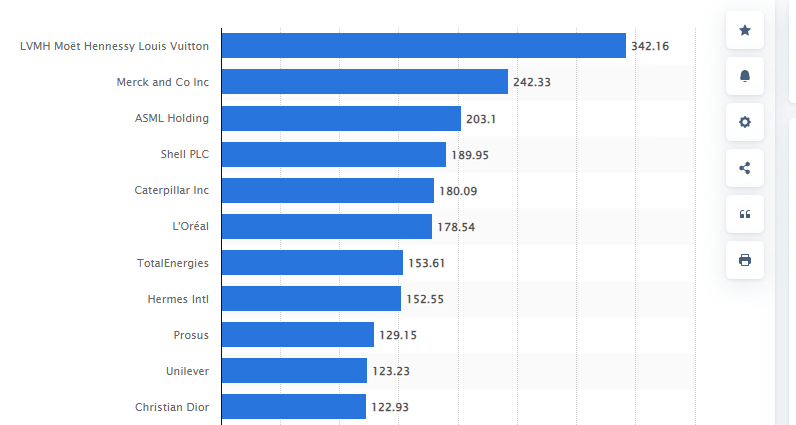

France was one of the first few countries that introduced a transaction tax for buying and selling of stocks. When it was launched in 2012, the French Financial Transaction Tax was 0.20% on all equity purchases of French firms with market capitalization of over over 1.0 billion Euros. In 2017 this rate was increased to 0.30%. This additional tax on top of high dividend withholding taxes make investing in French stocks unattractive for US investors. However France is still home to some world-class firms and potential investment opportunities can still be found despite the high costs of investing there. Back in 2012 I posted the list of French ADRs affected by this tax.

