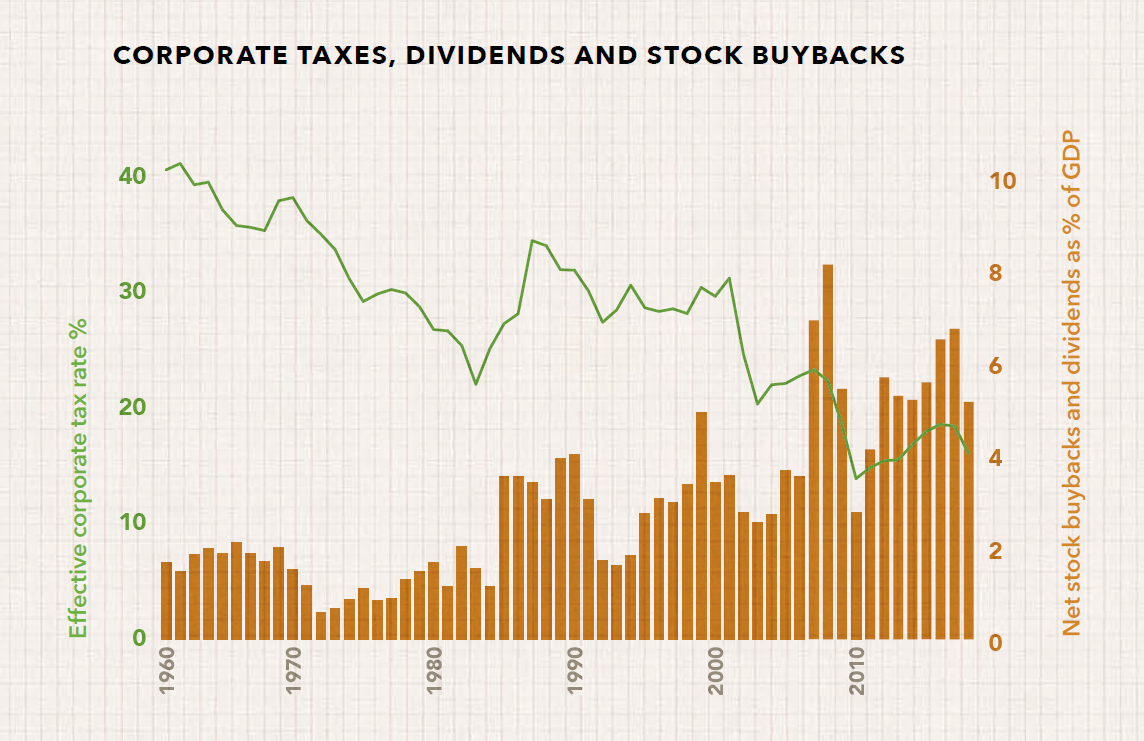

The corporate tax rate in the U.S. has declined steadily since the 1960s. The rate has declined from over 40% during that period to 21% this year. Lower taxes does not necessarily mean more productive investment by a company. Instead of spending on R&D and other long-term investments most firms spend more of their profits on dividends and buybacks. I came across an interesting article at Ruffer Investment that discussed the impacts of declining corporate taxes and rising dividends and buybacks. Stock holders are the winners when firms return profits to them in the form of dividends and buybacks. However this leads to further concentration of wealth in the hands of the capital owners and labor loses out. In addition, when companies fail to reinvest excess profits it has an adverse effect on the long-term potential of the economy.

Click to enlarge

Source: The Ruffer Review 2019, Ruffer Investment Company

US corporate investment as a percentage of GDP declined from about 4% in the 1960s to just 2% in 2017. But dividends and shareholder buybacks by non-financial firms have increased from less than 2% of GDP in the 1960s to over 5% in 2017 as shown in the chart above.