Some of the developed economies in the world are natural resources-based. These economies are dominated by commodity companies and financials. Highly innovative and disruptive tech sector form a small part of these countries. Countries such as Canada and Australia fall int his category. The Canadian economy is dominated by mining, energy and financials. Similarly resource and financial firms dominate the Australian economy. As a result, the largest companies tend to remain that way for years or even decades. Since technology sector is so small and there are no world leading startups, the top firms such banks and energy firms continue to remain the top 10 positions of the ASX 100 index.

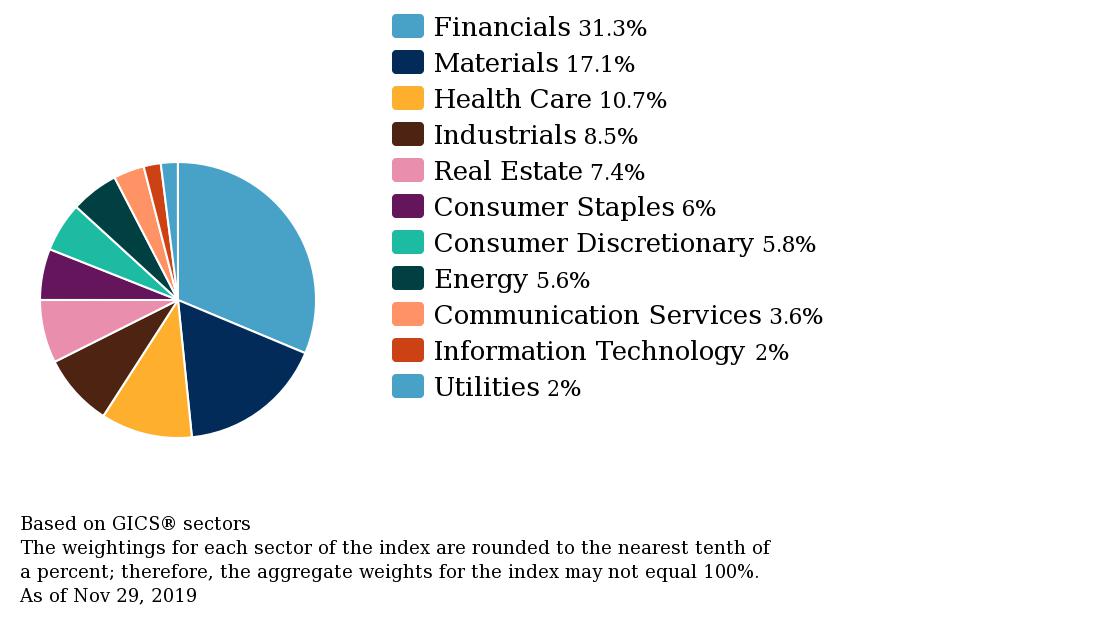

The following chart shows the sector breakdown of the benchmark ASX 100:

Click to enlarge

Source: S&P

The IT sector accounts for only 2% of the index.

Compared to the Australian index, the IT sector in the S&P 500 accounts for about 23% of the index. In the past decade, Apple(AAPL), Microsoft(MSFT), Alphabet(GOOG), Amazon(AMZN), Facebook(FB) have grown exponentially to become world leaders in their fields. The only tech company founded in Australia and turn into a global enterprise is Atlassian(TEAM) which is listed on the NASDAQ and has a market cap of about $30.0 billion.

