Single country funds are highly risky especially those related to emerging markets. Holding these funds for the long-term defined as five years or more requires strong conviction and patience and there is no guarantee that the bet would be a winner. I recently came across an article that discussed the risks and benefits of investing in single country funds. From the article:

Scottish American Investment Company was founded by William Menzies in the 1870s, after a series of visits to the US left him impressed by the wealth and opportunities the rapidly industrialising country presented. Being the most exciting emerging market of its day, America, it was hoped, would provide strong returns for investors in the UK.

Similarly, today, many investors are drawn to emerging markets undergoing their own economic transformations, typically by investing through an actively managed fund or investment trust. While many investors may opt to access such economies through broadly spread emerging market or regional funds or trusts, picking a single-country focused investment has become increasingly popular.

‘There has been a sudden rise in the popularity of single-country emerging market funds,’ notes Chady Jouni, senior portfolio manager at Barclays Wealth Management.

It’s not hard to see why. While emerging markets as a whole have done well in recent years, some individual countries have raced ahead of their peers. The Investment Association’s emerging markets sector returned 46.8 per cent over the past five years, while Asia Pacific excluding Japan returned 70.3 per cent. By contrast, funds in the China/Greater China sector more than doubled in value on average over that timeframe. It’s no surprise that China outperformed its peers in both the emerging market and Asia Pacific sectors, but it does underline an important point: going after a broader grouping of countries can act as a drag on returns.

Source: Investing in a country-specific fund – the risks and rewards by Tom Bailey, Money Observer

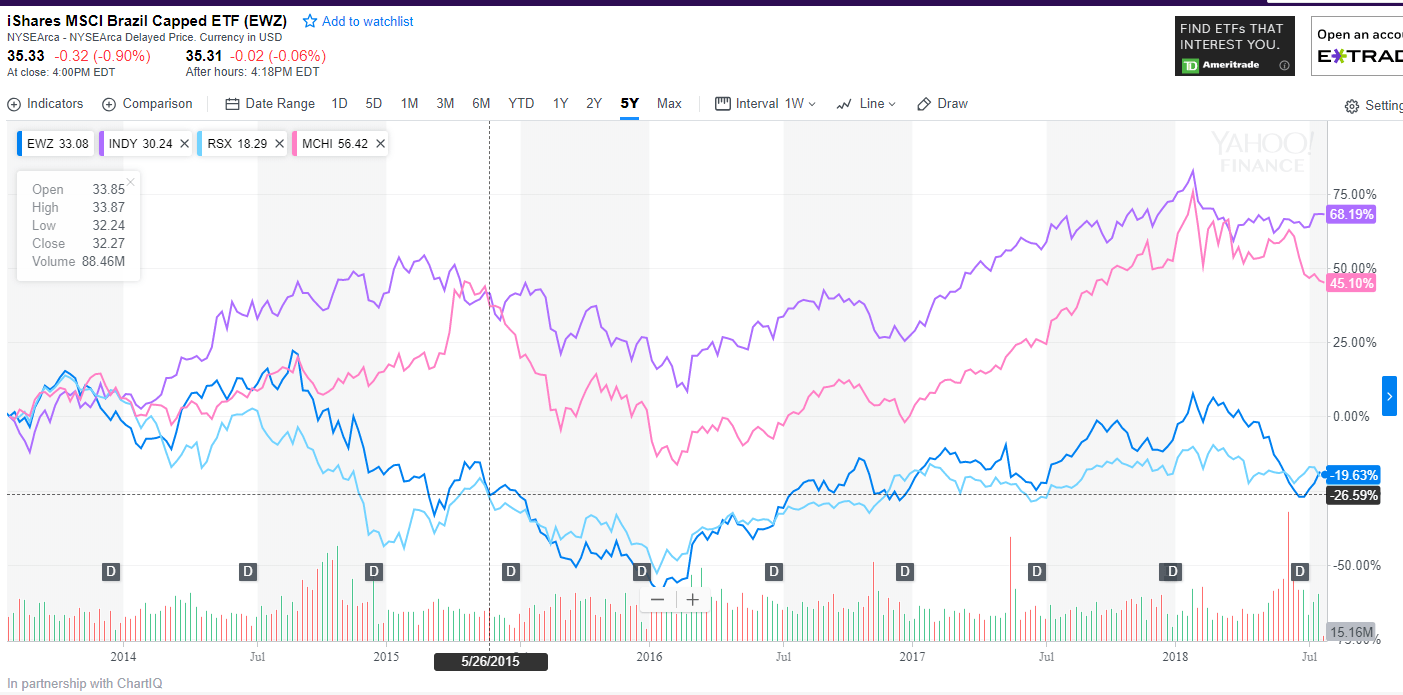

The following chart shows the performance of country ETFs for China, India, Brazil and Russia over the past 5 years:

Click to enlarge

ETFs shown:

- iShares MSCI China ETF(MCHI)

- iShares S&P India Nifty 50 Index Fund (INDY)

- VanEck Vectors Russia ETF (RSX)

- iShares MSCI Brazil ETF (EWZ)

Source: Yahoo Finance

China and India have been the biggest success in terms of returns over the time period while Russia and Brazil were poor performers with a decline of about 20%. This shows that an investor that believed in the growth of Russia and Brazil and invested in an ETF and held on for the past 5 years, lost money. The bet did not turn out as expected as Russia was hit hard with collapse in oil prices and Brazil plunged into chaos with a massive fraud at Petrobras(PBR)and other political instability issues.

So they key takeaways for investors is that investing in single country funds is not for the faint hearted. Emerging countries can easily go from top performing to worse performing. So diversify and do not bet too much of a portfolio on one country.

Disclosure: Long PBR