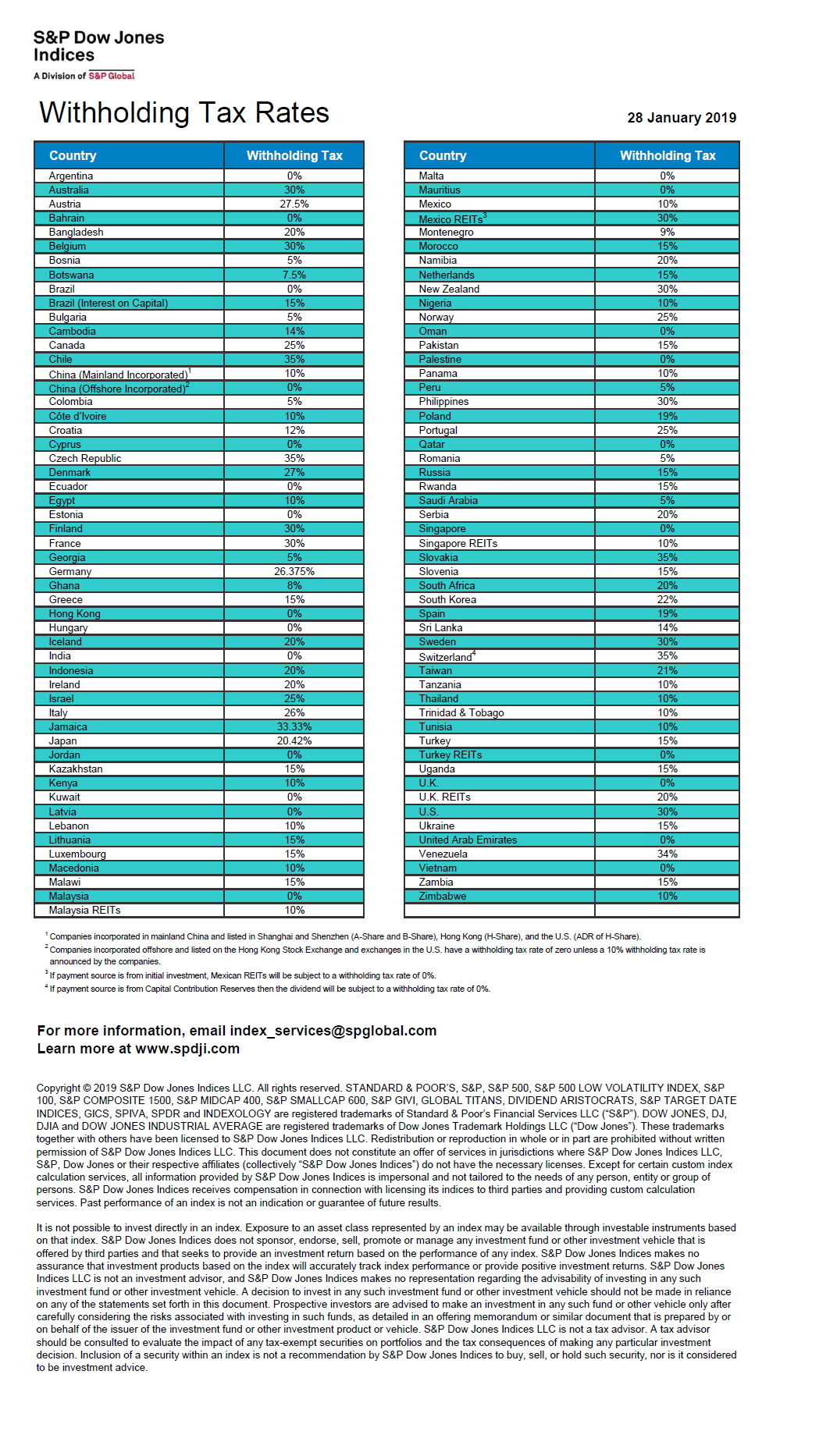

S&P Global has published the 2019 version of the Withholding Tax Rates for Foreign Stock Dividends by country. This simple table is highly useful for investors buying overseas stocks as withholding tax rates vary significantly among countries and high tax rates can cut a big chunk of the payouts. For example, in developed Europe Switzerland has a very high 35% withholding tax rate for non-residents while the UK charges 0% (for stocks only) for Americans. This difference is due to tax treaties between these countries and the US.

Update: Dividend Withholding Tax Rates by Country for 2021

Click to enlarge

Source: S&P Dow Jones Indices

Download: