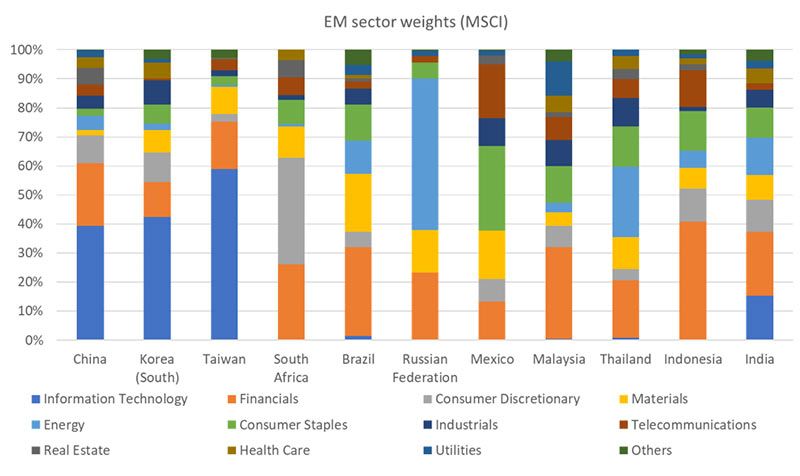

One of the issues with investing in emerging markets is that some of them are concentrated with certain sectors accounting for a large weightage than others. For instance, the Russian market is over weight in energy primarily crude oil. Taiwan is heavy in the tech sector such as semiconductors and hardware. Financials dominate the equity markets of Brazil, Indonesia and Malaysia. Compared to most emerging markets, the Indian stock market is much more diversified according to an article by Nimesh Chandan at Robeco.

The following chart shows the sector weights of major emerging markets based on the MSCI index of the respective countries:

Click to enlarge

Source: Why diversity and demographics favor investing in India, Robeco

Though financials account for the largest weightage in the MSCI India index, other sectors are more represented well in the index.

Below is an short excerpt from the above article:

The subcontinent is often overlooked in favor of its higher profile neighbor, China. Yet India offers much more choice in its investible sectors, an increasingly wealthy consumer, and demographics that China can only dream of.

The number of middle-class people with disposable income to spend on an increasing array of consumer goods – the bedrock of any growing economy – is about 350 million, or higher than the entire EU. It was once said that India has almost as many deities as languages (over 100), and such diversity is also reflected in its equity market.

“India is probably the most diversified among all the emerging markets in terms of the number of sectors contributing to the index,” says Nimesh Chandan, portfolio manager of the Robeco Indian Equities fund.

“Large sectors such as pharmaceuticals, consumer staples and telecoms contribute to index earnings, and these have been relatively immune (or less affected) during the Covid-19 pandemic.”

“That has given comfort to earnings: in fact, in the second quarter, Indian companies outperformed analysts’ earnings expectations by 10 percentage points. So, it seems like we are through the worst of the slowdown induced by the pandemic, and are looking for better opportunities and better times ahead.”

The complete article is worth a read.

For investors looking to invest in India, a few ADRs trade on the US markets. Another option is to go with ETFs the list of which can be found here.