One of the questions on many investors’ mind these days is this: Are Value Stocks Better Than Growth Stocks? Or is value investing dead? This is not surprising since 2020 has been the year for growth. Growth-oriented stocks in the tech, renewable energy, Electric Vehicle(EV), internet retail, etc. industries vastly out-performed value equities. Some of the winners from these industries that shot up substantially last year include Tesla(TSLA), Nio (NIO), Quantumscape Corp (QS), Amazon (AMZN), NVIDIA Corporation (NVDA), etc. The million dollar question is how long will these and other growth stocks will continue to rise. Of course, nobody knows the answer to this question. What do know is in the fight between value and growth, the winner is growth especially in the long run as measured in years or decades. A recent article by Matthew A. Young of Young Investments discussed this topic with supporting historical data. From the article:

Value-Oriented Strategies the Long-term Winner

Indeed, the latter point is undoubtedly true; but, unintuitively, over the long run, value-oriented stocks have performed best.

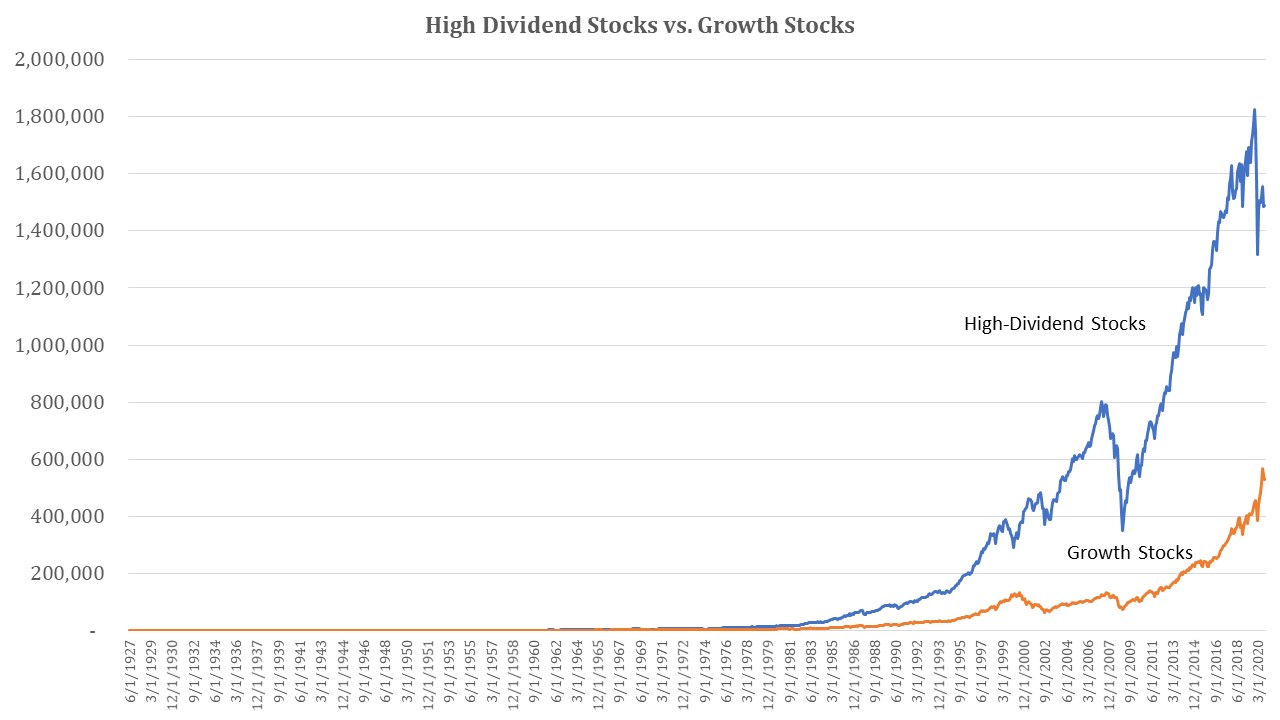

The chart below shows the long-term performance of $100 invested in high-dividend-yield stocks (value-oriented) versus $100 invested in growth stocks. The data comes from the Kenneth French Data Library. High-dividend stocks are measured by the top 30% of stocks ranked by yield and weighted by market value. Growth stocks are measured as the top 30% of stocks ranked by price to book (the most common metric to distinguish growth from value) and also weighted by market value.

As you can see in the chart, high-dividend stocks are the clear winner. Over the long run, it’s not even close. One hundred dollars invested in high-dividend stocks in June of 1927 is worth almost $1.5 million today. That same $100 invested in growth stocks is worth about $530,000 today.

The reason value-oriented shares outperformed growth shares is not because growth shares don’t have greater growth—they do. Value’s outperformance comes from a rebalancing effect. By example, you might buy a stock when the dividend yield is far above the market and sell that stock at a later date when the yield is far below the market. The same thing happens with growth stocks. A growth stock selling at a high price-to-book value may see growth slow, pushing it out of growth stock territory and resulting in growth funds selling the shares at a lower price.

According to Rob Arnott, chair of Research Affiliates and former editor of the Financial Analyst’s Journal, from 1963 through 2007 this rebalancing effect added 5.4% annually to value strategies and detracted 7% annually from growth strategies. The net effect was a 12.4% advantage for value shares. Since 2007, these figures are about the same. So even though growth stocks have greater growth in their fundamentals than value stocks, that growth differential isn’t enough to overcome the drag that growth strategies suffer from because of the rebalancing effect.

Source: No Easy Choices, Young Investments

The full piece is worth a read.

Key Takeaway: Growth stocks are great to own until the growth stops. So it is wise to not get carried away by spectacular returns and completely avoid value equities. The ideal solution is to diversify among various assets classes such as value, growth, domestic, foreign, real estate, gold, etc.

Disclosure: No Positions