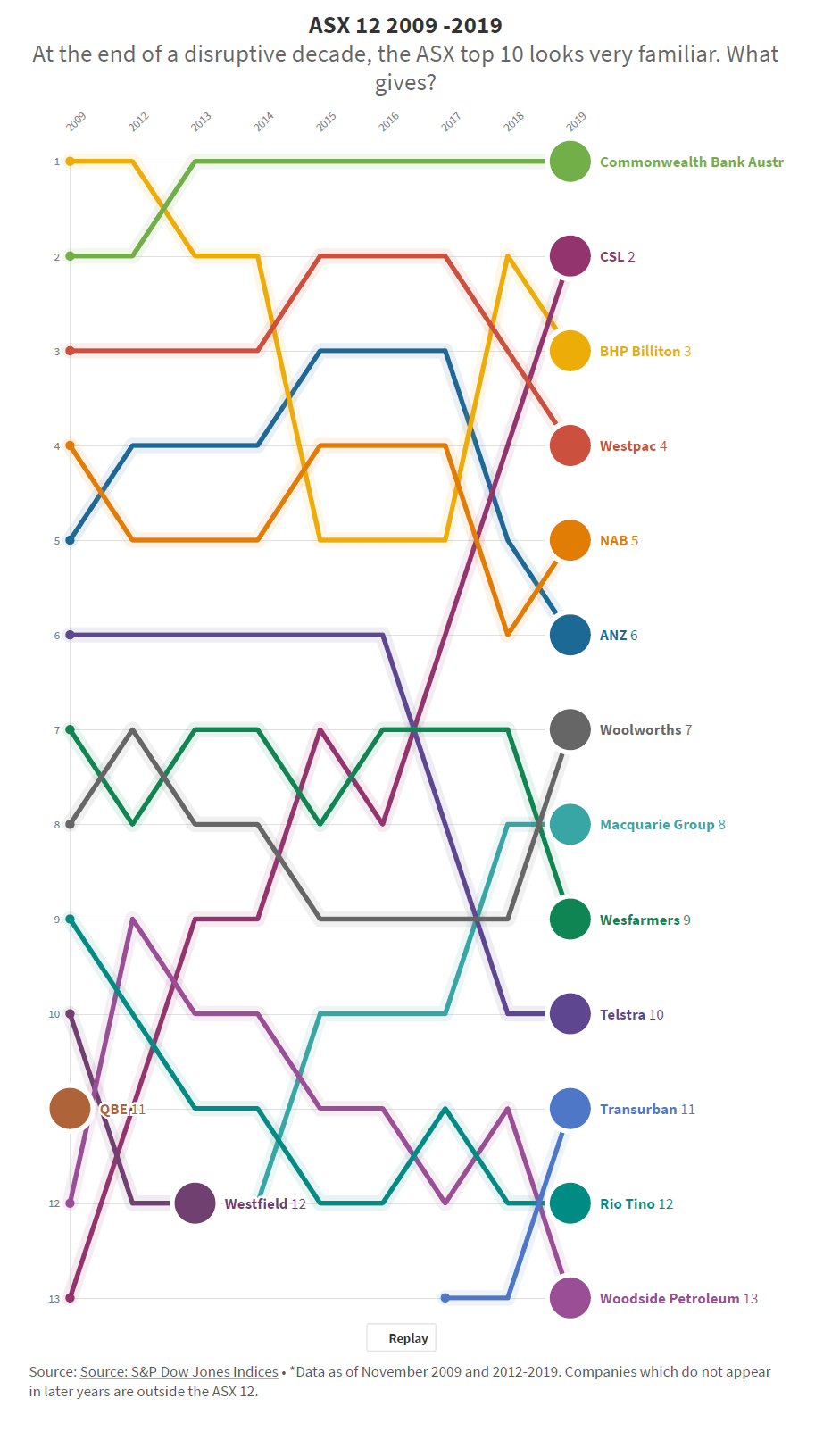

According to a recent article at WHICH-50, the top 10 firms in the ASX 100 have not changed much since 2009. Though some have changed positions with the top 10, the list remains the same. For instance, Commonwealth Bank (CMWAY) was number 2 in 2009 and how is the top company in Australia as shown in the chart below. From the article:

Despite a decade of disruption, Australia’s largest public companies of 2009 are still holding on to their positions at the top of the ASX100.

Australia’s newly-listed tech companies are starting to replace some of the traditional incumbents, but their failure to build genuine scale offshore is slowing their rise up the ranks.

It is a very different picture in the US, where Apple, Microsoft, Alphabet and Amazon have cemented their dominance over ten years — all hovering around $US1 trillion in market capitalisation.

The nine most valuable companies listed in Australia in 2009 — the big banks, miners, retailers and Telstra — have shuffled positions but can all still be found in the top 12 positions at the end of 2019. On the surface, they appear relatively immune from disruption despite the industries they operate in being radically reshaped by the rise of the internet and mobile technology.

Further down the list there is evidence of the erosion of value the internet has unleashed on traditional industries, particularly in the retail and media sectors. Of the companies that have disappeared from the list over the last decade, the majority have been acquired by foreign companies or swallowed by larger local players in their sector. Think Fairfax’s coupling with Nine Entertainment, CBS taking control of a flailing Network 10 and South Africa’s Woolworths buying David Jones — thwarting plans for the department store to merge with its rival Myer.

Australia’s experience contrasts with that of the US, where the story is of technology companies sucking up the oxygen and capital to dominate the index, giving rise to the term “big tech”.

The pace of disruption has claimed casualties along the way, around the world.

According to PwC’s Global Top 100 Companies by Market Capitalisation report, just 53 companies from the 2009 Global Top 100 survived to be in the list on 31 March 2019.

Amazon and Apple added the most to their valuations over the decade, followed by Microsoft and Alphabet. From China, internet companies Tencent and Alibaba — which were founded in 1998 and 1999 respectively — are also among the top ten most valuable global companies, illustrating the astronomical growth in the tech sector.

Kent Kwan, co-founder of investment company AtlasTrend, noted Australia has not experienced the growth of “big tech” like the US or China markets.

Source: Cover Story: At The End Of A Disruptive Decade, The ASX Top 10 Looks Very Familiar. What Gives? by Tess Bennett, WHICH-50

The entire article is worth a read.

Disclosure: Long Westpac(WBK) and National Australia Bank (NABZY)