The first round of Presidential election was held recently in Chile. The billionaire Conservative Sebastián Piñera won the first round and is due to face the Socialist candidate Alejandro Guillier in the second round on December 17. Mr.Sebastián is likely to win that round as well and become the President of Chile.

From an investment point of view, the fortunes of Chile is closely tied to Copper price since the country is the largest copper producer in the world. Copper prices have rebounded strongly in recent months and accordingly Chilean stocks have gone up nicely as well. The benchmark Santiago IPSA Index is up about 21% as of November 22. After the first round of elections, Chilean stocks sold off sharply. The long-term prospects are still good despite the political uncertainty. As one of the top emerging economies in Latin America Chile has many advantages for investors over other Latin American markets. For example, by law companies in Chile have to pay out a certain percentages of their profits as dividends to shareholders. So investors looking to gain exposure to Chile can consider the following five stocks for further research:

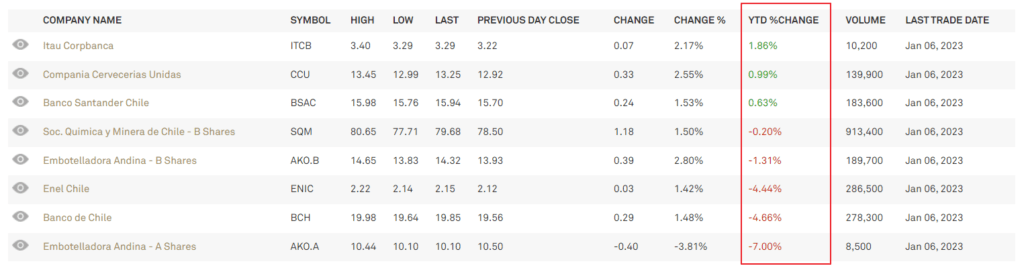

1.Company: Empresa Nacional de Electricidad SA (EOCC)

Current Dividend Yield:5.13%

Sector: Electric Utilities

2.Company: Banco Santander-Chile (BSAC)

Current Dividend Yield: 3.63%

Sector: Banking

3.Company: Banco de Chile (BCH)

Current Dividend Yield: 3.00%

Sector:Banking

4.Company:Vina Concha y Toro SA (VCO)

Current Dividend Yield: 2.64%

Sector:Beverages

5.Sociedad Quimica y Minera de Chile SA (SQM)

Current Dividend Yield: 3.20%

Sector:Chemicals

Note: Dividend yields noted above are as of Nov 22, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long BCH