Emerging market stocks are riskier than developed world stocks for the obvious reason that those markets are still developing – meaning institutions, rule of laws, regulations, policies, intellectual protection, etc. are still a work in progress. Hence investors investing on stocks from these countries are betting that despite these disadvantages companies would grow their profits and perform better than their developed peers. In addition, the saying goes taking bigger risks leads to bigger returns. This is true in emerging markets. Though emerging market equities can be extremely volatile in the short-term, they outperform developed world stocks in the long run. Investors who are able to wait out the stomach churning plunges in these stocks are rewarded well over the long-term.

For example, the S&P 500 is up by 8.76% YTD based on price alone. Compared to this solid return, some of the emerging markets’ returns are listed below:

China’s Shanghai Composite: -17%

India’s Bombay Sensex: 9%

Brazil’s Sao Paulo Bovespa: 2%

Russia’s RTS Index: -2%

Chile’s Santiago IPSA: -6%

Mexico’s IPC All-Share: 0.5%

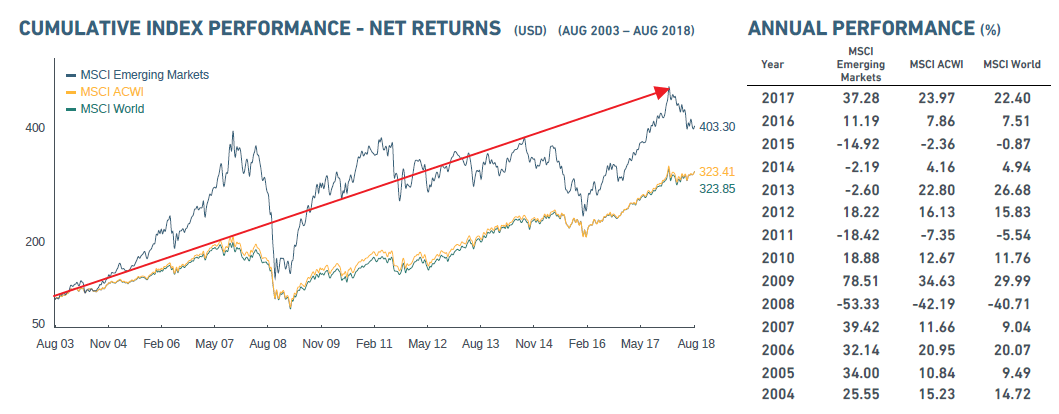

Just because these indices are down relative to the US market YTD does not mean they are poor performers over the 5, 10 or even 20 year time frames. In fact, these equities have beaten or generated comparative returns to the US market over the long run.The following chart shows the performance of the popular benchmark MSCI Emerging Markets Index from Aug 2003 thru Aug 2018:

Click to enlarge

Source: MSCI

In a recent post JEFFREY KLEINTOP of Schwab discussed the volatility of emerging markets and the solid returns they deliver over the long term. From the piece:

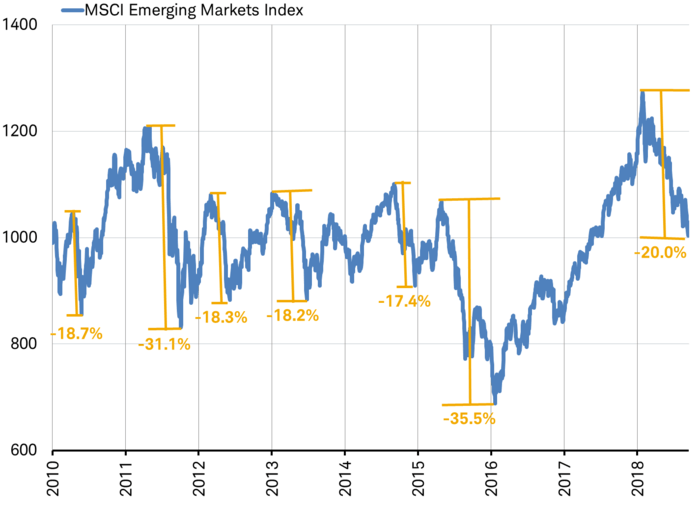

Emerging market stocks are highly volatile in the short-term—about twice as volatile than other equity asset classes. During almost every one of the past nine years the EM index has fallen around -20% or more only to bounce back, as you can see in the chart below.

Frequent pops and drops

Source: Charles Schwab, Bloomberg data as of 9/14/18. Past performance is no guarantee of future performance.

With this kind of annual volatility, timing the tops and the bottoms is nearly impossible given how rapidly and frequently they happen. Looking back since the inception of the EM index we can see in the table below that once it has fallen 20%, it is usually up double-digits just six months later—unless it is the end of the global economic cycle (2000, 2008). The end-of-cycle declines have been longer and deeper.

Rapid rebounds often follow 20% declines

Past performance is no guarantee of future performance.

Source: Charles Schwab, Factset data as of 9/11/18.

Source: Emerging Market Stocks: What We Are Watching by Jeffrey Kleintop, Schwab

Jeff noted that the benchmark index has declined by 20% or more in 7 of the past 9 years but has sharply bounced back.

A few takeaways:

- Emerging market stocks are not for the faint-hearted. If an investor cannot tolerate 20 to 50% falls within a short period of time, they should avoid these markets.

- With individual stocks, it is highly important to be selective.

- For many investors, the easiest option is to go with an ETF than trying to pick winners.

- Some of these markets are dominated by just a handful of companies. Hence over-concentration risk has to be taken into consideration.

- To protect from any blowups of a particular country or a sector, it is important to diversify across many countries and sectors.

Related ETFs:

Disclosure: No Positions