The US equity market is in positive territory with the S&P 500 up by 5.41% YTD. Most of the developed European markets are down so far this year. The Turkey crisis has added more pressure on some of the banks in Europe and the markets in general. Emerging markets have been hit especially hard with some of the currencies plunging to new record lows. Some of the emerging equity markets are also down year-to-date. For example, Shanghai Composite is off over 17%, Russia’s RTS is down by over 8%, Turkey’s BIST 100 is in the red by about 225, etc.

Some investors may be wondering which markets are cheap given the current market situation. According to Russ Koesterich, CFA of Blackrock says that Asian stocks are cheap in an article. He notes that Korea and Taiwan are especially cheap. From the piece:

While not enjoying 2017-like returns, stocks are having a decent year. Developed market equities are up more than 4% in dollar terms. Things look even better in the United States, with the S&P 500 Index up around 7%. As many markets started the year at already full valuations, investors could be forgiven for thinking that there are few bargains left. Interestingly, much of Asia appears really cheap.

As of the end of July, Japanese equities remain the cheapest equity market in the developed world. The Topix Index (TPX) is trading at 1.8 times price-to-book (P/B), roughly half the level of the S&P 500. The current discount is close to the lowest since 2012, a period that preceded a three-year, 150% rally.

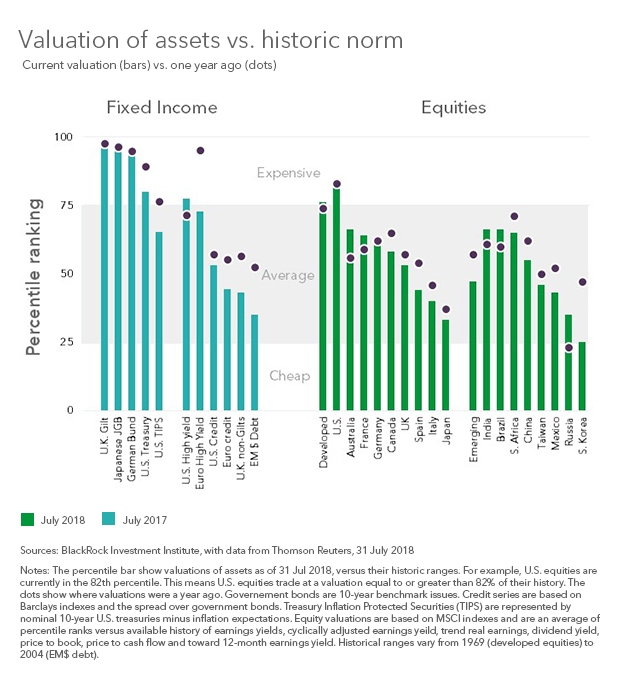

The Asian discount applies to a number of emerging markets as well. For example, Korean equities remains not only the cheapest equity market but by some measures the cheapest asset class (see Chart 1). Korean equities even look inexpensive relative to the already discounted emerging market space. The current valuation represents a 40% discount to the rest of EM, the largest discount since the 1997 Asian financial crisis.

Source: Asia on sale, Russ Koesterich, Blackrock

Related ETFs:

Disclosure: No Positions