Tech stocks are hot again this year. The top flying stocks are up by double digits percentage points year-to-date. The bull market in this sector continues for the past few years. Seemingly endless growth and innovation are driving investors to pay sky-high premiums for the top tech market darlings such as the FAANGs. Some of these firms are not exactly coming up with innovative products but rather adding new features or slightly tweaking existing products in order to provide an aura of ground breaking innovation. One company that follows this “strategy” is Apple(AAPL). Recently the firm add yet another camera to its flagship product iPhone claiming this is some of innovation and pricing it accordingly. Apple also added noise cancellation technology to its Airpods and named its Airpod Pro with a 50%+ increase in price. Obviously this sort of innovation is dubious at best. Apple simply expects customers will shell out an extra $100 or so for this feature. While airpods may be popular they are not really practical at all and are prone to getting lost easily Because they are so tiny many customers have lost them. So asking customers to pay more for the same product but with some new gimmick is probably a tough sell.

Other firms such as Facebook(FB) and Alphabet, parent of Google (GOOG) are also not exactly innovative firms anymore. Facebook in a true sense is a giant mess and is primarily an advertising company and extracting time and attention from people with time on their hands. Obviously it is not considered an ad company but rather a silicon valley giant. Wallstreet values Facebook as a tech company. Similarly lately Google has become another huge ad platform. Though the company is primarily in the search engine business, it is morphing into another ad platform.

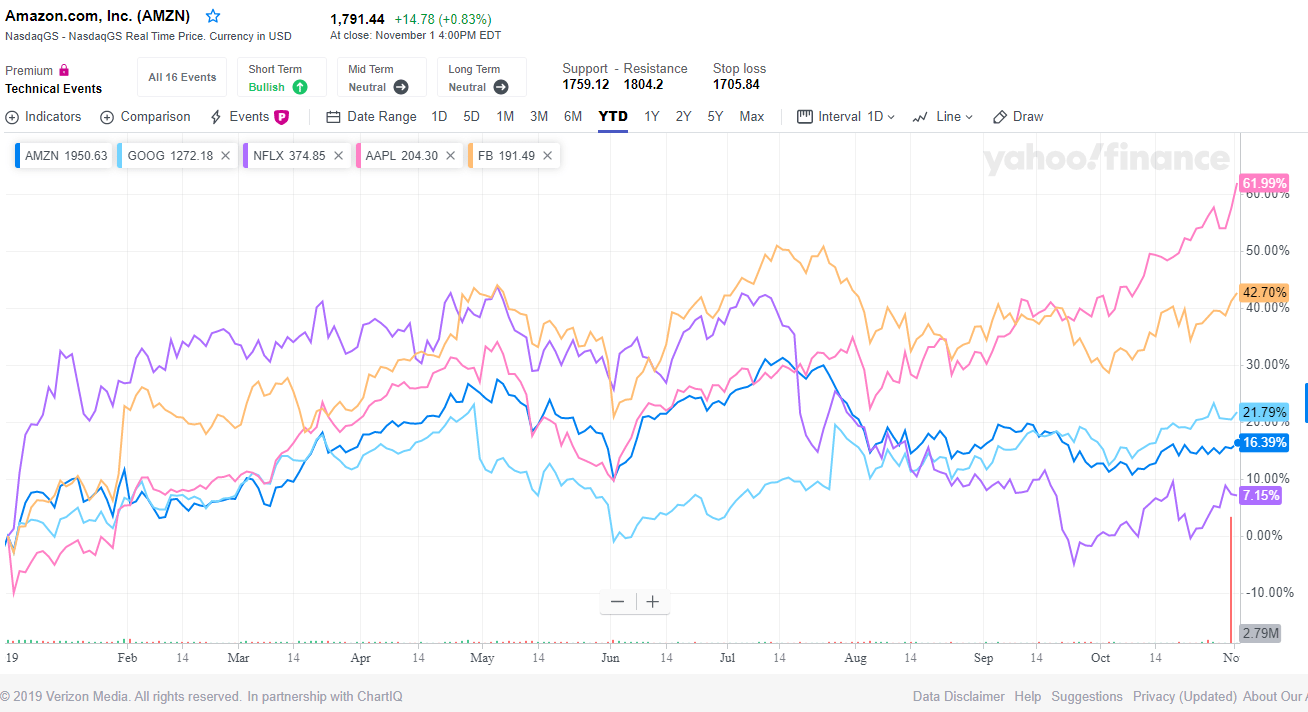

With that said, some investors may be wondering is it really different this time compared to the past NASDAQ collapse? The following chart shows the YTD price returns of the FAANGs:

Click to enlarge

Note: Data shown above is as of Nov 1, 2019

Source: Yahoo Finance

I came across an interesting article on this topic recently at Money Observer. From the piece:

Is Amazon, for example, a technology company, a cloud computing infrastructure provider or a retailer?

Rise and fall of the Nasdaq

-gained 358% Jan 1998 to March 2000Learning from history

Similar questions arose as the dotcom era gathered momentum. The likes of Boo.com and Pets.com were retailers using the internet as a distribution channel, but they were considered to be tech stocks and their valuations reflected that. It was the same with Webvan, the grocery delivery service that saw its price tumble from $30 a share at IPO in November 1999 to just 6 cents a share when it ceased trading, 20 months later.

This is why focusing on fundamentals and the business model of a company can help investors avoid repeating the mistakes of the dotcom crash, when many were dazzled by the hype surrounding certain firms rather than focusing on their actual value, says Mark Leach, portfolio manager at wealth manager James Hambro & Partners. “Always focus on value, cash and profits. It’s a lesson that investors repeatedly fail to heed – that’s why these bubbles happen.”

Source: Two decades on from tech bubble trouble: is it different this time?, Money Observer

Another dot con of the late 1990s that disappeared is Infospace. The CEO of that firm went on TV to proclaim that his firm will be the first trillion dollar market cap in the world. After that fantastic prediction he went the way of the dodo bird never to be seen or heard again.

Nobody knows if tech stocks are in a bubble or not. One thing is clear. The tech stock industry always goes thru booms and busts. Currently we are in the boom side of the two categories.

Disclosure: No Positions