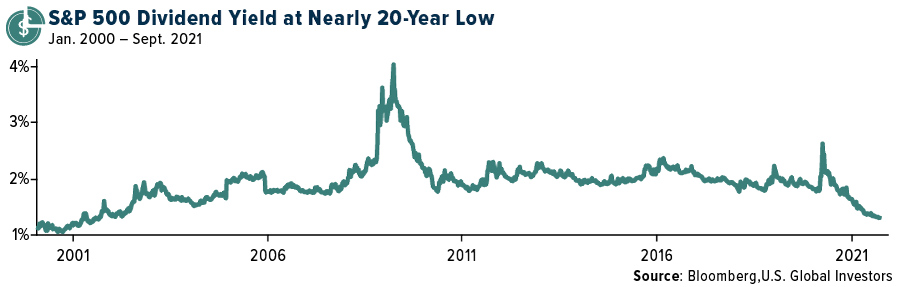

I have written many times before that the dividend yield of the S&P 500 has stayed low. It has been under 2% for a few decades. The dividend yield reached a 20-year low of 1.32% as of September 10th. This rate is well below the annual inflation rate according to an article by Frank Holmes at U.S. Global Investors.

Click to enlarge

Source: Remembering 9/11 on the 20th Anniversary, U.S. Global Investors

With dividends so low, an argument can be made that investors are betting on the greater fool theory. Whether a stock is at $100 or $500 or even over $1,000 they are buying them anyway in the hope that they can unload it some other fool who is willing to buy at even higher prices. It remains to be see how long this logic will work.

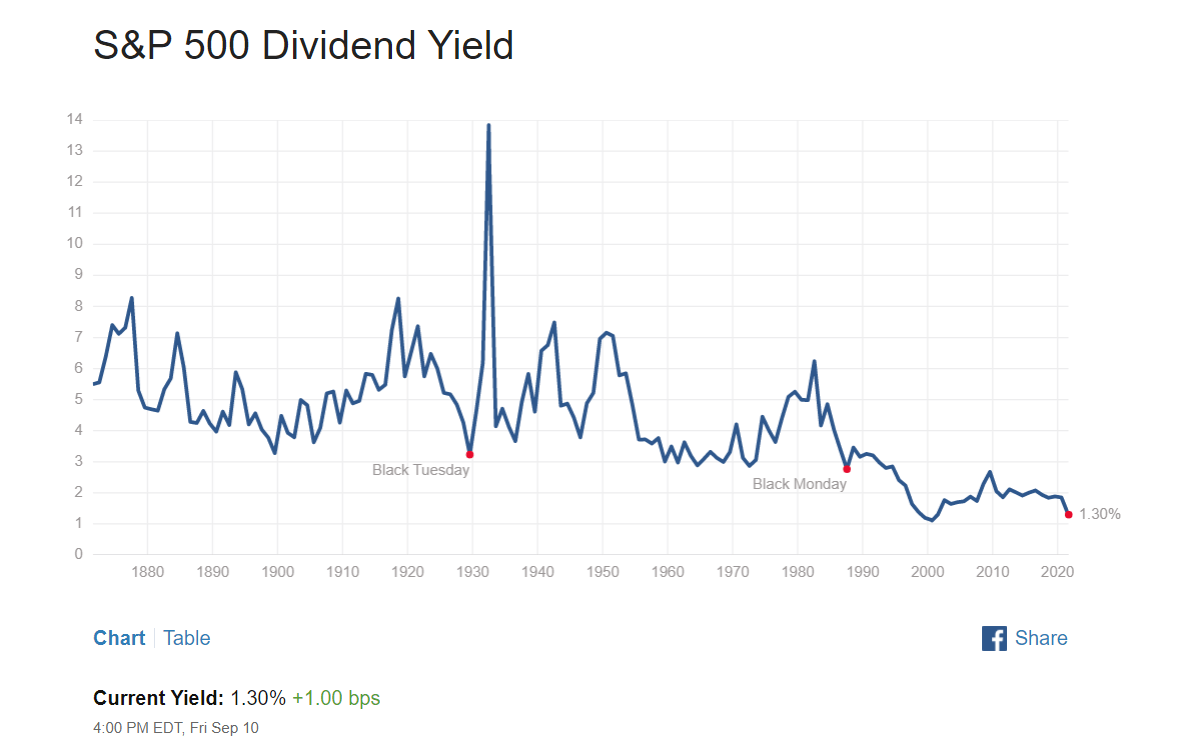

The following chart shows the dividend yield of the S&P 500 since 1870:

Click to enlarge

Source: Multipl.com

With multiple headwinds facing the US economy and the P/E ratio at above historic mean levels, caution is warranted with investing in stocks.

Related ETF:

Disclosure: No positions