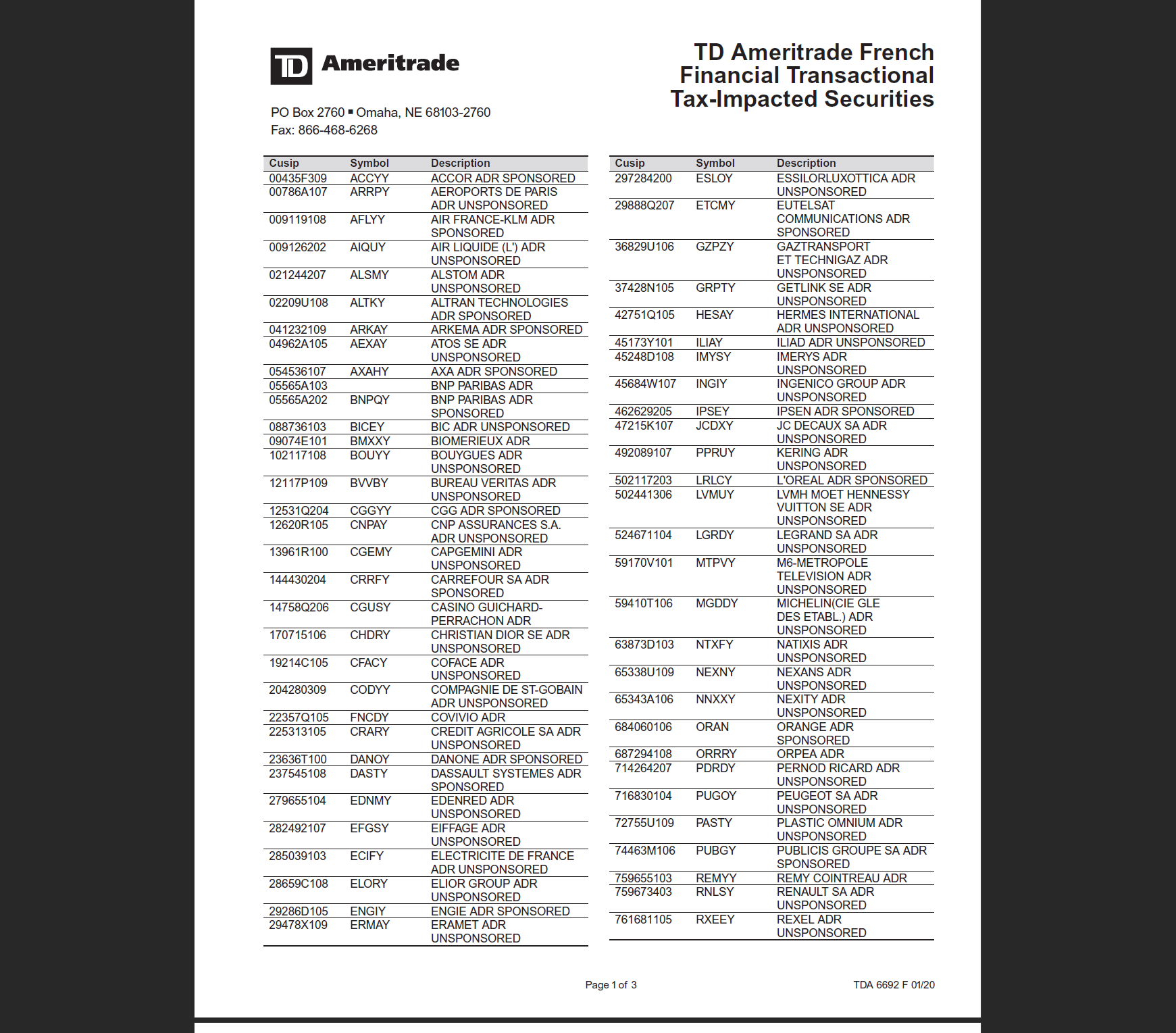

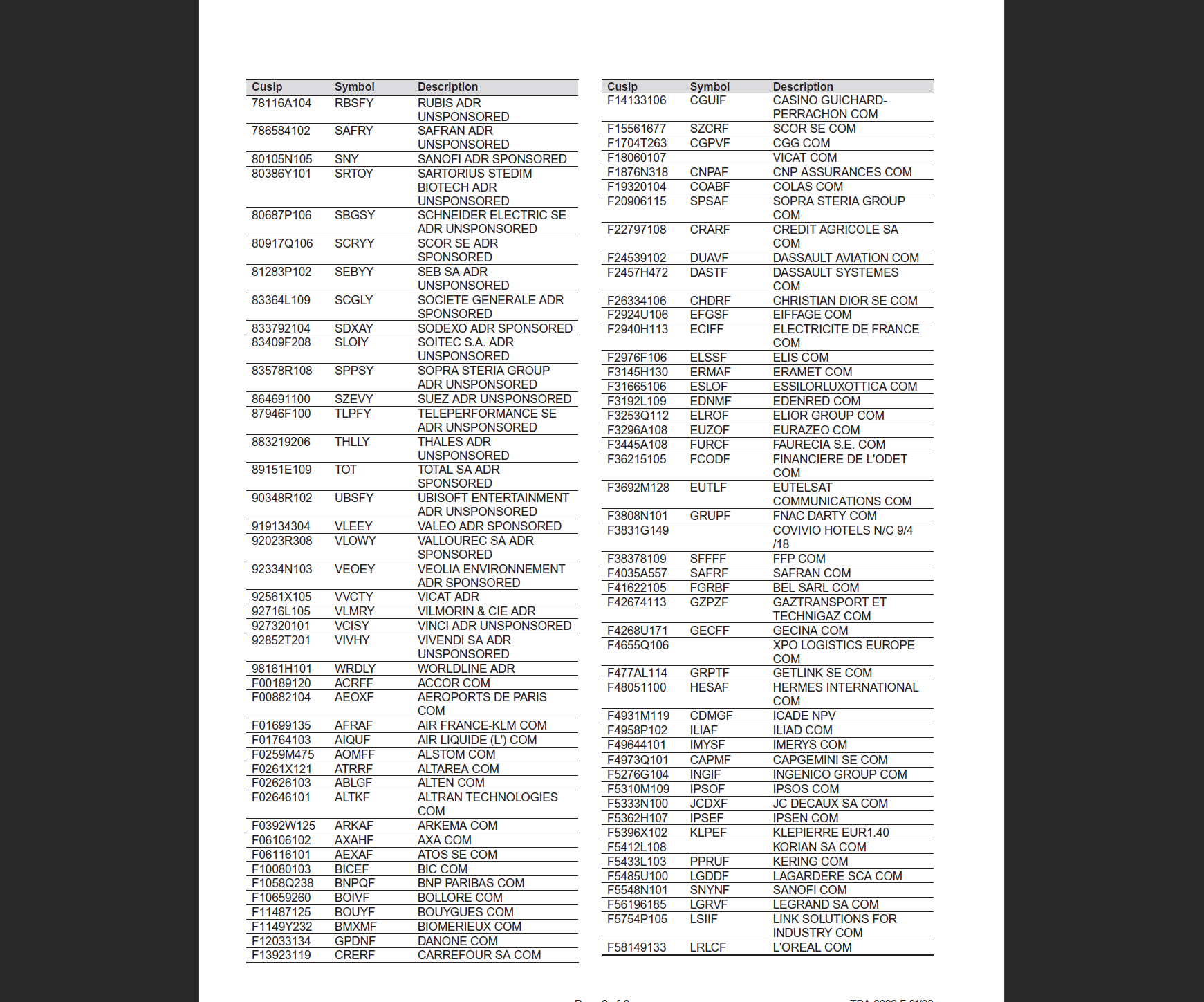

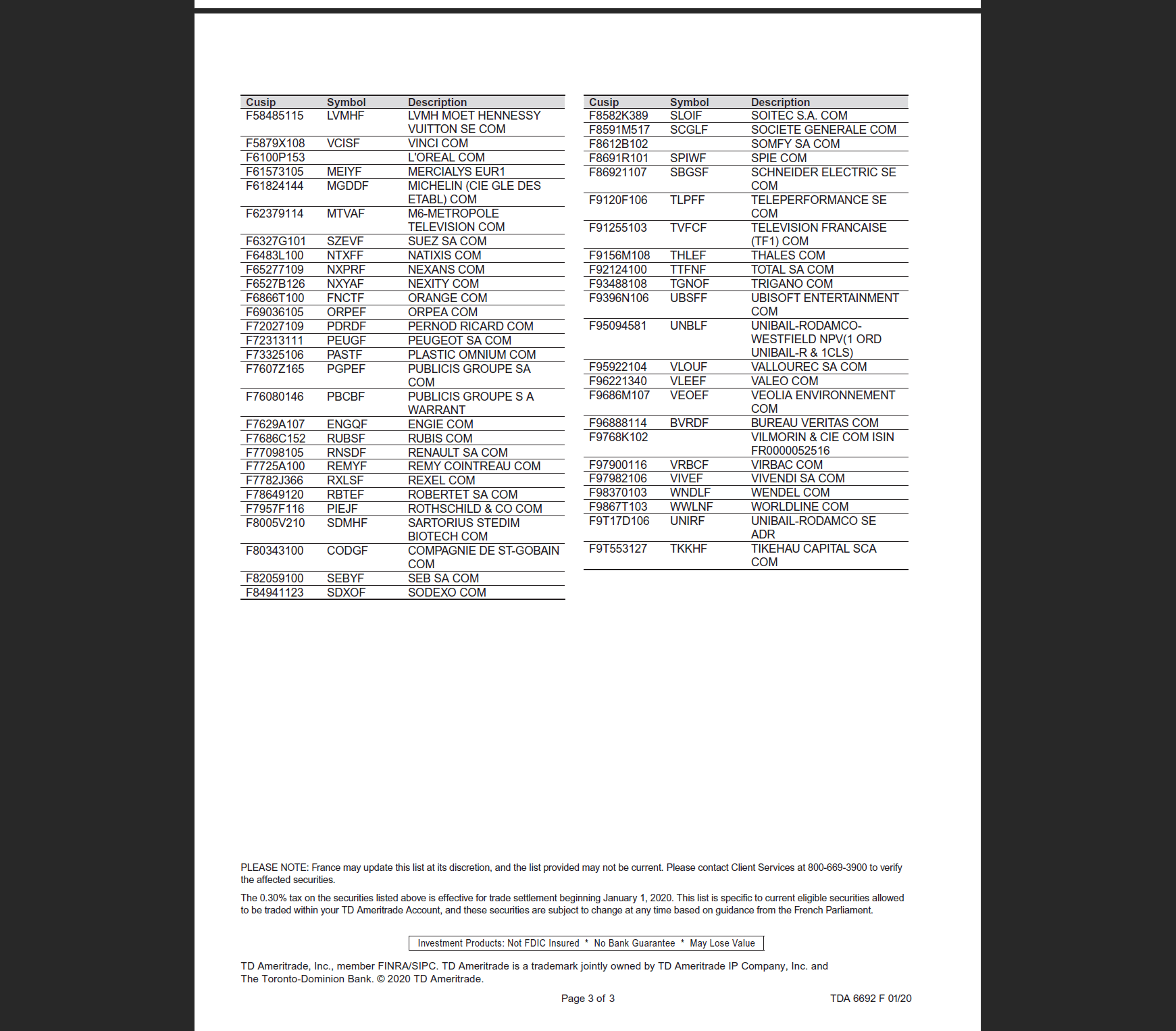

The following is an updated list of French ADRs subject to the Financial Transaction Tax. Before investing in French stocks investors can review this list as part of the due diligence:

Click to enlarge

Source: TD Ameritrade

Download List:

The Complete List of French ADRs can be found here.

es ist ja nicht nur die Finanztransaktionssteuer, sondern auch die besondere Behandlung der Ausschüttung/Erträgen durch die französischen Instutitionen bei deutschen Anleger. Dies bezeichne ich als um organisierte Wegelagerei.

Deshalb – einfach nicht mehr in französische Werte Investieren

Thanks. I did not know about that tax implications for German investors in French companies.

Good luck !