Pullbacks are common in equity markets. In any given years stocks tend to go up and down for any number of random reasons. Just because stocks have had declines in a year does not mean they will have a negative return for that year. Even when stocks have had big declines they have soared back to yield positive returns for the year.

From a recent article at Charles Schwab:

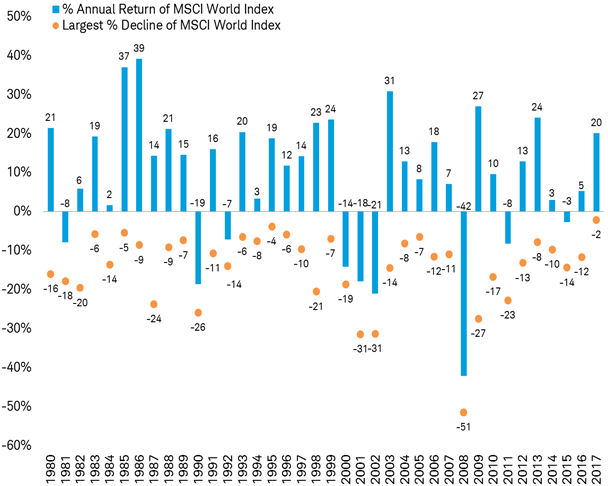

It isn’t unusual to see pullbacks. The peak-to-trough drawdown in global stocks so far this year, at about 8%, is only about half of the average annual pullback of the past 37 years. That could mean there is more to come, either for the current pullback or additional pullbacks over the course of the year. Global stocks have fallen from peak-to-trough by more than 10% in two-thirds of the years since 1979; yet most of those times still posted a gain for the year, as you can see in the chart below.

Declines are common and usually don’t mean losses for the year

Past performance is no guarantee of future results.

Source: Charles Schwab, Factset data as of 2/7/2018.

Source: Schwab Market Perspective: Volatility…it’s Back!, Schwab