Emerging market stocks are in vogue again in recent months. After abandoning these markets in the past few years global investors are slowly returning back to them in order to profit from higher growth potential than in developed markets.

It is important to note however that not all emerging markets are driven by similar forces. While some may be dependent on commodity exports others may be more driven by the state of the domestic economy. So taking these factors into consideration when selecting destinations for emerging markets is critical. For example, Chile is highly dependent on copper (a volatile commodity) but Mexico’s economy is tied to the US economy. Moreover Mexico is not a commodity-driven economy. Its economy is focused mainly on manufacturing and tourism. Similarly the Asian countries of China and India do not depend on exports heavily. But instead their economies are dependent on domestic growth and other local factors.

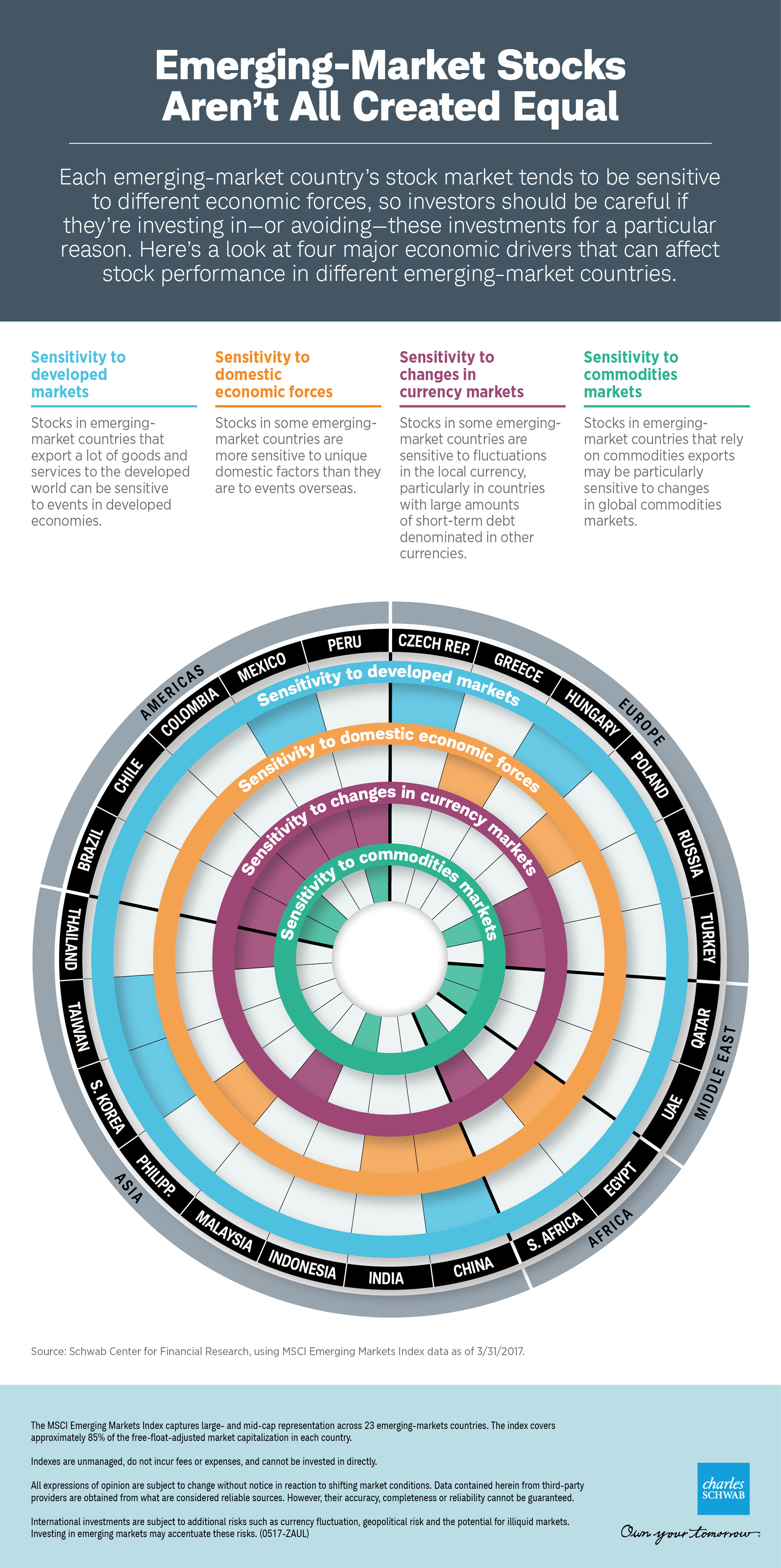

The following neat infographic from Schwab identifies four economic factors that drive emerging markets:

Click to enlarge

Source: Emerging-Market Stocks Aren’t All Created Equal, Charles Schwab, May 24, 2017

Related ETFs:

Disclosure: No Positions