China’s three major oil majors are the top performing stocks year-to-date among the exchange-listed ADRs trading in the US markets. These stocks have fared relatively well compared to other foreign oil firms.

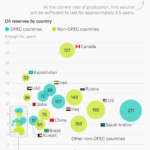

Before we get to the performance list, crude oil decline dramatically since the start of the year even before COVID-19 started raging the western world. The collapse in oil prices was due to the fight between Saudi Arabia and Russia, two of the big producers in the world. Then the arrival of the deadly Coronavirus pretty much put the final nail in the crude oil coffin or more aptly the crude oil barrel. Oil supply was still high and the demand crashed as billions of the people are in lockdowns around the world. Fearing further declines would certainly lead to global dislocation and cost thousands of jobs and possibly his re-election changes, President Trump initiated negotiations between the warring countries. This led has led to yesterday’s OPEC+ deal which reduce production by around 10 million barrels per day from next month to push prices higher.

From a Guardian article:

The world’s largest oil producers have agreed a historic deal to cut global oil production by almost 10% to protect the market against the impact of the coronavirus pandemic.

Members of the Opec oil cartel and its allies have agreed to withhold almost 10m barrels a day from next month after the outbreak of Covid-19 wiped out demand for fossil fuels and triggered a collapse in global oil prices.

The biggest oil production deal in history is double the size of the cuts agreed following the global financial crisis and marks a truce in the oil price war brewing between Saudi Arabia, Opec’s de facto leader, and Russia.

The alliance, known as Opec+, agreed to the production cuts after more than a week of tense talks between the world’s biggest oil-producing nations to shore up the battered global oil market.

Opec+ has also called in help from major oil producers outside the alliance – including Brazil, Canada, Norway and the US – which could double the size of the unprecedented deal to 20m barrels a day.

Source: Major oil-producing nations agree historic 10% cut in output, The Guardian, April 12, 2020

Some experts are already stating this cut is still too little and too late. It remains to be seen how much oil prices benefit from this deal moving forward.

The following table shows the year-to-date performance of exchange-listed oil stocks:

| S.No. | Company | Ticker | Price as of April 10, 2020 Close | Year-to-date Change (%) | Country |

|---|---|---|---|---|---|

| 1 | China Petroleum & Chemical | SNP | $51.00 | -15.21% | China |

| 2 | PetroChina | PTR | $38.01 | -24.48% | China |

| 3 | China National Offshore Oil-CNOOC | CEO | $111.56 | -33.07% | China |

| 4 | Equinor | EQNR | $13.25 | -33.45% | Norway |

| 5 | TOTAL | TOT | $36.74 | -33.56% | France |

| 6 | BP | BP | $24.90 | -34.02% | United Kingdom |

| 7 | Eni | E | $20.20 | -34.75% | Italy |

| 8 | Transportadora de Gas del Sur | TGS | $4.62 | -35.56% | Argentina |

| 9 | Royal Dutch Shell - A | RDS.A | $37.91 | -35.72% | United Kingdom |

| 10 | Royal Dutch Shell - B | RDS.B | $36.55 | -39.05% | United Kingdom |

| 11 | Ecopetrol | EC | $11.92 | -40.28% | Colombia |

| 12 | Petroleo Brasileiro-Petrobras | PBR | $6.72 | -57.84% | Brazil |

| 13 | YPF | YPF | $4.20 | -63.73% | Argentina |

| 14 | Vista Oil & Gas | VIST | $2.60 | -66.88% | Argentina |

| 15 | Sasol | SSL | $3.88 | -82.05% | South Africa |

Source: BNY Mellon

A few observations:

- China’s Sinopec(SNP) is down 15% YTD, the lowest in this list.

- The worst performer is Sasol(SSL) of South Africa.

- Already beaten down Petrobras(PBR) declined another 58% YTD.

- All the major western oil majors – BP(BP), Royal Dutch Shell(RDS-A) & (RDS-B), TOTAL (TOT) and Eni(E) are all down 33% or more in sync with the price of oil.

From an investment standpoint it may be too early to jump into oil stocks at the current time. It wise to wait and monitor the sector for attractive entry points.

Disclosure: Long PBR and EC