Germany is the largest economy in Europe and the country’s blue chips are also some of the top dividend payers in the continent. Unlike other indices, the benchmark DAX Index is a total-return index and higher dividend payouts tend to further increase returns. Below is a quote from one my article back in 2014:

In hindsight, there is no doubting that the DAX has created wealth. It has increased more than eightfold in its nearly 25 years of existence. Put another way: Someone who put 1,000 (or close to 2,000 DM) euros into the DAX back then would have around 8,500 euros at the end of May 2013. It has been,despite all the highs and lows, a good investment.It’s interesting to note: 46 % of DAX performance came from dividend distributions.

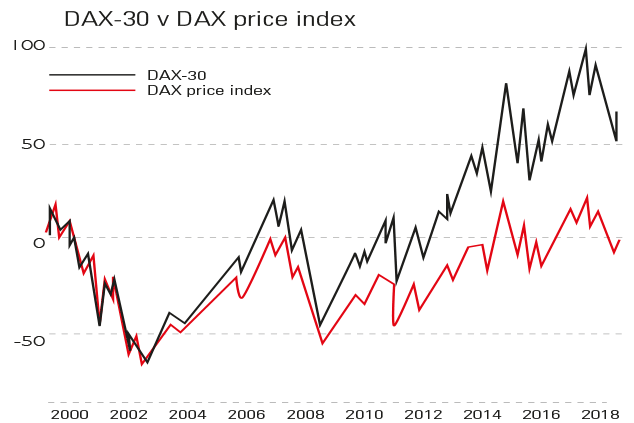

Moneyweek published the following chart showing the difference in returns between the DAX Index and the DAX price index:

Click to enlarge

Germany’s blue-chips are about to start paying their annual dividends, says the Frankfurter Allgemeine Zeitung. And there’s a record sum in the kitty: according to estimates from Commerzbank, some €38bn will be handed out for 2018, 3% more than in the previous year. The higher dividends are excellent news, as reinvested income is crucial to healthy long-term returns.

The chart shows the blue-chip DAX-30 index (a total-return index, so it includes reinvested income) and the Dax price index, which only reflects price movements. The cumulative impact of reinvesting dividends since the turn of the century is huge. Investors who did so would have gained around 60% by now; those who didn’t are marginally in the red.

Source: Chart of the week: German blue-chips dip into the kitty, Money Week

As an investor based in the US, how can you invest in German stocks?

One easy option to invest in German stocks is via the iShares MSCI Germany ETF (EWG). This ETF tracks the MSCI Germany Index and not the DAX Index.

For investors looking to invest in individual companies, a handful of German ADRs trade on the US exchanges. However over 100 firms trade on the OTC markets. Some of the stocks that investors can consider for further research are listed below:

1.Company: Henkel AG & Co KGaA (HENKY)

Current Dividend Yield: 2.36%

Sector:Household Products

2.Company: Fresenius Medical Care AG & Co (FMS)

Current Dividend Yield: 1.70%

Sector: Health Care Providers & Services

3.Company: Adidas AG (ADDYY)

Current Dividend Yield: 1.36%

Sector:Textiles, Apparel & Luxury Goods

4.Company: BASF SE (BASFY)

Current Dividend Yield: 4.95%

Sector: Chemicals

5.Company: Allianz SE (AZSEY)

Current Dividend Yield: 4.50%

Sector:Insurance

6.Company: Continental AG (CTTAY)

Current Dividend Yield: 3.48%

Sector:Auto Components

7.Company: E.ON SE (EONGY)

Current Dividend Yield: 3.25^

Sector:Multi-Utilities

Note #1: Dividend yields noted above are as of Feb 1, 2019. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Note #2: The dividend withholding tax rate is nearly 27%. This will substantially reduce the net yield. In addition, foreign currency exchange rate also will impact the actual dividend yields received by US investors.

Earlier:

Disclosure: Long EONGY, RWEOY, CTTAY