Reinvesting dividends can boost returns especially in the long-term due to the effect of compounding. One of the simplest and easiest ways for investors to earn higher returns is signing up for automatic dividend reinvestment. Unless one needs the cash for some other investment or one lives off of dividend income, reinvesting dividends is a smart strategy.

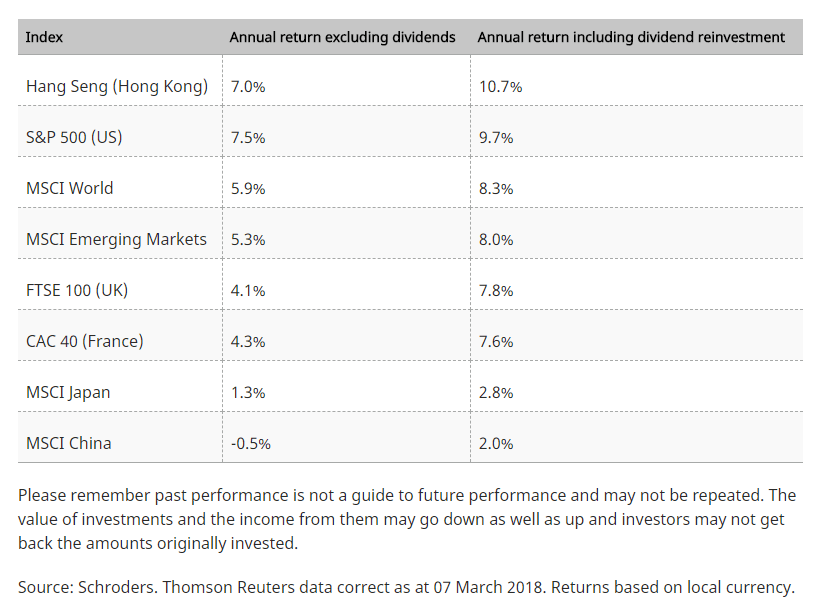

The difference in annual returns with reinvesting dividends and excluding dividends varies across major markets as shown in the table below:

Click to enlarge

Note: The returns shown above are based on historical data for the past 25 years.

Source: How reinvesting dividends has affected returns over 25 years by David Brett, Schroders

In the US dividend reinvestment increases annual returns by 2.4%. In high dividend yield markets such as the UK, the difference in annual returns is a staggering 3.7%.