Emerging equity markets have performed well so far this year. After a few years of disappointing average to poor returns emerging stocks are projected to have good growth potential this year. For example, commodities such as copper prices are rising due to rising demand.

Some of the emerging markets’ year-to-date returns are listed below:

China’s Shanghai Composite: 4.8%

India’s Bombay Sensex: 8.0%

Brzail’s Sao Paulo Bovespa: 14.7%

Russia’s RTS Index: 0.8%

Chile’s Santiago IPSA: 5.0%

Mexico’s IPC All-Share: 4.3%

Source: WSJ

In an article published last week, Stephen H. Dover of Franklin Templeton Investments is also bullish on emerging equities. From the article:

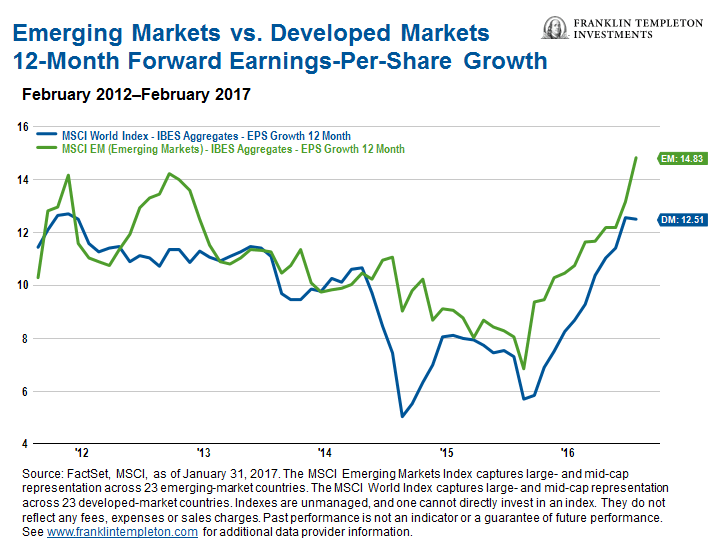

Despite some uncertainties, we see opportunity in emerging markets in 2017 and are optimistic many investors will see value in making greater allocations to them. GDP growth is expected to outpace that of developed markets, with the International Monetary Fund projecting growth of 4.5% in emerging and developing economies versus 1.9% in developed markets this year.8 We see evidence that earnings growth in emerging markets could likely be higher than in developed markets, too. Emerging markets have been lagging in regard to earnings growth, but 2016 marked the first time in more than five years they outperformed developed markets. We think there’s still quite a bit of room for emerging markets to further catch-up.

8. Source: International Monetary Fund World Economic Outlook, January 2017 update. There is no assurance that any estimate, forecast or projection will be realized.

Source: An Emerging-Market Evolution, Franklin Templeton Investments

From an investment perspective, not all emerging markets are out of the woods yet. However many attractive opportunities can still be found in some markets such as Chile, Brazil, Mexico, etc.