Investing in many European equities involve a tax called Financial Transaction Tax (FTT). This tax was implemented in some countries in Europe after the Financial crisis of 2008-09. In the basic sense, FTT is a levy or duty charged just for the privilege of transacting in certain financial securities including stocks.

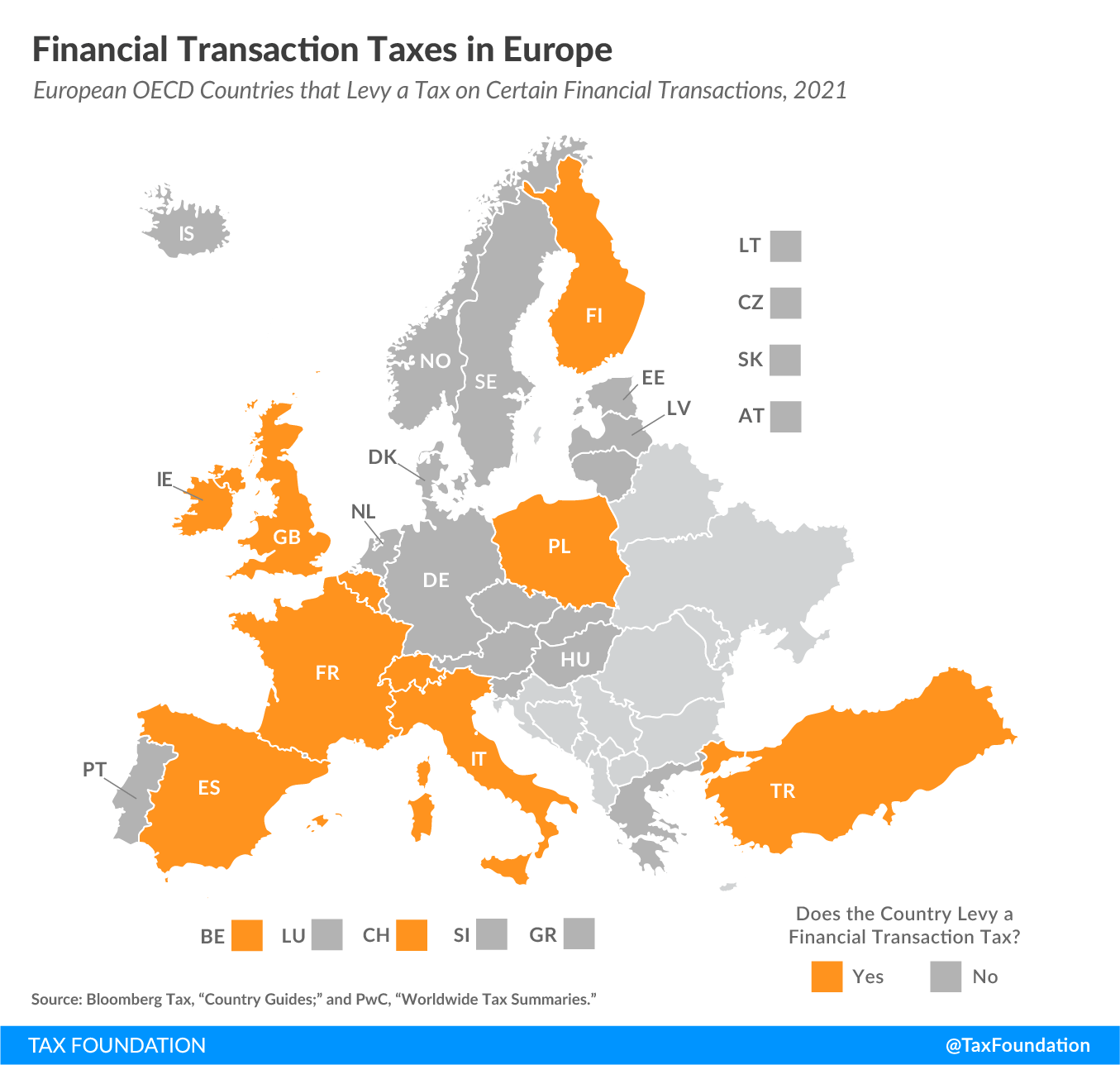

The following chart shows which countries apply the Financial Transaction Tax for 2021:

Click to enlarge

The FTT rate varies widely across countries. The latest rate is shown in the following table:

| Country | Tax Rate |

|---|---|

| Belgium (BE) | 0.12% – 1.32% |

| Finland (FI) | 1.6% – 2.0% |

| France (FR) | 0.01% – 0.30% |

| Ireland (IE) | 1% |

| Italy (IT) | 0.02% – 0.20% |

| Poland (PL) | 1% |

| Spain (ES) | 0.20% |

| Switzerland (CH) | 0.15% – 0.30% |

| Turkey (TR) | 0.0% – 1.0% |

| United Kingdom (GB) | 0.5% – 1.5% |

| Sources: Bloomberg Tax, “Country Guides,” https://www.bloomberglaw.com/product/tax/toc_view_menu/3380; and PwC, “Worldwide Tax Summaries,” https://taxsummaries.pwc.com/. | |

Source: Financial Transaction Taxes in Europe by Elke Asen, Tax Foundation

Obviously the introduction of FTT has made European stocks unattractive to American investors. In addition to FTT, US investors in ADRs pay additional charges like a Dividend Withholding Tax and an ADR fee, if applicable as well.

Let’s take an example of French auto parts maker Valeo(VLEEY). An investor buying 100 shares would pay the following FTT:

VLEEY price on 2/19/21 = $19.48

For 100 shares = $1,948.00

FTT at 0.30% for $1,948 = $5.85

The FTT amount would be charged at the time of both buying and selling. Assuming the investor sells at the same $19.48 price, would pay a second FTT of $5.85. Because the FTT is a percentage and not a fixed amount, of course if the investor sells at a higher share price, he/she would pay a higher FTT as well.

On top of this, any dividends paid out will be reduced by 26.5% for dividend withholding taxes. Finally the ADR fee of $0.02 per ADR would be charged annually. So that would be $2.00. Usually this amount is deducted from the dividend paid to make it easier for investors. If a company does not pay a dividend, then it will be taken from the cash portion of an account.

Of course if the stock goes to $0, one would lose not only the original investment but also ends paying the FTT for nothing. This benefits the French government as some kind of free money donated by unknown nameless strangers from a foreign land.

The recent GameStop saga has some calling for the introduction of the FTT by the US. However it is unlikely to gain traction in the US.

Disclosure: Long VLEEY