US firms are increasingly spending more of their earnings on stock buybacks than dividend payments to shareholders. One of the main reason for this is that the tax rate on capital gains is lower than that of dividends for investors. Hence investors are content with companies buying their own stock than returning cash to them as dividends.

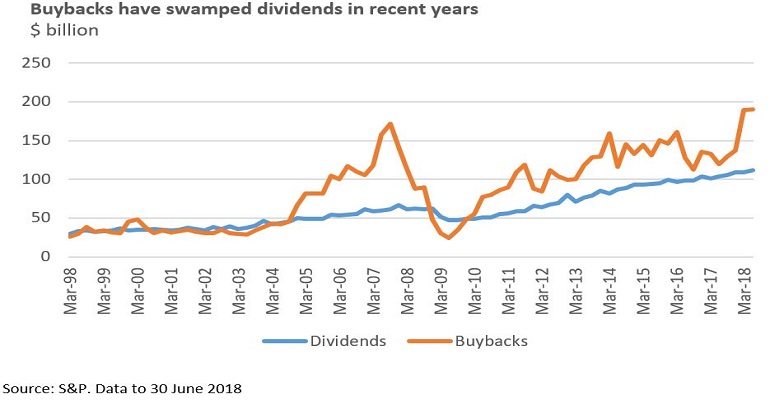

The chart below shows the dramatic growth in buybacks over dividends in the past few decades:

Source: Six reasons you should care about share buybacks by Duncan Lamont, Schroders

From the above article:

As the chart below shows, US companies spent around $200 billion in buybacks and around $100 billion in dividends in the year to June 2018. Compare that with around $30 billion of each 20 years earlier.

Mr.Duncan makes a few other interesting observations regarding buybacks in that piece. Readers may want to review the rest of the article.