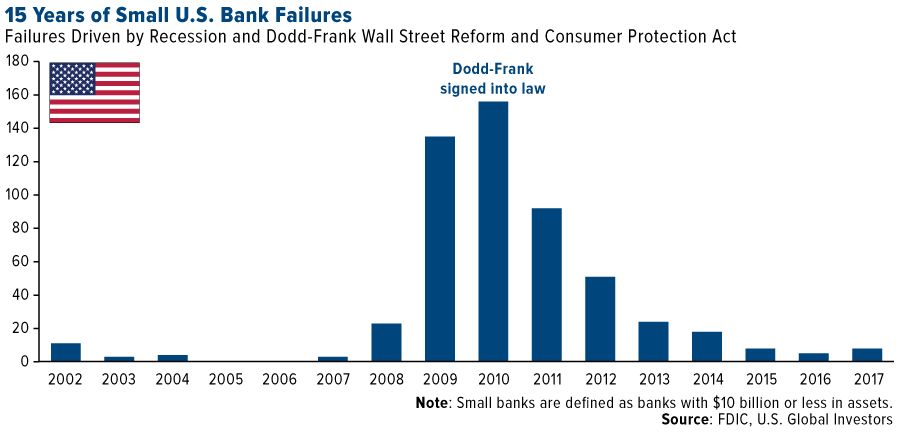

Small cap banks in the US provide a vital function to the economy. They offer loans to about 44% of farms, 50% of small businesses and 15% of all residential mortgages. When the Dodd-Frank Act was signed into law in 2010 in response to the Global Financial Crisis(GFC) small banks were hurt more than their large and medium peers. In fact, at the height of the crisis in 2009 and 2010, every week some bank collapsed. Usually these negative stories were released on Friday evenings in order to lessen media publicity and attention of the general public.

The chart below shows the yearly failures of US small cap banks in the past 15 years:

Click to enlarge

Note: A small cap banks are defined as banks with assets of $10 billion or less.

Source:With Rollback, Dodd-Frank Is Now Officially a Dud, US Funds