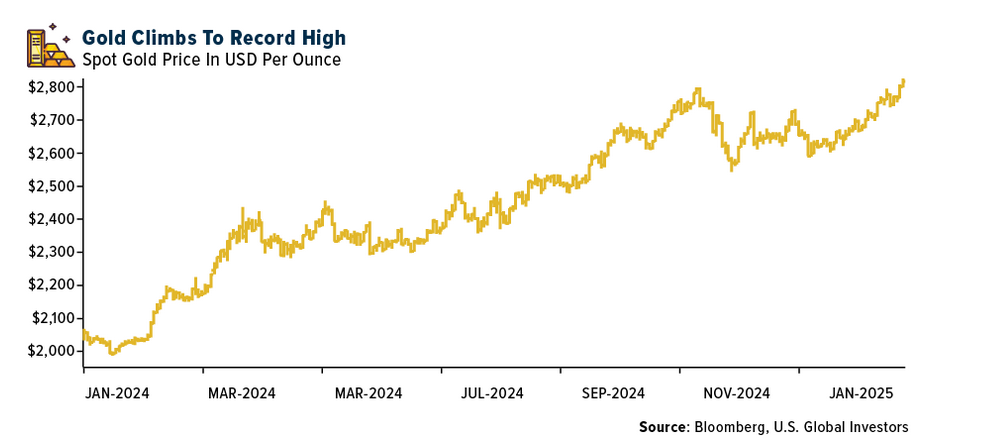

Gold has had an excellent run so far this year. The yellow metal is up over 28% year-to-date as investors pile into it as a hedge against risky assets and uncertainties brought by Covid-19. In general, gold as an asset class performs well when stocks and bonds do not.

I recently across an article by Matthew A. Young at Young Investments where he discussed the performance of gold over stocks and bonds in the past few decades. From the article:

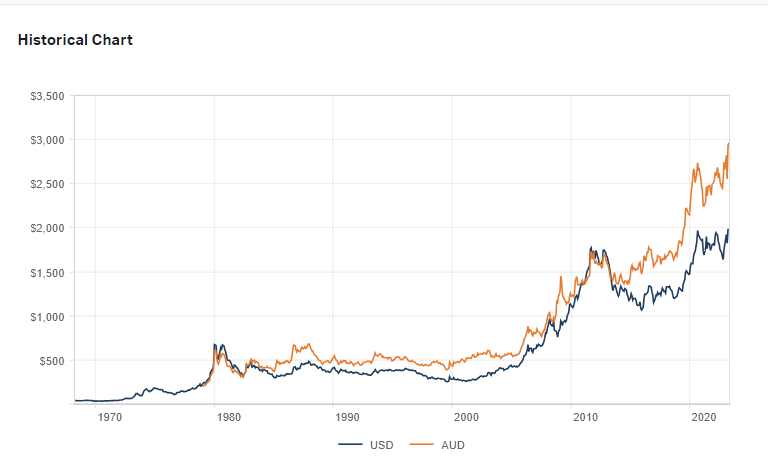

Like many financial assets that have risen over the long run, the 50-year price explosion in gold hasn’t been a straight line. Gold has compounded at 8.5% since August 1971, which compares favorably to stocks and bonds; but as the table below shows, gold has also experienced long dry spells.

The 1970s were gold’s best decade, with the price compounding at more than 35%. Over the next two decades, gold was down in price. During the 2000s, gold prices soared again, rising at a compounded annual rate of over 14%. During the 2010s, gold didn’t perform as well as it did during the 2000s, but it kept pace with inflation and edged out bonds.

Source: July 2020 Client Letter, Young Investments

The above table clearly shows gold is an important asset to own as its performance is inversely related to stocks and bonds for the most part.

Related ETF:

- SPDR Gold Trust (GLD)

Disclosure: No Positions