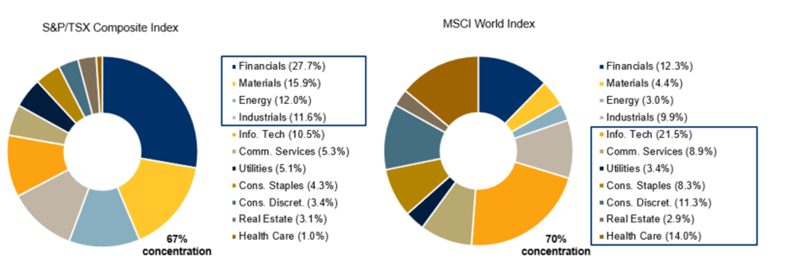

The Canadian equity market is highly concentrated. Just four sectors – financials, materials, industrial and energy account for about 70% of the market. As with investors in any other country it is wise for Canadian investors to not hold all their assets in the domestic stocks and instead diversify across other sectors in foreign countries. The latest data for the benchmark S&P/TSX Composite Index is dominated by Financials at just over 30%.

Jillian Richmond of PH&N Investment Services discussed the need for Canadian investors to diversify in an article a few months ago. From the article:

By investing globally, you can benefit from exposure to other sectors that are under-represented at home, including Information Technology and Health Care. Exposure to Health Care may be particularly timely as a number of COVID-19 vaccines are being developed in labs outside Canada.

97% of the world’s investment opportunities lie outside of Canada

Canadian market is focused in four sectors, while global markets are very well diversified.

Sources: S&P and MSCI Indices as of July 31, 2020.

Source: How to avoid home country bias, PH&N Investment Services

In the Info Tech sector Canadians can find plenty of opportunities just south of the border relative to the home market.