Investing in emerging markets involves more risk than investing in the developed world. In addition to foreign currency, economic and transparency issues in these markets, investors need to be aware of political risks. Unlike in developed markets such as in Europe and North America, political risks can appear almost overnight in emerging countries.

Let’s take the example of the country of Chile, an emerging market in Latin America. Until very recently the country was a shining star in the region known for its economic stability and democracy. While others like Brazil, Mexico, Peru, Bolivia, etc. were plagued by chaos, Chile remained strong and stable.

However years of that stability vanished almost overnight when protests erupted in later 2019. What started as a small protest against higher subway fare turned into a major countrywide protest movement leading to many deaths and economic collapse. International investors fled Chilean equities in panic leading to further crash in the local equity market.

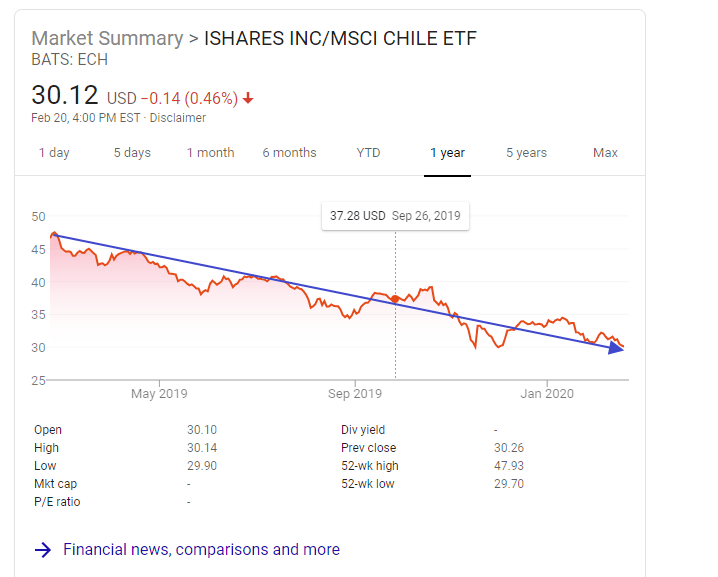

The impact of political risk can be seen in the decline of Chilean stocks and ETFs. The fall in the iShares Chile ETF (ECH) is shown in the chart below:

Click to enlarge

Source: Google Finance

From over $47 in early 2019, the ETF fell dramatically in later in the year to as low as $30 per share.Yesterday it closed at $30.12.

Some of the Chilean ADRs have also fallen heavily in the past 6 months or so. But recovery can be expected later in the year after government policy changes are launched in April. Investors willing to wait for at least a year can consider adding some of these stocks at the current prices.

Chile ADRs to consider adding at current levels include:

- Banco de Chile (BCH)

- Banco Santander- Chile (BSAC)

- Empresa Nacional de Electricidad SA (EOC)

- Soc. Quimica y Minera de Chile (SQM)

- Compania Cervecerias Unidas (CCU)

How political risk is real and severe to equity markets in developing countries than developed markets?

Chilean stocks lost over 50% in just a few months as a result of the political protest that was triggered by a subway fare increase. Similar collapses in the developed world are highly unlikely.

For instance, a rise in New York city subway fares is 100% unlikely to trigger a national protest movement and the crash of the stock market. Even if a protest were to start, it will be a local news and will swiftly contained.

Hence events such as this episode in Chile are usually normal in developing countries with weak institutions and political systems.

Disclosure: Long BCH