Gold has outperform ed other assets during some periods in the past. Usually when investors look for safe haven such as during bear markets they tend to flock to gold. However during most time when equity markets are “normal” or in growth mode, gold has lagged other assets.

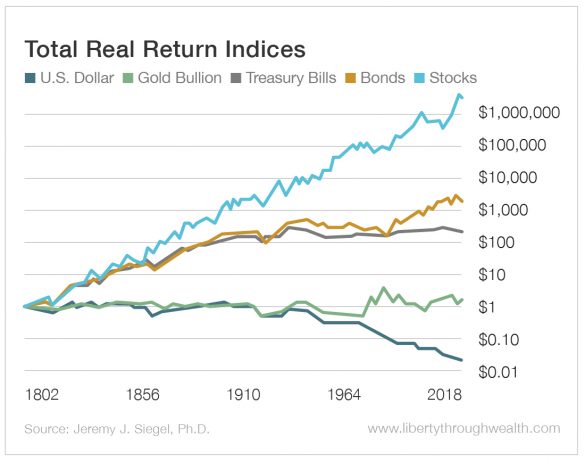

Over the really long term gold has significantly under-performed other assets. For example, the value of 1$ invested in stocks in 1802 would have grow to $1.39 million in inflation-adjusted terms compared to very poor returns in gold as shown in the chart below:

Click to enlarge

Source: The Chart Gold Bugs Love… and the One They Hate by Alexander Green, Liberty Through Wealth

From the above article:

It, too, is based on data rigorously compiled by Siegel and extended by my research team.

The bottom two lines – the dollar and gold – are identical to the first chart.

But this graph also shows what would have happened if an investor held T-bills and rolled them over when they came due, or held bonds and reinvested the interest payments, or held a diversified portfolio of stocks and reinvested the dividends.

As you can see, a single dollar invested in T-bills in 1802 and continually rolled over grew to $267.73 in inflation-adjusted terms. That’s much better than the return on gold over the period.

A dollar invested in bonds with interest payments reinvested turned into $1,393.40 in inflation-adjusted terms.

And a dollar invested in common stocks with dividends reinvested turned into – trumpets, please – more than $1.39 million in inflation-adjusted terms.

Gold is the ultimate inflation hedge? Hardly.

Related ETFs:

Disclosures: No Positions