The average stock holding period for developed markets has been on the decline for many years now. For example, by one estimate the average holding for stocks listed on the NYSE is just 7 months or less than 2 years by another estimate.

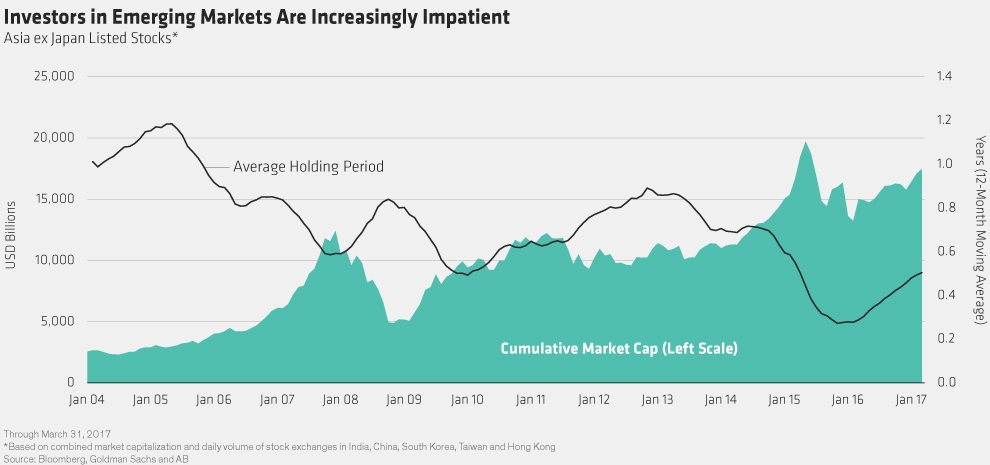

In emerging markets(EM) also, the average holding periods are very low. EM investors also have short-term investment horizons and tend to be very impatient as the chart shows below:

Click to enlarge

Source: Patience Pays in Emerging Equities, Alliance Bernstein blog

As with developed markets, low holding periods in emerging markets is bad for investors. Since stocks in developing countries are even more volatile than their developed world peers, holding stocks for short duration is an unwise strategy.

Also see: Duration of Stock Holding Periods Continue to Fall Globally, TFS